The New England Power Pool Participants Committee on Thursday heard about ISO-NE’s response to Connecticut state regulators, who last month held a public hearing to examine whether the RTO’s wholesale electricity markets are geared to serving the state’s clean energy objectives.

ISO-NE Vice President of External Affairs Anne George recounted her testimony at the hearing, saying she recommended the state pursue a general policy discussion rather than a regulatory proceeding, especially as no specific regulation could take effect before the end of the 2020s. (See Connecticut Weighs Pros, Cons of ISO-NE Markets.)

PC Chair Nancy P. Chafetz directed stakeholders not to get into a deep policy discussion of ISO-NE’s response to Connecticut officials.

Loads Fall to Historic Lows

ISO-NE COO Vamsi Chadalavada reported that January — like December — saw record high temperatures averaging 7.8 degrees Fahrenheit above normal, which was reflected in loads.

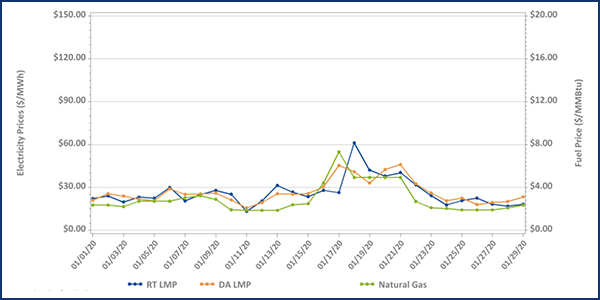

“Real-time loads have been averaging just about 14,000 MW, and the natural gas prices are just about averaging $3/MMBtu,” Chadalavada said.

“Our loads have been averaging close to historic lows for the months of December and for January, almost directly correlated to the very mild weather,” he said. “Season to date, temperatures have been about 4.5 degrees warmer than normal, and January has been much higher than that, almost double at close to 8 degrees more than normal.

“Also there’s been very little snow cover, so the output from the PV installations … is going to be more efficient, and that also factors into these low loads that we see during the middle of the day when the sun is out,” Chadalavada said, adding that the RTO forecasts more of the same for the coming weeks, aside from a brief cold spell at the end of this month.

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to amplify their presentations.]

Net commitment period compensation (NCPC) payments have also hovered at record lows, continuing a trend from 2019, he said, noting that second contingency payments totaled $108,000, down $2.5 million from December, all of it in Southeast Massachusetts/Rhode Island and resulting from a transmission line being out of service.

Chadalavada also responded to a stakeholder question received offline about testing energy imports for their intensity of emissions.

“We’re hoping to take that up in April, but what we’ve seen based on our research is that there isn’t really granular information that’s available that allows for either a monthly or even a real-time assessment,” Chadalavada said. “There is an opportunity on an annualized basis to collate some data, but to get a more granular level requires some source of public information that we haven’t been able to find.”

Litigation Report

NEPOOL Secretary David T. Doot highlighted several items from the monthly litigation report, starting with the proceedings involving broad resistance to FERC’s December decision to subject new self-supply units to the minimum offer price rule (MOPR) in PJM’s capacity market (EL16-49, EL18-178).

The commission said PJM must expand its MOPR to counter increasing state subsidies, primarily for renewables and financially struggling nuclear generation, but self-supply load-serving entities argue the order will unravel their business model. (See MOPR Ruling Threatens to Upend Self-supply Model.)

Other discussion focused on Forward Capacity Auction 14, which last week cleared 33,956 MW of capacity for 2023/24 after five rounds of bidding at a record low of $2/kW-month, a nearly 50% drop from $3.80/kW-month in 2019. (See related story, ISO-NE Capacity Prices Hit Record Low.)

FERC last week rejected a couple waiver requests related to FCA 14. The commission denied solar aggregator Genbright a waiver for 14 distributed energy resources projects “to avoid ISO-NE’s complex interconnection study process, including the system impact study, which is ISO-NE’s comprehensive reliability evaluation” (ER20-366). (See related story, FERC Rejects Genbright Waiver on FCA14.)

In the second case, the commission denied Mystic owner Exelon a waiver to amend its cost-of-service agreement and allow the generator to retire in the second year of the two-year agreement (ER19-1164).

Doot also highlighted FERC declining to reconsider two orders upholding NEPOOL’s gag rule but allowing an RTO Insider reporter to join the organization’s End User sector. (See FERC Rejects Rehearing on NEPOOL Press Rules.) The commission also denied Public Citizen’s request for rehearing of its April 2019 ruling rejecting RTO Insider’s complaint seeking to void NEPOOL’s policies prohibiting nonmembers, including the press and public, from attending stakeholder meetings (EL18-196-001).

Tariff Revisions on Storage

The PC on Thursday approved Tariff revisions to enumerate the services that will result in the transmission charge exemption and expanded its explanation regarding why exempting electric storage facilities from transmission charges is justified given the policy direction set out in FERC Order 841.

The commission in December conditionally accepted ISO-NE’s Order 841 compliance filing but asked for additional changes to clarify the application of transmission charges to electric storage resources (ER19-470). (See Storage Plans Clear FERC with Conditions.)

— Michael Kuser