The Department of Energy released a pair of reports from the National Petroleum Council recommending changes to gas and electric coordination and to permitting rules for oil and gas.

The council is a federal advisory committee made up of leaders from the oil and gas industry and academia, with power sector interests participating in the coordination report.

“The National Petroleum Council’s findings confirm what President Trump has said from Day 1: America needs more energy infrastructure, less red tape and serious permitting reform,” Energy Secretary Chris Wright said in a statement Dec. 3. “These recommendations will help make energy more affordable for every American household.”

The coordination study shows how rising natural gas and electricity demand are combining with shifting use patterns to “strain natural gas pipelines in key regions of the United States.”

“Since natural gas became the dominant fuel for U.S. electricity generation in 2016, the interdependence between the gas and electric systems has deepened — but so have the risks of misalignment,” the report says. “The two systems function under fundamentally different commercial, regulatory and operational frameworks.”

The gas industry is built around long-term contracts and steady demand, while the wholesale power markets are based on real-time market dispatch and hourly price signals. The differences create persistent mismatches in timing and incentives, especially during periods where demand is high for both — most notably during extreme winter weather, the permitting report says.

That issue is bigger in organized wholesale power markets, in which generators depend on hourly price signals and lack the incentives to pay for firm pipeline capacity.

“Their gas procurements rely less on long-term delivery contracts and more on a variety of shorter-term commodity procurements and lower-priority transportation arrangements,” the report says. “When the gas and electric systems are both under stress, these arrangements are the first to be curtailed.”

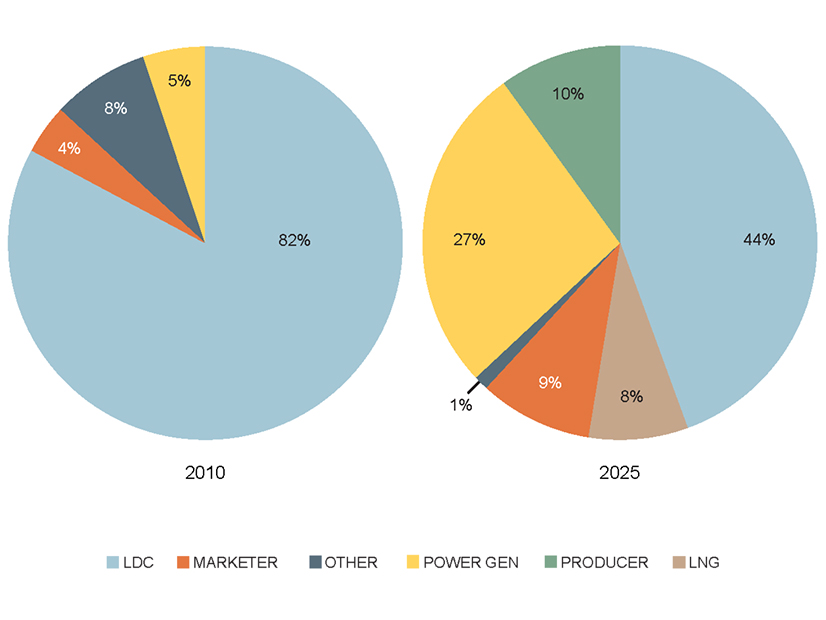

The two reports both recommend building new infrastructure, with part of the recommended fix to longstanding coordination issues being expanding pipelines. Electricity generation has become the biggest consumer group for natural gas, beating out local delivery companies, as coal plants have retired and been replaced by generators burning cheap shale gas.

“As a result, gas demand has become far more variable and dynamic, with power generators — especially in deregulated markets — often relying on secondary or interruptible pipeline capacity, which amplifies intraday and seasonal fluctuations,” the report says. “The rapid expansion of wind and solar resources, which together account for more than 60% of new U.S. generation capacity since 2010, has made gas-fired units essential for grid balancing, requiring flexible fuel supply and rapid ramping capability.”

Some pipeline expansion has happened over the past decade, but most of that involved reversing flow directions and adding compressors rather than building new lines. That has helped to meet higher demand, but it has also contributed to fewer flexibilities for generators that would benefit from them.

Storage would also help generators, but the sector has not invested in it, with most expansions being tied to LNG exports, the report says.

The report recommends that Congress and the executive branch take immediate legislative and administrative action to reform permitting to unlock fit-for-purpose infrastructure investment. The two industries should work together to expand new infrastructure to serve generation and prioritize actions to enhance and expand existing infrastructure.

Most previous gas-electric coordination efforts have focused on the few peak winter days, but that risks the broader trajectory of the system, with electric demand poised to rise significantly in the coming decade and some regions’ grids shifting to winter peaks from summer, it says.

The report notes that current market structures fail to incentivize generators to secure either long-term gas transportation or highly flexible premium products. The two sectors’ different business models mean the pipeline sector has not expanded to meet the growing needs of power generation.

The report calls on ISO/RTOs and state and federal regulators to ensure adequate risk-based compensation for gas-fired power generators to get enough fuel and operate reliably when called upon.

FERC should direct ISO/RTOs to conduct comprehensive long-term planning that integrates resource adequacy and fuel assurance considerations, the report says.

On the gas side, the report recommends that policymakers and the industry work to address changing hourly gas flow patterns with alternative tariff structures that enable enhanced gas service offerings and flexible contracting arrangements with generators.

The Natural Gas Council, which is made of trade organizations from that industry, and the Reliability Alliance, which includes the Electric Power Supply Association, Interstate Natural Gas Association of America and the Natural Gas Supply Association, released a joint statement supporting the reports and asking for state and federal regulators to act on its recommendations.

“Time is of the essence,” they said. “Policymakers and industry must act swiftly to develop the infrastructure that will win the global energy and AI race while continuing to meet growing demand for affordable, reliable and secure energy. While the natural gas and power industries are fully capable and committed to supporting our nation’s expected energy demands, we need additional direction and policy changes from state and federal policymakers to facilitate prompt implementation of these recommendations. We ask Congress, the U.S. Department of Energy, FERC and state commissions to undertake action aimed at ensuring adoption of the recommendations in these reports.”