ISO-NE intends to design a forward ancillary services market to complement the day-ahead one proposed under its energy security improvements (ESI) initiative, stakeholders learned last week.

It will formally signal that intent in its April 15 filing with FERC of the long-term fuel security mechanism (EL18-182).

“Based on this analysis to date, we expect that the forward sale of ancillary services could support the efficient energy inventory arrangements and therefore could improve energy security and market efficiency,” Christopher Geissler, ISO-NE economist, told the New England Power Pool Markets Committee during a three-day meeting.

The new market would allow RTO participants to sell ancillary services “seasonally forward, perhaps for longer time periods,” Geissler said. “One piece of the puzzle, as discussed at previous meetings, is that the forward reserve market as it currently exists cannot continue under ESI, being incompatible.”

The RTO sees the new effort as a replacement or, at least, a substantial redesign of the forward reserve market, which is unlikely to be completed this year, he said. It hopes to implement the forward market construct along with the spot market built into the ESI because such procurements work well when they settle against a transparent, spot price for the underlying service, he noted.

The Participants Committee plans to vote on the overall energy security plan at its April 2 meeting, ahead of FERC’s April 15 filing deadline.

The forward market presentation followed a high-level summary of ESI, the problems it attempts to address and the specific solutions the RTO is proposing.

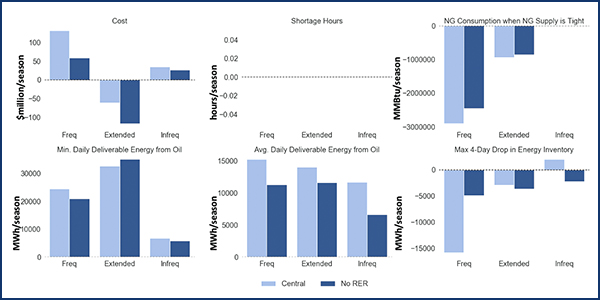

Full ESI vs No-RER impact analysis results | Analysis Group

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to clarify their presentations.]

Geissler emphasized that the RTO was in the early stages of planning and design on the forward ancillary services market.

Brett Kruse of Calpine asked the RTO to clarify what season-ahead products it foresees selling among general contingency reserves (GCR), energy imbalance reserves (EIR) and replacement energy reserves (RER).

“We’re thinking about whether we would procure all three of those products or, instead of separately, having some sort of blended average of them that was procured forward, or whether we would buy only a subset of them,” Geissler said. “We might think of the GCR and RER products as having a relatively predictable, stable quantity looking ahead, on average, whereas with the EIR product, a lot of hours may be zero, or some hours it will be positive, so trying to procure that forward may present different challenges.”

Strike Price Adder Impact

Geissler also addressed the New England States Committee on Electricity’s presentation last month advocating a fixed $10/MWh adder on the strike price for all energy call options under the ESI plan. His analysis suggested that the adder — called a “bias” by the RTO — would reduce the incentive for option sellers to procure fuel. (See “Fixed Strike Price Adder,” NEPOOL Markets Committee Briefs: Jan. 14-15, 2020.)

The RTO’s current proposal does not include the adder; it has instead proposed the strike price be set at the expected real-time LMP but is also open to stakeholder feedback on the pros and cons of an adder, Geissler said.

He said the RTO assumes that a resource that sells day-ahead energy or ancillary services under ESI will be incentivized to spend on fuel to make itself available in real time, but it will see those incentives decrease as the strike price increases above its marginal costs.

“This means that if we add a bias that makes the strike price much higher, the likelihood that the strike price exceeds the resource’s marginal costs are greater, and as a result, the resource’s incentives to procure the fuel or take the actions necessary to be available in real time may therefore be diminished.”

Under frequent stressed conditions, a strike price bias of $10 reduces the incentive for 21% of all day-ahead options sold during periods where the real-time LMP exceeds $150/MWh. | ISO-NE

The incentive depends on the resource believing that its operation or failure to operate will have some impact on real-time prices, said James Wilson, a consultant with NESCOE.

“The point is that if you raise the strike price, it reduces the settlement, but if the reduction in the settlement from the resource’s perspective is the same, whether or not it acquires fuel and is able to run … then the higher strike price doesn’t really affect its incentive to acquire fuel,” Wilson said.

Geissler agreed but also noted that if the resource’s real-time availability doesn’t affect real-time prices, one has “assumed away the misalignment problem” — between the cost of acquiring extra fuel and benefit of being available for power — that prompted the region’s concerns about fuel security.

Preliminary analysis suggests that a modest adder would reduce the incentive to procure fuel for a portion of resources that sell day-ahead options in the ESI winter central cases. For example, a $10 adder would reduce the incentive between 2 and 9% across all hours in those cases.

However, the impact is more significant during periods of system stress, as a bias impacts the incentives of approximately 20% of all option megawatt-hours sold, he said.

“Once the strike price is at or above [a generator’s] marginal cost, that incentive to actually go out and buy the fuel starts to diminish because the delta between its net revenues from buying the fuel versus not buying the fuel starts to decrease,” Geissler said.

ESI Increases Generator Margins

Todd Schatzki of Analysis Group presented a draft impact analysis that shows ESI increasing margins for selling power through forward energy requirement (FER) payments and additional returns earned through the sale of day-ahead energy options.

He recommended the report’s overview section as a good three-page summary for stakeholders who are not as interested in the technical details of ESI as others.

The analysis is both quantitative and qualitative, assessing impacts on economic and reliability outcomes, as well as market participants’ behavior, such as spurring generators to acquire sufficient fuel to power them through an extended period of stressed conditions, he said.

The tables demonstrate that the average incremental payments to resources under ESI generally far outweigh the additional holding costs, with ESI revenues in these cases far exceeding the change in holding costs for all fuel-oil resource categories. | Analysis Group

“To assess the magnitude of these incentives, we start by comparing these new ESI revenues to the change in inventory costs, given the quantity of incremental fuel ESI is assumed to incent,” the report says. “New revenue streams that are large relative to the change in inventory costs is an important indicator of the proposal’s strong incentives.”

The report shows the change in economic costs of incremental energy inventory, measured by the financial — or holding — costs of having more fuel in inventory at the end of the winter because of decisions to increase inventory for the season.

The study of winter months demonstrates “that the average incremental payments to resources under ESI generally far outweigh the additional holding costs. In the ‘frequent’ or ‘extended’ cases, these ESI revenues far exceed the change in holding costs for all fuel oil resource categories,” the report says.

For example, for dual-fuel, combined cycle units in the “frequent” case, the incremental cost of holding a larger quantity of fuel at the end of the winter because of more aggressive refueling is $14/MW. By contrast, the additional revenues earned because of ESI compared to current market rules are $5,591/MW ($5,452 and $139 for FER payments and day-ahead energy options, respectively), for a net increase in revenue of $5,577/MW.

The results show the additional market revenues from ESI far exceed the change in costs of holding additional fuel, illustrating the initiative’s strong incentives for oil resources to increase the quantity of fuel held during winter. This incremental oil will help maintain system reliability during periods of system stress, he said.

— Michael Kuser