SPP has made it official: The operator of the sprawling Midwestern grid technically is in the Western Interconnection.

That means it has office space in downtown Denver that includes a sizeable meeting room, a break room and several offices with three workspaces. That allows SPP to boast a “physical presence” in the West, as one staffer said.

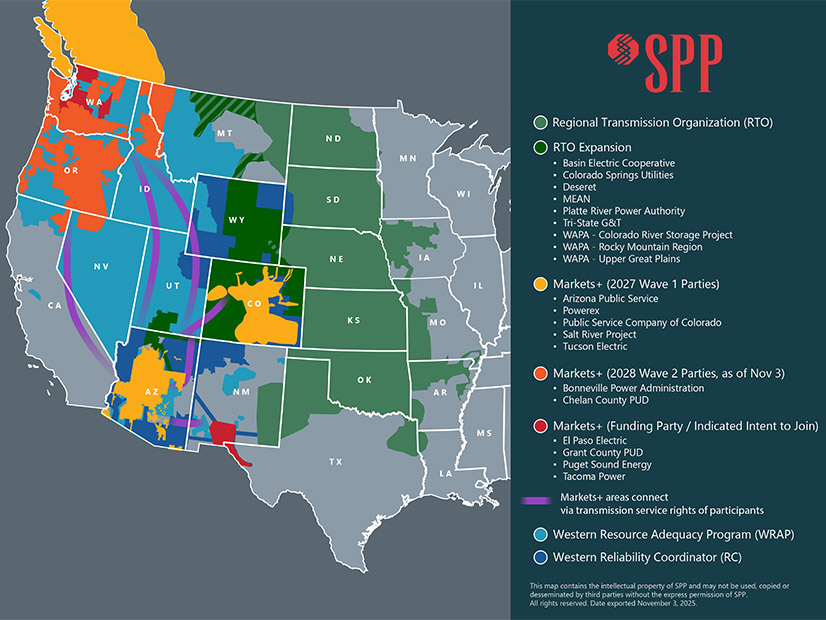

In April, it’s scheduled to become operational. That’s when the grid operator’s 14-state footprint will increase by three. Utilities from Arizona, Colorado and Utah will place their facilities under SPP’s tariff. It will make the grid operator the first to provide full market services in the U.S. system’s two major interconnections, thanks partly to three DC interties totaling 510 MW.

The expansion comes little more than a year after FERC approved an amended tariff that adds the western members to the RTO and drew praise from several commissioners. Judy Chang said the approval is “another major milestone for the market evolution in the Western part of the U.S.” (See FERC Approves Tariff for SPP RTO West.)

All seven members of RTO Expansion — as SPP refers to its new market on the other side of the Rockies — currently participate in SPP’s Western Energy Imbalance Service market; four of them (Basin Electric Power Cooperative, Municipal Energy Agency of Nebraska, Tri-State Generation and Transmission Association, and the Western Area Power Administration’s Upper Great Plains-East Region) are members of the legacy RTO in the East.

A 2022 Brattle Group study for SPP determined the expansion will produce between $68 million and $81 million in annual Westside adjusted production cost benefits and wheeling revenue. Eastside members will see between $3 million and $8 million of those benefits.

SPP says it will decide Feb. 2 whether to launch the market April 1 as planned.

“Right now, everything seems to be on track,” CEO Lanny Nickell told his board in November.” We’re looking forward to working with our new members in the West.”

The RTO expansion has been somewhat overshadowed by the noise surrounding SPP’s Markets+ day-ahead offering, which is providing Western utilities an alternative to CAISO’s Extended Day-Ahead Market.

The grid operator’s staff and Markets+ stakeholders are well into the initiative’s second phase, working together to build the market’s operating systems and conduct market trials and parallel operations. SPP says 41 entities have committed to covering the market’s $150 million in development expense; the costs will be recovered through future operations. (See SPP Markets+ Cruising Through Early Development.)

Interested market participants have until April 1 to register. They will have about 45 days to complete their registration workbook.

Arizona Public Service, Powerex, Public Service Company of Colorado, Salt River Project (SRP) and Tucson Electric Power are moving forward as balancing authorities. The Bonneville Power Administration will join the secondary market launch in October 2028, along with four other Pacific Northwest BAs.

SPP is targeting October 2027 as the Markets+ go-live date. When the Northwest BAs join in 2028, it will consist primarily of the Pacific Northwest, Desert Southwest and along the Rockies.

The series of complicated seams that will result have caught the attention of FERC, which has asked Western stakeholders to get ahead of seams issues before the markets launch. SPP, experienced in managing seams with MISO, ERCOT and WECC, is hosting a Western Seams Symposium open to western stakeholders at SRP’s Tempe, Ariz., headquarters Feb. 26. (See FERC Report Urges West to Address Looming Market Seams Issues.)

SPP’s western expansion effort is just one of its three overarching goals. The others are accelerating its generator and large load interconnection processes and mitigating its resource adequacy risk.

The grid operator will begin transitioning in 2026 to its Consolidated Planning Process, which combines its transmission planning and GI studies into a three-year process that aligns system modeling, planning assumptions and cost allocation across load and generation needs. The CPP’s “ready-to-go” construct replaces the current “request-then-analysis” framework by identifying system needs and costs before the generator asks to connect. (See SPP ‘Blazes Trail’ with Consolidated Planning Process.)

A transition study is underway and will result in a 20-year assessment in November 2026. The 2027 study will sunset the current process and integrate RTOE transmission needs before the first full CPP 10-year assessment in 2028.

The studies will be run in parallel with a strategic partnership announced during the summer between SPP and global tech giant Hitachi. The two organizations are collaborating to accelerate the GI process by reducing study times 80% through end-to-end industrial AI and advanced computing infrastructure. (See SPP, Hitachi Partner to Use AI in Clearing GI Queue.)

SPP’s two previous planning cycles resulted in more than $16 billion of transmission projects and included five 765-kV lines, the RTO’s first. (See SPP Board Approves $7.65B ITP, Delays Contentious Issue and SPP Board OKs Updated 2025 Transmission Plan.)

Several other 765-kV projects were set aside as SPP, like other grid operators, prepares for a future projected to be dominated by data centers, crypto miners and industrial electrification. A more recent Brattle Group study found the RTO will require at least $88 billion and up to $263 billion of generation investment to support load growth through 2050. (See SPP Study: $88-263B in Generation Needed by 2050.)

Naturally, affordability is a concern for regulators and other stakeholders. SPP has created the Cost Control and Allocation Review and Evaluation (CARE) Team, a cross-functional leadership body to review and recommend refinements or alternatives to the current transmission cost controls and cost-allocation methodologies. The team met once in December 2025 and took a deep dive into SPP’s various cost mechanisms; it has set a meeting schedule that lasts into November 2026.