By Rich Heidorn Jr.

Facing opposition from state regulators and consumer advocates, PJM said Monday it will suspend an initiative that could tighten fuel requirements for black start resources.

PJM’s David Schweizer told a special meeting of the Operating and Market Implementation committees that the initiative will go on “hiatus” for several months to allow the RTO to do additional analysis on the potential benefits of requiring some or all black start resources to have a secondary source of fuel in addition to their primary source.

Citing potential capital costs of up to $513 million, the Organization of PJM States Inc. (OPSI) told PJM in a letter Feb. 13 that “with no clear measure of benefit or risk reduction … there is not a strong foundation at this time to support any of the options” under consideration. It recommended “stakeholders consider refocusing their efforts towards exploring risk-informed measures that would be used to better define black start resource availability expectations.”

Based on OPSI’s feedback and discussions with other stakeholders, Schweizer said PJM concluded the “best approach is to step back and further assess the impacts” of the proposals before bringing any of them to a vote. The MIC had been planning a vote on the packages in a special session before its regular March 11 meeting. That special meeting has been canceled.

PJM called for the initiative in 2018, noting that the only fuel assurance requirement for black start resources is that they maintain enough for 16 hours of run time.

During the hiatus, Schweizer said the RTO will pursue a “three-pronged” research project, including expanding a previous study on the impact of delayed restoration resulting from the unavailability of black start units lacking fuel.

“We may look at expanding that analysis to look at more transmission operator zones or a different type of analysis with different assumptions,” he said.

RTO staff also “will look at something with respect to gas pipeline assessment impact analysis” and seek to estimate the economic impact of a delayed restoration “to address the concerns that the state commissions have raised,” Schweizer said.

He said the studies will take “several months to six months.” Staff will provide more details on the studies and timeline at the Market and Reliability Committee’s March 26 meeting.

In the meantime, he said, PJM also will propose a new problem statement and issue charge on the “rather urgent” need to update black start testing requirements. It also would consider updating black start termination and substitution rules and the capital recovery factors for compensation to reflect current tax laws and interest rates.

“ODEC will be very pleased to hear this news,” Old Dominion Electric Cooperative’s Adrien Ford said of PJM’s decision to conduct additional analysis on fuel security before seeking a vote.

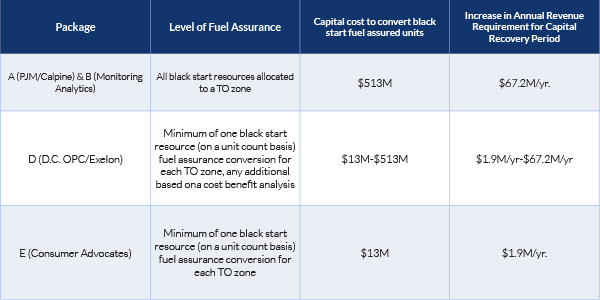

Before adjourning the meeting, stakeholders heard summaries of two alternatives to the PJM/Calpine proposal that 100% of black start units have a secondary fuel source. PJM estimates its proposal would require $513 million in capital spending, increasing annual revenue requirements by $67.2 million over the current $65 million.

Alternative Plans

Greg Poulos, executive director of the Consumer Advocates of the PJM States (CAPS), offered a proposal that would limit fuel assurance requirements to one resource per TO zone. “I didn’t see the votes [of consumer advocates and load interests for] going any higher than that. That’s why I put this together,” he said.

Poulos said the proposal was based on discussions with “a couple” of state advocates’ offices but was not an official CAPS proposal, which would require a vote of members. PJM estimated the capital cost of the proposal at $13 million, or $1.9 million per year.

After the Feb. 5 MIC meeting, Exelon and the D.C. Office of the People’s Counsel joined on a proposal that each TO zone have at least one fuel-assured black start resource, with additional fuel-assured resources being awarded based on a cost/benefit analysis performed by PJM with input from the TO. (See “States, Advocates Unsure of Black Start Fuel Assurance,” PJM MIC Briefs: Feb. 5, 2020.) PJM estimated the cost would fall between Poulos’ and the RTO’s plan.

Tom Hyzinski of GT Power Group said that even doubling black start costs would add only $2.50/year to his electric bill for an all-electric home. “It’s been asserted that the benefits [of the PJM/Calpine proposal] haven’t been shown,” he said. “The cost of even the most expensive option is relatively modest.”

Erik Heinle of the D.C. OPC noted that the costs would not be spread evenly over the RTO’s footprint. “Some zones wouldn’t pay anything; others would be hit more substantially,” he said.

Thus, he said, PJM should allow state regulators to determine their “risk tolerance.”

“It would be their ratepayers who would be responsible for coming up with that difference,” he said.