By Hudson Sangree

Xcel Energy and three other Colorado utilities decided to join CAISO’s Western Energy Imbalance Market instead of SPP’s Western Energy Imbalance Service in December because of projected economic benefits.

Those benefits could have been far greater, however, if the other former members of the Mountain West Transmission Group also had selected the EIM instead of the WEIS, a Brattle Group study found.

Mountain West was a coalition of seven utilities whose effort to join SPP’s RTO fell apart when Xcel withdrew in 2018. (See Still ‘Committed,’ SPP Halts Mountain West Integration Effort.)

If all seven had joined the EIM, the benefits for Xcel and the three other utilities in its balancing authority area would be $17.34 million instead of $1.98 million per year, the study found.

“The benefits jump eight to nine times as high,” Jason Smith, senior manager of market operations for Xcel, told the EIM’s Regional Issues Forum on Wednesday. “There’s just a ton of transmission to optimize within that footprint.”

Smith gave the most detailed public explanation yet of the decision by Xcel’s Public Service Company of Colorado — together with Black Hills Colorado Electric, Colorado Springs Utilities and Platte River Power Authority — to join the EIM as soon as 2021. (See EIM Lands Xcel, 3 Other Colo. Utilities.)

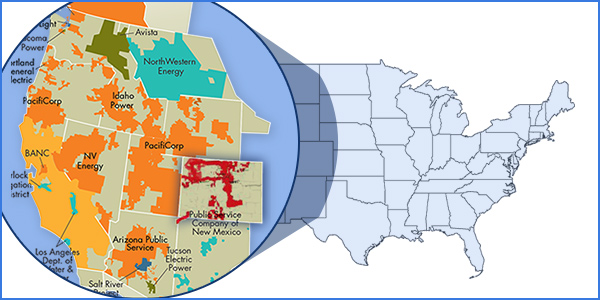

Xcel’s BAA covers the greater Denver area and most of eastern Colorado. The utility alone serves about half the state’s load.

The three other one-time members of Mountain West — the Western Area Power Administration, Basin Electric Power Cooperative, and Tri-State Generation and Transmission Association — announced in September they would join SPP’s nascent WEIS, saying they thought it would be more cost-effective and collegial. (See WAPA, Basin, Tri-State Sign up with SPP EIS.)

SPP said in June it would start the WEIS to compete with CAISO’s fast-growing EIM. SPP’s move, and a new Colorado law requiring the Public Utilities Commission to examine market options, prompted Xcel to examine the costs and benefits of joining the imbalance markets, Smith said.

They hired Brattle, which found that even if all seven Colorado utilities joined the WEIS and not the EIM, the benefits to the four entities in Xcel’s BAA would add up to just $1.62 million per year — about one-tenth as much as if all seven joined CAISO’s imbalance market.

The EIM has provided nearly $862 million in benefits to participants since it began operating in 2014, mainly through cost savings and the use of surplus renewable energy, according to CAISO.

Asked if he thought the Brattle study might encourage the utilities that signed on with SPP to change their minds, Smith said he couldn’t speak for them but wouldn’t rule it out.

“In the future, things may change, but that’s just a guess on my part,” he said.

‘A Close Call’

Brattle projected the four Xcel BA entities would spend roughly $1.6 million in start-up costs to join the market and $450,000 in annual administrative charges, Smith said. The WEIS wouldn’t require any start-up costs, but administrative fees would run about $3.5 million per year because of the relatively small number of participating entities to share the market’s expenses over time, he said.

Only the three other former Mountain West participants have decided to join the WEIS so far. The EIM has nine active participants and 11 more scheduled to join by 2022, not including Xcel and the three other Colorado utilities.

Imbalance markets allow utilities to trade excess energy across BAs, often maximizing use of renewable energy such as wind and solar, and Xcel was the first large investor-owned utility to commit to becoming carbon-free by midcentury, a pledge it made in December 2018 partly in reaction to customer demands. The city of Boulder, served by Xcel, has been trying to buy its assets there to create a municipal utility. (See Xcel Pledges to Go 100% Carbon Free.)

Smith said the time zone difference between Colorado and California and the states’ different resources would complement each other well. Colorado’s solar power comes online an hour before California’s morning peak, and eastern Colorado’s ample wind energy continues after the sun sets on the West Coast during the evening peak.

The same synergy wasn’t there if Colorado sent electricity east and south into SPP’s footprint, he said.

“The geographic distance gave us an advantage quite a bit,” Smith said. “That just wasn’t there when you look at a north-to-south diversity overall.”

Colorado has more transmission connections to SPP. Connection rights to CAISO and the other EIM entities are limited but should be adequate, he said.

“It was a close call, but we’ve got just enough transmission to make it viable,” Smith said.

Buying or building more transfer capability should increase benefits, he told the Regional Issues Forum during its teleconference. (The planned in-person meeting in Phoenix was called off because of the COVID-19 coronavirus.)

The four utilities are working toward signing an implementation agreement with CAISO and don’t anticipate any roadblocks, he said.

“We’re ready to kick off,” he said.