Wednesday’s Planning Advisory Committee meeting opened with stakeholders asking for information on proposals generated by ISO-NE’s first competitive transmission solicitation in December.

The RFP seeks to address reliability concerns over the planned retirement of the Mystic Generating Station near Boston. (See ISO-NE Issues First Competitive Tx RFP.)

The RTO “received 36 Phase One proposals prior to the submission deadline of March 4, with costs ranging from about $49 million to $745 million,” said ISO-NE Director of Transmission Planning Brent Oberlin. In-service dates ranged “roughly” from mid-2023 to 2026, he said.

“Right now, the ISO is weeding its way through all the proposals … and we have received a number of requests to publish them,” Oberlin said. “Our current policy is that we want to release that information together with the ISO’s draft determination.”

Oberlin noted that eight qualified transmission project sponsors submitted bids. Among them was Anbaric, which on Thursday announced details of its proposed 900-1,200 MW Mystic Reliability Wind Link project, including an option for an additional 1,200 MW.

In response to a question from Sebastian Libonatti, of Avangrid Networks, Oberlin said ISO-NE would not immediately release executive summaries of the various proposals. In a Thursday memo, the RTO explained it would wait 175 calendar days to divulge proposal details because of concerns over inadequate or inaccurate information in some of the proposals.

ISO-NE’s memo said that some proposals do not meet the identified needs, or violate the Tariff, and that due to the two-phase solicitation process, some of the initial proposals’ life-cycle costs are misleading.

“Posting a list of the Phase One Proposals with these potential serious flaws without noting them will not facilitate meaningful stakeholder discussion or review and will result in wasted effort as non-compliant proposals are evaluated,” the memo said.

During Wednesday’s meeting, Phelps Turner, a senior attorney for the Conservation Law Foundation in Maine, said, “We also want to flag that we have due process concerns with the proposed schedule, which should be expedited to ensure openness and transparency, planning principles that were clearly outlined in [FERC] Order 1000, and we also want to make sure we set a good precedent with this first competitive procurement [in New England].”

Turner told RTO Insider that the CLF was concerned about the evaluation process for all proposals, not just for any single bid.

“Order 1000 says that stakeholders must be provided an opportunity to participate in the process in a timely and meaningful manner,” Turner said, comparing the 175 days the RTO is taking to the week or so its solicitation schedule provides for stakeholders to see the proposals and submit comments.

“It’s standard practice in the legal community to share redacted versions, and while we would prefer the unredacted proposals be published, redacted ones are better than nothing,” he said.

Modeling More Offshore Wind, Slowly

ISO-NE presented the PAC preliminary results of the Anbaric 2019 Economic Study for scenarios adding from 8,000 to 12,000 MW of offshore wind in southern New England, which it found causes export interface congestion in the Southeastern Massachusetts/Rhode Island (SEMA/RI) interface.

The assumptions include retirements of nearly 4,500 MW.

The RTO’s lead engineer for system planning, Haizhen Wang, led discussion of the study, which compared the Anbaric results to those presented at last month’s PAC from a similar study requested by the New England States Committee on Electricity (NESCOE). (See ISO-NE Planning Advisory Committee Briefs: Feb. 20, 2020.)

NESCOE, Anbaric and RENEW Northeast had requested separate analyses at the April 2019 PAC meeting.

The new analysis found that interconnecting more OSW close to load centers outside of the SEMA/RI areas (such as the Mystic and Millstone substations) would reduce the congestion hours of the SEMA/RI export interface.

Total renewable spillage in the Anbaric_8000 scenario, primarily OSW and hydro, decreases approximately 50% compared to the NESCOE scenario. This is because the assumed nuclear retirements decrease the energy oversupply in the Anbaric scenario. | ISO-NE

Retirement of large baseload must-run nuclear generation would lower spillage associated with over generation, the report said.

Theodore Paradise, Anbaric senior vice president for transmission strategy and counsel, asked about a rise in natural gas energy production under both constrained and unconstrained scenarios for 8,000 MW OSW, which assumes new OSW insufficient to cover the retired nuclear generation.

Peter Wong, ISO-NE manager for resource adequacy, said that more assumed nuclear retirements means fewer hours of oversupply, during which the RTO would otherwise spill the offshore wind.

“As [OSW] increases to 10,000 MW and 12,000 MW, does the natural gas run in terms of amount decrease?” Paradise asked.

“As we add more offshore wind to the system, the need for other generating resources would decrease when the offshore wind is not constrained by export limits,” Wong said. “That’s why the natural gas generation keeps decreasing as we add additional offshore wind to the system.”

The RTO plans to present additional spillage and marginal emissions results from the NESCOE study in April, complete ancillary service analysis by May and publish the final report by June 1, Wang said.

The Anbaric study will see additional GridView results presented with 2015 load/PV/wind profiles in April, with the final report to be published in June or July. The RTO also will present NESCOE and Anbaric transmission cost estimates in March and April.

If time does not permit a presentation at the PAC, the RTO will still make the relevant information available to stakeholders, Wang said.

The RENEW GridView results with 2015 load/PV/wind profiles will be presented in April, and the final report in July.

Draft 2020 CELT Load Forecast

Jon Black, manager of load forecasting, presented an update on the annual 10-year forecasts of energy and demand that the RTO publishes as part of the capacity, energy, loads and transmission (CELT) report.

He focused on the heating and transportation electrification forecasts newly included in CELT 2020, saying that the usual topics of gross energy, summer demand and winter demand forecasts, as well as energy efficiency and solar forecasts will be discussed in more detail at the April PAC.

The 2020 heating electrification forecast focuses on the adoption of air-source heat pumps (ASHPs), currently the most prevalent heat pump technology, he said.

“Heating electrification is a nascent trend,” Black said, noting that the emergence of other technologies, such as ground-source heat pumps, may warrant consideration in future forecasts.

Final draft 2020 heating electrification forecast in terms of monthly energy (GWh) | ISO-NE

One stakeholder wondered how the RTO could estimate the effect of ASHPs on load while only using three winter months of data.

“We’re mapping it to heating degree days, which is a variable that we use in our forecast models,” Black said. “In general, when it gets cold, you use your heat pumps more, and we are mainly focusing on getting the winter demand impact as good as we can, which is why we focused on more of the colder months.

“Essentially, those colder months yield a relationship between how cold it is and how much electricity you use before and after installing a heat pump,” he said. “We apply those assumptions to all the months and days in our forecast where you have heating degree days.”

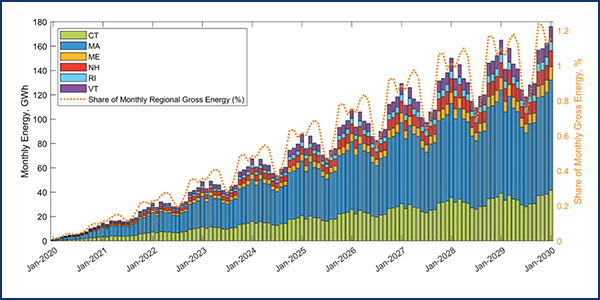

A related presentation at last month’s PAC showed that heat pumps and plug-in electric vehicles make up only 4% of projected 2030 annual net load, which spikes to about 10% during winter evening peaks. But the draft CELT shows EV load impact steadily rising from near zero today to 1.2% of load and nearly 180 GWh in terms of monthly energy in January 2030.

Final draft 2020 EV forecast in terms of monthly energy (GWh) | ISO-NE

The EV forecast in the draft CELT estimates the adoption of electrified light-duty vehicles for each state and the region over the next 10 years, both battery-electric vehicles (BEV) and plug-in hybrids (PHEV), Black said.

The RTO takes the adoption estimates and extrapolates monthly demand and energy impacts per EV based on recent historical EV charging data licensed from ChargePoint. It developed energy and demand assumptions based on an aggregate EV charging profile reflecting between 118 and 247 EV drivers across the region between June 2018 and May 2019.

The aggregate profile reflects 78% residential and 22% non-residential, he said.

Natural Gas Use Rises in NE

Tom Kiley, CEO of the Northeast Gas Association, gave a brief review of the natural gas industry in the region, as well as of what turned out to be a mild winter. He referred to a separate winter review posted that day by the RTO for stakeholders seeking greater detail on the season.

“We plan for a lot of eventualities and scenarios, but certainly this COVID-19 pandemic is quite extraordinary … and clearly emphasizes how industry coordination and communication during challenging times remain of critical importance,” Kiley said.

U.S. natural gas production in 2019 set new all-time records (92.2 Bcf/d), as did consumption (85 Bcf/d).

“The EIA reported U.S. natural gas consumption grew in the electric power sector by 2.0 Bcf/d, or 7%, but remained relatively flat in the commercial, residential and industrial sectors,” Kiley said.

New 2019 additions to gas generation capacity in New England | NGA

New gas generation capacity in New England last year included PSEG Power’s 485-MW Bridgeport Harbor Station 5 in Bridgeport, Conn.; NRG Energy’s 333-MW Canal 3 plant in Sandwich, Mass.; and Exelon’s 200-MW West Medway unit in Medway, Mass.

Two New England pipeline capacity expansion projects went into service in 2019, both part of the Portland Natural Gas Transmission System: the second phase of Portland Xpress and the first phase of Westbrook Xpress.

Projects expected to go into service this year are the second phase of Enbridge’s Atlantic Bridge Project in Weymouth, Mass., the third phase of Portland Xpress, and the Station 261 Upgrade on the Tennessee Pipeline in Agawam, Mass.

Since 2012, more than a million new households have been connected for natural gas use in the six New England states plus New Jersey, New York and Pennsylvania, he said.

“Today this represents over 12 million households in total,” Kiley said.

— Michael Kuser