The expected rapid addition of large loads to the grid need not raise electricity rates, EPRI explains in a new research paper.

The authors conclude that if the incremental costs of serving the new loads are below the current average costs, new demand can actually lower the average retail rates as the system costs are spread across a wider base.

However, this depends on excess grid capacity or a relatively cheap source of new electrons being available.

If, instead, expensive grid investments are needed to serve that new load, or if the new load reduces its demands before those investments are paid for, the opposite effect can be seen: Prices could rise for other customers on the grid.

That is the root of the growing consternation about the largest component of the large load influx expected for the U.S. grid, data centers and the growing calls to make them pay their own way as electricity rates surge far above inflation. (See U.S. Utility Rate Increase Requests Topped $30B in 2025.)

EPRI President Arshad Mansoor said in a Jan. 29 news release the research paper shows a path toward the right balance: “As AI, electrification and industrial onshoring reshape the U.S. energy landscape, understanding how load growth interacts with system costs has never been more important. This research shows that with planning, pricing structures and flexible demand, growing electricity needs can support affordability and reliability for all.”

“Win-Win Watts: When Can Data Centers, Efficient Electrification and New Loads Lower Electricity Prices?” suggests three main action points:

-

- rate design and cost allocation that protect existing customers;

- demand flexibility; and

- proactive planning that links demand with clean energy and grid investments.

Striking the right balance could lower costs, accelerate clean energy resources, support emerging technologies, reduce emissions and support better system operations.

The authors acknowledge the challenges implied in all this: “Whether those ‘win-win’ outcomes are realized depends on rate design, infrastructure needs and policy choices that affect whether new loads cover their costs and risks. Some answers depend on testing new technologies and business models, such as [EPRI’s DCFlex Initiative’s] demonstrations of data center load flexibility, that could offer new tools for managing growth while protecting affordability.”

The factors that help determine whether a new load raises or lowers electricity prices include:

-

- system conditions: generation mix, current average costs, demand profiles, spare capacity, investments in the pipeline and reliability requirements;

- shape of new loads: size, load factor, coincidence with net system peaks and ability to shift or curtail demand during stress periods;

- technologies available: costs and performance of new generation, energy storage and demand-side options, including how quickly they can be financed, permitted and built; and

- regulatory and market context: in cost-of-service regions, more of the new infrastructure costs show up directly in rates; in restructured markets, more of the impact shows up in wholesale prices and contracts that large customers sign with suppliers.

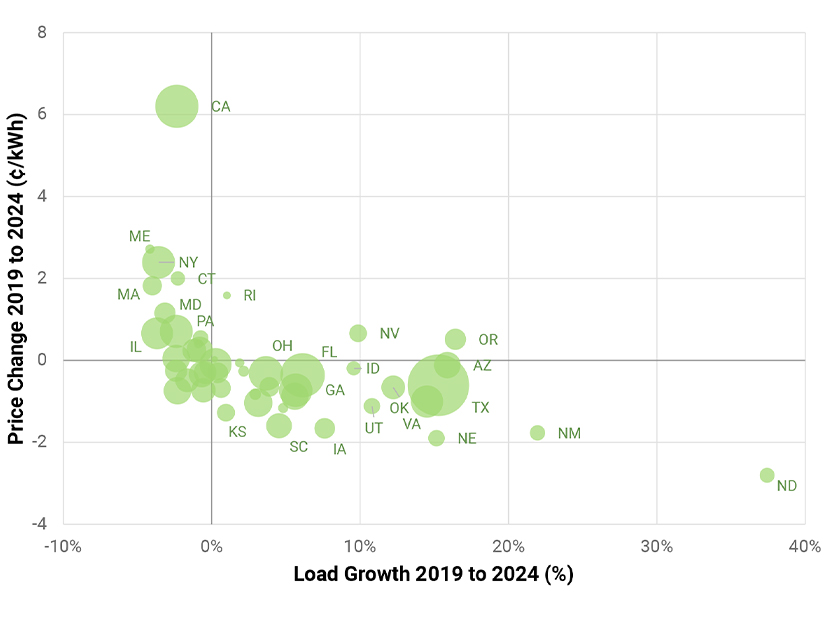

A correlation emerges in state-level analysis: States with faster load growth from 2019 to 2024 experienced smaller price increases or even price decreases, but states with flat or decreasing power sales saw larger price increases.

Large loads, the authors note, tend to locate where they expect future costs to be favorable.

Factors identified as supporting affordability amid large load growth:

-

- incremental costs for generation, transmission and distribution additions being lower than present average costs;

- high and predictable rates of utilization, to avoid wide gaps between contracted and realized load;

- data availability and baseline transparency, so that flexibility can be incorporated into planning;

- favorable load shapes and flexibility, so the new demand either flattens the system profile or does not contribute to its coincident peaks; and

- well-designed tariffs and cost allocations that ensure large load customers cover the costs and risks they impose and are compensated for flexibility they offer.

EPRI, which describes itself as “rigorously objective,” has a board of directors populated almost entirely by top executives of major power providers.