By Amanda Durish Cook

MISO tossed a curveball at stakeholders Tuesday when it said it will now consider two types of solutions to mitigate its Midwest-South transmission constraint before the original term of the settlement agreement facilitating transfers draws to a close.

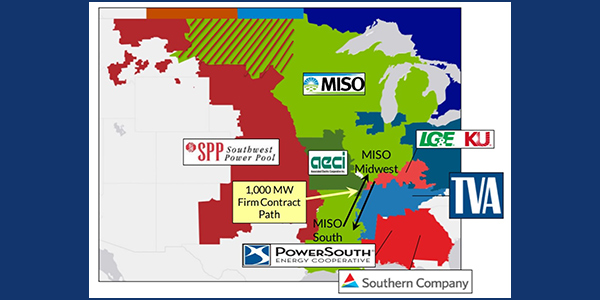

The 2016 agreement with seven joint parties — including SPP — limits transfers between MISO Midwest and South to 3,000 MW southbound and 2,500 MW northbound. The deal is set to expire next year, leaving MISO and its members to confront escalating costs under a new arrangement.

Speaking during a conference call Tuesday, economic studies engineer David Severson revealed more details about the original solution, saying that MISO is focusing on three proposed projects to alleviate the constraint.

But Severson also posed a new option: MISO could avoid building new transmission by instead exploring ways to purchase firm capacity to supplant the settlement agreement. The revelation caused consternation among some members on the call.

Joint parties to the settlement agreement | MISO

Three Projects…

Severson explained that each of three proposed projects under consideration would create a new 345-kV line terminating at the Jim Hill substation in southeastern Missouri. Costs for the proposals range from $152 million to $262 million, with cost-benefit ratios from 2.04:1 to 1.1:1. Two of the projects would increase the existing 1,000-MW contract path by 2,574 MW, while the most expensive proposal would increase it by 2,302 MW.

MISO requires projects to demonstrate at least a 1:1 benefit-to-cost ratio over 20 years to be considered under its Market Congestion Planning Study. It used an economic model from its 2019 Transmission Expansion Plan (MTEP 19) to estimate benefits for the proposals.

“Going forward, we plan on doing some refinement, getting stakeholder feedback and doing some external outreach,” Severson said of the project ideas.

MISO had been focusing on nine possible projects after receiving 35 proposals last summer to alleviate traffic on the constraint or even eliminate the need for the settlement agreement altogether.

RTO staff extended its analysis of the projects beyond the MTEP 19 approval deadline in December. (See MISO Studying Projects to Cut North-South Tx Reliance.) That work will be completed in the first half of this year, MISO executives have said.

During Tuesday’s call, MISO staff said the three projects will now enter a more rigorous testing that includes alternative components. WPPI Energy’s Steve Leovy said MISO should examine combining elements of the three different projects.

Some MISO stakeholders warned that approval of just one of the projects might not be a panacea for all subregional transfer constraints. They called for more analysis on the nearby system.

Veriquest Energy’s David Harlan asked MISO to take a closer look at how the projects could alter flow patterns on nearby lines or tax existing substations, impacting either SPP or the joint parties to the settlement agreement.

“I would hate to see us lose all of our settlement payments … only to hit a constraint with SPP,” WEC Energy Group’s Chris Plante added.

The agreement requires MISO to make monthly payments for usage based on a capacity factor. At a 20% or less capacity factor, MISO pays $1.33 million per month, while a 20 to 70% capacity factor sends the price to $2.25 million per month. A factor higher than 70% results in a $3.17 million monthly payment.

Those payments are set to escalate annually beginning next month — by an additional 2% for up to a 70% capacity factor and 4% for capacity factors above 70%.

The agreement’s initial term ends on Jan. 31, 2021, when it automatically converts into yearly extensions which can be terminated with a 12-month written notice by any of the settlement’s seven joint parties, which include MISO, SPP, Tennessee Valley Authority, Southern Co., LG&E and KU Energy, Power South Energy Cooperative and Associated Electric Cooperative Inc. If that happens, the parties enter a four-month renegotiation period. If no agreement can be reached, MISO’s rights on the transmission systems of the other parties are terminated, leaving it once again subject to paying SPP unreserved transmission-use penalties for flows above MISO’s 1,000-MW contract path capacity.

Senior Adviser Jack Dannis said MISO is currently discussing next steps of the settlement agreement with the other parties.

…or Buy Firm Service?

Dannis emphasized that MISO has three options for increasing its contract path post-settlement agreement: building new transmission, adding a new transmission-owning member that connects the regions, or obtaining firm transmission service from another company connected to both regions.

“We’re in frequent communication with SPP and the joint parties,” Dannis said. The parties are currently “performing transmission planning analyses to identify cost-effective solutions for providing MISO firm transmission rights,” he said. Those solutions may involve upgrades to SPP or neighboring systems in order to offer MISO new firm rights.

Dannis said for every 1 MW of increased capacity on the contract path, MISO’s payment is reduced by $667/MW-month.

That MISO is considering purchasing firm transmission rights from its neighbors came as a surprise to some stakeholders.

LS Power’s Pat Hayes said MISO last year only asked that transmission developers propose solutions that could increase capacity on the transfer limit — and didn’t let on that firm service purchases were also an option under consideration.

“This is a pretty big transparency issue, and we should be able to participate, and we’re not right now,” Hayes said. “I know that there are other parties in the room that feel this way.”

Hayes said it also isn’t clear whether MISO stakeholders would have another opportunity to propose projects that would increase transfer capacity between the regions through a coordinated system plan between MISO and SPP. The RTOs will decide this spring whether to embark on a study that could result in an interregional project. MISO officials said it was too early to speculate on what type of projects would be examined under such a study.