By Michael Kuser

Eversource Earnings Go South on Northern Pass.)

The company on Wednesday reported full year 2019 earnings of $909.1 million ($2.81/share), down from just over $1 billion ($3.25/share) in the same period a year ago.

Excluding that impairment, Eversource would have earned $1.1 billion ($3.45/share) last year. In the fourth quarter, Eversource earned $250 million ($0.76/share), up slightly from $231 million ($0.73/share) in the same period a year ago.

“The credibility generated by our strong operating performance helps us achieve very tangible results, especially in areas such as structuring long-term rate deals in our regulatory jurisdictions, or entering new business ventures such as water and offshore wind,” CEO Jim Judge said in an earnings call.

All New England states are targeting at least an 80% reduction in greenhouse gas emissions by the year 2050, and in December the company announced a goal of becoming carbon-neutral by 2030. Eversource has already reduced its carbon emissions by approximately 70% over the past few years, primarily by divesting fossil generation in New Hampshire, Judge said.

Offshore Wind Advantages

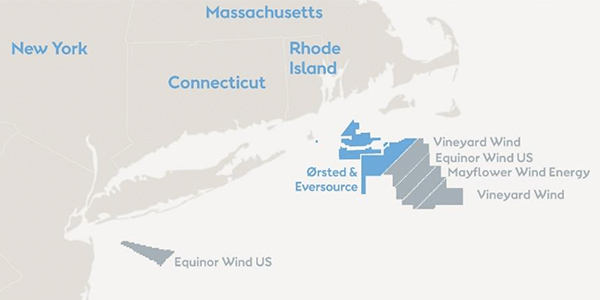

Judge said Eversource’s partnership with Ørsted will result in “at least” 4,000 MW of offshore wind off Massachusetts, which is “incremental to making our operations carbon neutral by 2030.”

The companies in October signed a contract with New York for the 880-MW Sunrise Wind offshore wind project, which comes on top of their 130-MW South Fork project 30 miles off Montauk, Long Island. Their Revolution Wind project has commitments from Connecticut and Rhode Island for 600 MW of offshore wind.

Connecticut Gov. Ned Lamont earlier this month announced a public-private partnership with Eversource and Ørsted to upgrade the New London pier for offshore wind operations.

Planned filings with the U.S. Bureau of Ocean Energy Management (BOEM) will be consistent with the plan that Revolution will have its first full year of operation in 2024 and Sunrise in 2025, he said.

“We continue to target operation of the first and smallest of these three projects, South Fork, by the end of 2022,” Judge said. “We are currently reviewing that schedule in light of BOEM’s recent announcement that it will not complete its cumulative impact study on the six tracks of Massachusetts until mid-June. That study is part of the Vineyard Wind application but will likely encompass all of the tracks.” (See Offshore Wind Slogs Forward in Massachusetts.)

The partners did not win in the most recent awards in Massachusetts and Connecticut; while the latter price was not disclosed, Massachusetts released the record-low price submitted by Mayflower Wind: $58.47/MWh.

“Although disappointed, I was comfortable with our bid not being selected,” Judge said.

With at least 15 GW of contracts likely available to developers over the coming years, “the last thing we would want to do is lock ourselves into contracts for 20 to 25 years that would not allow us to earn our targeted returns because we bid too aggressively,” he said.

The partners control the two best ocean tracks that BOEM has auctioned off in New England, which are the closest to shore, and should be the most economic to develop and maintain, Judge said.

“We consider our sites to be a tremendous competitive advantage, and we’ll be disciplined in our bidding,” he said. “We’ll take some additional few years to reach the 4,000-MW capacity for our tracks. We are fine with being patient and preserving our potential returns.”

CFO Philip Lembo said the company expects to invest $300 million to $400 million in its offshore wind projects in 2020.

Regulatory Update

The total investment needed to switch over all electric and natural gas customers to advanced metering infrastructure (AMI) in Connecticut and Massachusetts would be approximately $1 billion, Lembo said, adding that it’s unclear whether regulators will authorize AMI.

Public Service Company of New Hampshire filed a rate case last year seeking a $70 million increase in base distribution rates. Following the settlement with the staff, the state’s Public Utilities Commission approved a $28 million temporary increase that will remain in effect until the PUC implements a final decision on the permanent rates, which he said the company expects in May with an effective date July 1.

Call transcript courtesy of Seeking Alpha.