WESTBOROUGH, Mass. — ISO-NE’s Energy Security Improvements (ESI) proposal neared the finish line last week as study refinements showed a reduced level of total customer payments compared with preliminary results reported in December.

Stakeholders questioned the RTO’s methodology and timing.

Todd Schatzki of Analysis Group presented new impacts analysis to the New England Power Pool Markets Committee on Wednesday that included updated results for the winter month central case and selected other winter scenarios.

The results for the central case of a representative winter month showed total customer payments increasing in two out of three scenarios, compared to all three in the results shared at the December MC meeting. But total customer payments are lower across all cases in the latest analysis compared with the December results. (See NEPOOL Markets Committee Briefs: Dec. 10-11, 2019.)

The RTO has less than three months to meet an April 15 deadline to file a long-term fuel security mechanism with FERC (EL18-182). The Participants Committee likely will vote on the new market construct at its April 2 meeting. The program would use financial incentives in day-ahead options and forecast energy requirement (FER) payments to persuade generators to buy fuel in advance to avoid shortages during periods of extreme cold.

The new results from Analysis Group reflected ESI shortage prices above those currently proposed by ISO-NE and adjusted solar and wind’s participation in the day-ahead market.

The new analysis showed that in the “frequent” stressed conditions scenario, total payments by load would increase 3.7% to $4.27 billion, with $257 million in FER payments and $222 million in day-ahead option payments partially offset by a $174 million reduction in payments for energy and real-time operating reserves.

Under the “extended” stressed conditions case — based on 2017/18, with its one long cold snap — load costs would decrease $63 million (-2.3%) to $2.66 billion.

The “infrequent” stressed conditions case, based on 2016/17, showed $1.8 billion in load costs, a $48 million (2.8%) increase.

The other scenarios studied produced a wide range of outcomes in customer costs, from a reduction of $316 million (increasing load by 5%) to an increase of $407 million (the “no incremental oil” scenario). Schatzki said the results reflected factors including changes in market tightness, risk premiums and replacement energy reserve (RER) quantities.

Fixed Strike Price Adder

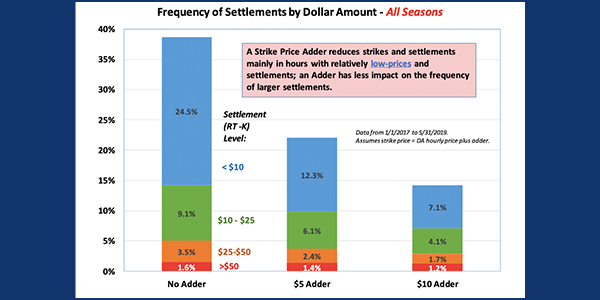

New England States Committee of Electricity (NESCOE) Director of Analysis Jeff Bentz presented a proposal for a $10 adder on the strike price, saying, “We really do remain concerned that consumers could be left on the hook for costs.”

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to amplify their presentations.]

Increasing the strike price by $10/MWh in all hours, as ISO-NE proposes, reduces the frequency of option striking and should lower costs, according to NESCOE. The fixed-price adder has a minor effect on incentives to cover the call and deliver energy, which translates into a minor effect on energy security. It could also increase participation under the ESI proposal, which increases the likelihood of the design being successful.

“The fixed dollar amount adder diminishes the ‘noise’ of uncertainty … and we don’t think this materially affects the incentive,” Bentz said. “It’s all about cost and benefits.”

NESCOE believes the $10 adder will reduce the cost and risk of the option for sellers, which should reduce the clearing prices and cost to consumers while maintaining strong incentives.

As part of a broader market power mitigation package under the amendment, resources with a capacity supply obligation would be subject to a must-offer requirement.

As recommended by Connecticut regulators, NESCOE wants regular assessments of the competitiveness of ESI and the call option offers.

ESI Methodology in Question

Christina Belew of the Massachusetts attorney general’s office presented two amendments: one to eliminate RER from the ESI design, and the second to add a look-back provision to the ESI program to enable evaluation of its efficacy.

The look-back would take place after ESI has been in effect three years and would use evaluation criteria vetted through the NEPOOL stakeholder process. “We chose a three-year period before reporting because we felt that was adequate to acquire indicative performance data,” Belew said.

On the proposed amendment to eliminate RER, her colleague Ben Griffiths, an energy analyst for regional and federal affairs, questioned the cost-effectiveness of the product and the RTO’s rationale that RER ensures the day-ahead market will award sufficient “replacement energy” options to restore operating reserves consistent with NERC/Northeast Power Coordinating Council restoration time standards.

In addition, RER is intended to account for load forecast error, but the RTO does not define the methodology to be used.

“Unlike the more formulaic requirements of generator contingency reserves [GCR] and energy imbalance reserves [EIR], this open-ended load forecast error makes me uncomfortable,” Griffiths said. Increasing RER requirements leads to “modest impacts on fuel security but could entail large impacts on costs, which doesn’t strike me as prudent.”

“I’m still struggling with a lack of value, a lack of design,” Griffiths said. “From what we’ve done so far, I feel we should proceed with parts that we have a better understanding of, especially because the results don’t show any fuel security benefit, even though our mandate in this docket was narrowly tailored to addressing fuel security.”

The RTO’s lead analyst for market development, Ben Ewing, presented the following day and concluded that RER is a conceptual extension of GCR, and that both awards “cascade down” and their respective clearing prices “cascade up” while ensuring the RTO’s ability to meet reliability standards.

LNG Contracts

Karen Iampen of Repsol, which operates the Canaport LNG terminal in New Brunswick, Canada, said that ISO-NE is misrepresenting or misunderstands how LNG contracting works, and that because LNG contracts require market commitment prior to being procured and scheduled weeks in advance, developing financial options around a day-ahead price does not ensure fuel security.

“Revenue certainty is the only thing that will persuade generators to stock up on LNG or natural gas,” Iampen said.

In his presentation, Schatzki said LNG contract structure is not a “key determinant” in the model’s estimates. He admitted that “the model’s ‘full supply’ assumption may overstate available LNG in some cases” but said a scenario with less LNG available produced ESI impacts similar to the central cases.

Gary Ritter of Excelerate Energy, which runs the Northeast Gateway Deepwater Port for LNG, situated 13 miles offshore Boston, said his company shares many concerns with Repsol.

“Right now, in the middle of January, we are not present here with a [floating storage and regasification unit],” Ritter said. “We don’t have a dedicated ship for New England, not to say we’re not committed to the region. We just need an appropriate commitment.”

— Michael Kuser