By Rich Heidorn Jr.

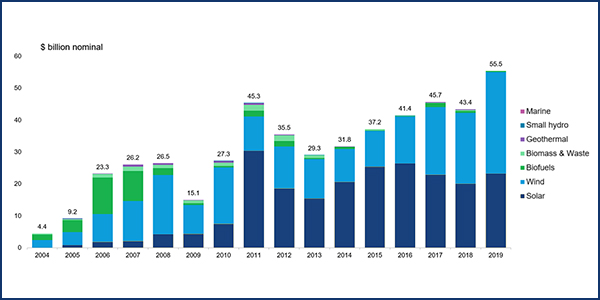

U.S. renewable investments jumped 28% to a record $55.5 billion in 2019, showing the clean energy revolution is thriving despite the federal government’s failure to enact climate policies.

“We’ve seen renewable energy capacity double [in the U.S.] since the beginning of the decade,” said Ethan Zindler, Americas chief for BloombergNEF (formerly Bloomberg New Energy Finance), who released the data during a webinar by the American Council on Renewable Energy (ACORE) on Wednesday. “Solar capacity is probably 40 times what it was a decade ago.”

Renewable generation has increased about 75% to 761 TWh in 2019. Renewables now represent 18% of U.S. generation nameplate capacity. Including nuclear power, 38% of the country’s generating capacity is carbon-free.

Zindler said the biggest reason for the results in the U.S. was “a bit of a frenzy ahead of [the] anticipated step downs in tax credits.”

Globally, investment grew to $282 billion, a $1 billion increase from 2018, as the U.S.’ strong performance overcame a slowdown in China. The peak was $315 billion spent in 2017.

Although global spending was virtually flat in 2019 from 2018, Zindler said, declining costs meant developers were able to add 180 GW of generating capacity, up about 20 GW from the prior year. Wind edged out solar slightly in total investment worldwide, rising 6% to $138 billon while solar dipped slightly to $131 billion.

Growth was fueled in part by corporate power purchases, which totaled 50 GW, most of them in the Americas. The RE100 — 221 companies that have committed to 100% renewable electricity — have total electric demand about equal to that of South Africa, Zindler said.

Zindler said Congress’ one-year extension of the production tax credit is likely to result in a 1.5- to 2-GW increase in wind growth through 2025. Bloomberg projects 28.5 GW of new renewables in 2020, which would be the largest ever “by a pretty decent amount,” Zindler said.

Separately Wednesday, the American Wind Energy Association reported that 2019 was the U.S. wind industry’s third strongest year, with developers adding 9,143 MW of capacity. An additional 44 GW of wind projects, totaling more than $62 billion, are under construction or in advanced development, AWEA said.

Challenges

Other panelists on ACORE’s “Outlook for Growth & Investment in 2020” webinar discussed industry trends and challenges.

“The conversations taking place today are slightly different than they were a couple years ago,” said Craig Gordon, vice president of government and regulatory affairs for Invenergy. “Companies like Invenergy aren’t just doing wind. They’re doing wind, solar and storage in the renewables space.”

Gordon cited the challenges of developing new generation at a time of record low power prices and flat demand. “We’re pushing new megawatts onto a grid that’s already oversupplied. That’s very apparent in places like PJM,” he said.

Gordon also complained of “regulatory uncertainty” in New York, citing Gov. Andrew Cuomo’s Jan. 24 budget address.

“He said he would like the state government to begin doing the siting and transmission and development and then bring in developers after the fact to build the projects that they’ve cleared the way for,” Gordon said. “That’s really not helpful in a state where we’ve already seen significant regulatory burdens in getting projects done.”

He also slammed FERC’s Dec. 19 order directing PJM to expand its minimum offer price rule.

“If FERC was really hoping to just allow coal, I think they miscalculated … big time,” he said. “I think they may have taken a sledgehammer when a scalpel would have been more appropriate to deal with the issues around the capacity market.”