Northeastern power systems cannot afford to drop offshore wind if they are to maintain reliability, reduce emissions and lower electricity prices, according to a new analysis from Charles River Associates.

The analysis, released Dec. 2, examined both NYISO and ISO-NE and found that retaining existing natural gas while completing queued OSW projects were necessary to maintain reliability and affordability.

“We found that there are quite material resource adequacy risks in New York City,” Oliver Stover, an associate principal of Charles River, said during a webinar Dec. 4 to discuss the paper. “This is important from the perspective of offshore wind because it can have a non-trivial impact on helping reduce these risks.”

Stover added that New England’s exposure to tightening natural gas and electricity markets could be mitigated by investment in OSW.

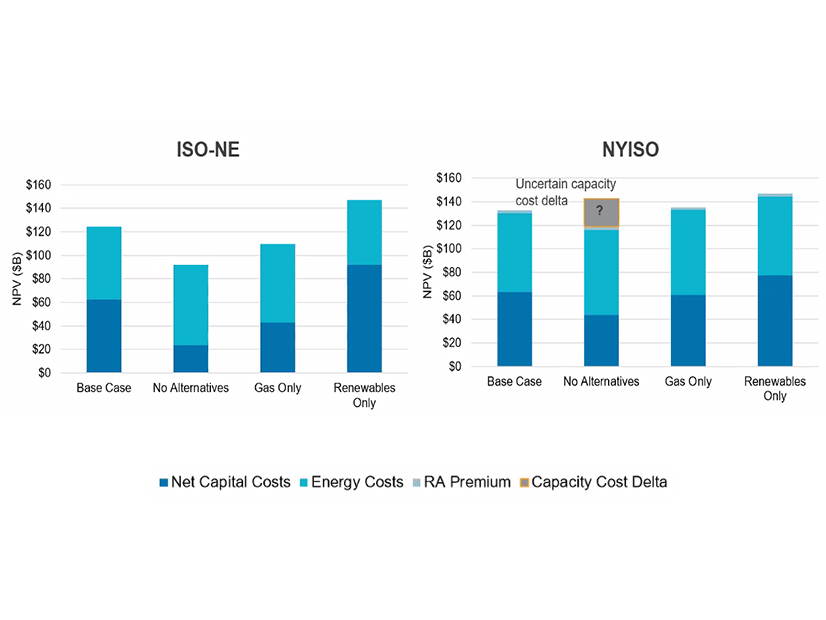

The base case in the analysis assumes the current queue of OSW projects in both markets will be completed on time and that existing gas resources are retained. When compared to cases in which OSW is canceled without substitutes, replaced by onshore renewables or replaced by gas, the base case performed better on prices and reliability.

Developing gas alone was found to raise prices and emissions while possibly reducing overall capital costs. Onshore renewables could match base case prices and emissions but were weaker for reliability without extensive transmission upgrades. Failing to bring on new resources at all had the worst overall performance.

“This is not just a winter problem, particularly in the New York ISO,” Stover said. “We see summer challenges continuing into the nighttime hours, and offshore wind is well positioned to augment solar builds in filling in those hours.”

These findings mirror the policy preferences of major stakeholders and politicians in New York. The Independent Power Producers of New York, the Alliance for Clean Energy New York and Gov. Kathy Hochul have said they favor an “all of the above” approach to energy.

Stover said OSW’s proximity to load pockets, particularly in New York City, made it better for reliability than onshore renewables in general. Bypassing transmission congestion to inject directly into load pockets was a major source of OSW’s reliability benefits in the analysis. Without OSW development, Boston and Vermont were at risk of load shedding by 2036.

Gas-fired generation development is difficult in high-population areas of New York and New England. The existing gas system already is constrained, and there is limited headroom on the gas distribution system to bring on more firm generation, Stover said.

“They are both challenging places to build. They’re expensive. They’re coastal. They’re quite dense, and there is limited fuel,” Stover said. “Those problems might be solved in the long term … but that might be challenging.”

Stover pointed to a recurring topic of conversation at NYISO stakeholder meetings: the aging fossil fleet. If nothing new comes online, it places greater burdens on aging infrastructure, which increases the likelihood of generator failure and forced retirement. ISO-NE’s generation portfolio is a little more flexible in this respect, as the region could afford to retire units more than New York.

While reliability and energy prices fell in the base case “OSW+ NG” scenario, capital costs were slightly higher than the gas-only scenario. Stover said this was because OSW, and renewables broadly, required more infrastructure investment to bring them online.

“You have to pay for the upfront capital cost, and then we enjoy the benefits of paid dividends on driving down the energy price,” Stover said.