IESO downgraded less than 100 MW of capacity for November’s auction in the first application of its Performance Adjustment Factor (PAF) in both the winter and summer seasons.

The PAF ensures the ISO procures only capacity that has been confirmed by testing.

“It really was a small number of megawatts that ended up being derated because of the [PAF] … less than 100; probably less than 50 megawatts. But it was a very small amount,” Laura Zubyck, IESO’s capacity auction supervisor, said during a Jan. 29 engagement. “We’ve seen good performance in our capacity tests, and so we rarely derate.”

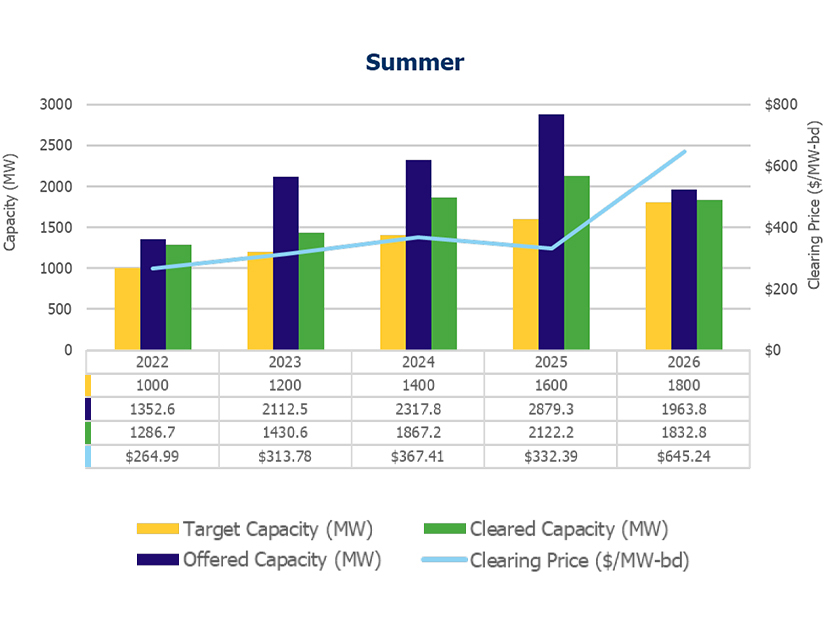

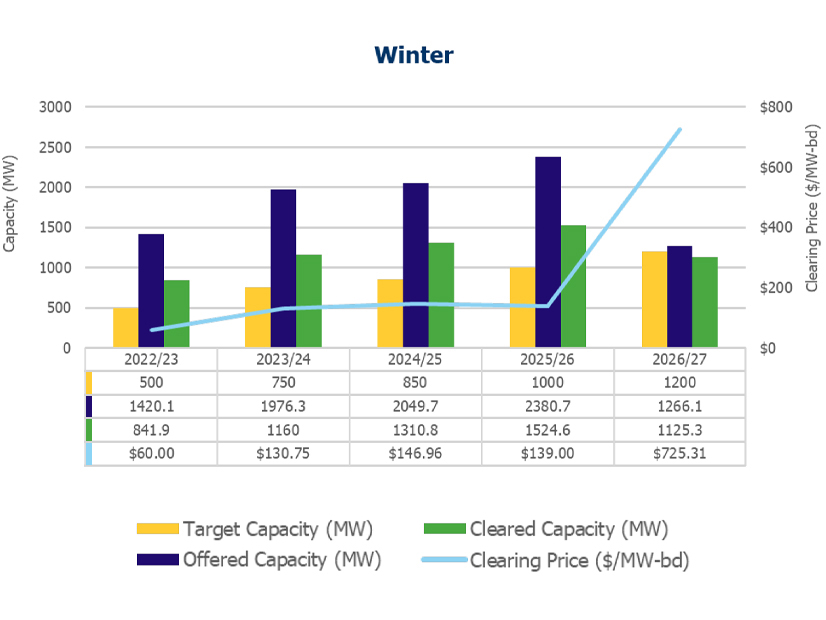

Clearing prices hit a record $471/MW-day for summer 2026, nearly double the $243 from 2024, and $530/MW-day for winter, more than five times the previous $102. (See Big Jump in Ontario Capacity Prices Signals Tightening Supplies.)

IESO’s Paulo Antunes said the results reflected short-term changes in supply combined with a 200-MW increase in the target capacity. The auction cleared 1,832.8 MW for summer 2026 and 1,125.3 MW for winter 2026/27.

IESO cleared no imports from New York, a loss of 200 to 300 MW compared with previous years. Antunes said. In addition, about 200 MW of Ontario-based generation that previously participated in the auction instead signed contracts with the ISO under its second medium-term procurement.

“The remaining available supply in the market was not enough to offset the combined impact of these two factors,” said Antunes, who also noted the impact of increasing electricity demand and ongoing nuclear refurbishments.

Virtual hourly demand response resources made up the largest share of cleared capacity, representing almost 41% in summer and 60% in winter. (See related story, IESO, Stakeholders Ponder Changes to Hourly DR.)

The largest increase in cleared summer capacity came from system-backed imports, which accounted for almost one-third of cleared capacity.

The increase largely was enabled by increasing the Hydro-Québec import limit from 400 MW to 600 MW.

Generation-backed imports, in contrast, declined.

The 2025 auction also showed a narrowing gap between offered and cleared capacity. “In previous years, the gap has been much bigger, and this is resulting in an upward pressure on price,” Antunes said.

Julien Wu, of Brookfield Renewable, thanked the ISO for providing more detail on auction results than in past years but asked officials to provide still more, including information on the technology types that experienced derates due to the PAF.

“The more information we have, the easier it is for us to make scheduling and trading decisions,” he said.