By Amanda Durish Cook

MISO last week released a set of draft future scenarios that would reflect in its transmission planning process the increasingly dominant role clean energy resources will likely play within the footprint as Midwest states push to decarbonize and electrify vital parts of their economies.

The RTO will use more aggressive renewable generation projections beginning with its 2021 transmission planning cycle (MTEP 21). Late last year, it released three draft 20-year futures — Announced Plans, Accelerated Fleet Change and Advanced Electrification — that take into account utilities’ decarbonization plans, the push toward renewable generation and increasing electrification in the footprint, respectively.

In December, some stakeholders questioned whether the proposed futures went far enough in terms of renewable projections. (See Stakeholders Debate MISO Planning Futures.)

At a special workshop Thursday, MISO revealed an updated strawman proposal, assigning the futures more neutral Roman numerals instead of titles.

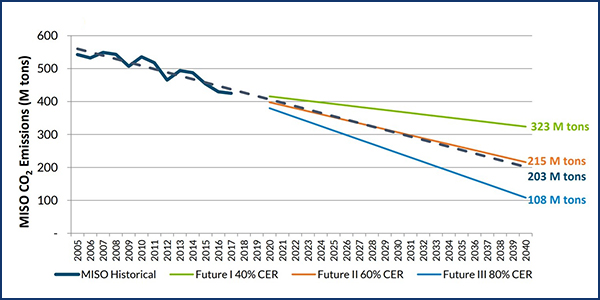

Future I — formerly Announced Plans — assumes an 85% probability that companies’ renewable growth and carbon-cutting goals will materialize and full certainty that states’ clean energy plans will come to pass. It also includes a nearly 35% renewable generation penetration and a 40% reduction in carbon emissions from 2005 levels by 2040.

“This is hedging the possibility that some of these plans are vague and may not come to fruition,” MISO Planning Manager Tony Hunziker said.

Future II — previously Accelerated Fleet Change — assumes MISO members meet or exceed decarbonization plans while carbon emissions drop 60% from 2005 levels. Electric vehicle adoption stimulates demand, while residential and commercial electrification reaches 39% of its technical potential.

Future III — Advanced Electrification — also assumes members fulfill their renewable plans and consumers adopt EVs. It foresees a sharp increase in demand because of electrification and residential and commercial electrification hitting 77% of its technical potential. MISO also experiences a minimum 50% renewable penetration level as carbon emissions dip 80% below 2005 levels.

MISO said the proposed MTEP 21 futures show “significant evolution” from those of MTEP 19, where renewable penetration topped out at about 36% of the resource mix by 2035 in the most aggressive future.

The RTO wants to have the new futures finalized by July.

Hunziker said MISO’s Board of Directors is “very interested” in moving ahead on the futures redesign in light of the RTO’s rapidly changing resource mix and recently filed integrated resource plans at state commissions.

“It’s still very much a draft,” Hunziker told stakeholders. “We’re pouring the concrete, but it hasn’t set yet, so we can still form it, push it around before it is set in stone.”

The futures will go before the Planning Advisory Committee at its March 11 meeting, where stakeholders will have another opportunity to suggest alterations.

‘Choking Point’

Some stakeholders asked how flexible the concrete will be when dried, asking if MISO was leaving room in its planning scenarios to include even more fleet transition. They said the RTO seems to be at an inflection point of utilities and states announcing stepped-up carbon-cutting measures.

Hunziker said MISO is introducing a survey tool as part of the futures’ analysis to continue to solicit companies’ announced plans along with state mandates and goals.

He also said the RTO is partnering with the Organization of MISO States to get commissions’ most up-to-date decisions on their utilities’ resource additions and retirements. The idea is to get a single repository of commissions’ decisions instead of MISO “minding the vast, expansive infowebs,” he said.

Mississippi Public Service Commission consultant Nick Puga asked if MISO has vetted the futures’ electrification predictions with outside consultants.

Hunziker said MISO’s electrification projections are based on internal research and data from outside consultants, including Applied Energy Group.

“If the Super Bowl ads were any indication, it looks like there will be a lot of electric vehicles … potentially in the next year,” Hunziker said.

Multiple stakeholders asked MISO to schedule a special workshop with stakeholders to describe the RTO’s approach to its electrification projections. Hunziker said MISO will consider the request.

Veriquest Group’s David Harlan asked that MISO provide stakeholders with each future’s projected subregional energy mix, capacity supply broken down by fuel type and load shapes. He argued that if the futures are intended to drive transmission investment decisions, members should have a better idea of which generation sources will be matched up with load on the subregional level.

Minnesota Public Utilities Commission staff member Hwikwon Ham reminded stakeholders that MISO is planning for new transmission, not trying to pinpoint exact locations of future generation.

“We don’t need to project where resources will be precisely available,” Ham said, adding that the system has recently become a “choking point” in getting new resources built and interconnected.