By Hudson Sangree

CAISO’s congestion revenue rights auction continued to lose money in 2019 but significantly less than in prior years, the ISO’s Department of Market Monitoring said in a recent report to the Board of Governors.

Even so, the department, a longtime critic of the CRR auctions, still wishes the ISO would get rid of CRRs or at least take ratepayers, who are unwittingly covering tens of millions of dollars in annual losses, out of the equation.

“Rule changes made by the ISO reduced losses from sales of congestion revenue rights significantly in 2019,” DMM Executive Director Eric Hildebrandt wrote in a memo to the board. “However, DMM continues to recommend that the ISO take steps to discontinue auctioning congestion revenue rights on behalf of transmission ratepayers.

“If the ISO believes it is highly beneficial to actively facilitate hedging of congestion costs by suppliers, DMM recommends that the ISO modify the congestion revenue rights auction into a market for financial hedges based on clearing of bids from willing buyers and sellers,” Hildebrandt said.

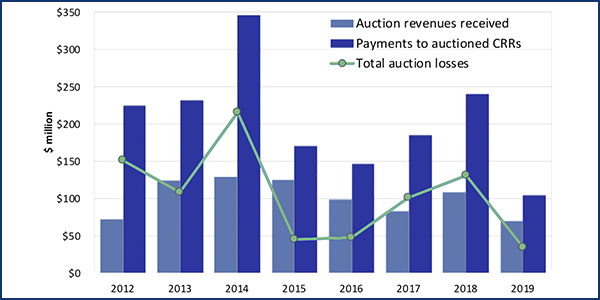

From 2009 to 2018, CAISO’s CRR auctions resulted in net losses of more than $800 million for transmission ratepayers, Hildebrandt said in his March 25 update to the board. (Hildebrandt’s memo was a summary of a more detailed report filed Jan. 27.)

Revenues collected in the auction worked out to about 50 cents on dollars paid out, it said. Losses from sales of CRRs totaled $100 million in 2017 and $131 million in 2018, the DMM said. (See CAISO Q4 CRR Revenues Falling Short After Summer Surplus.)

Starting in 2019, CAISO instituted rule changes meant to stanch the flow of money from ratepayers to commodities traders. The rule changes reduced losses significantly last year in conjunction with lower congestion on the grid, the department said.

Losses from sales of CRRs totaled approximately $34 million in 2019, including $22 million in the fourth quarter alone. Transmission ratepayers took in about 68 cents on each dollar paid out, while financial entities reaped $33 million in profits, the department said.

One rule change, called Track 1B, reduced payments to non-load-serving entities by $44 million, according to the DMM. The change limited payments from exceeding the congestion rent collected on the underlying constraints.

Another change, Track 1A, limited the kinds of CRRs that could be purchased at auction. It also appeared to have helped, though the changes couldn’t be quantified, the department said.

FERC OKs CAISO Plan to Deal with CRR Shortfalls.)

The DMM said a third factor — lower congestion than in past years — played a major role too. Day-ahead congestion rent fell from $628 million in 2018 to $355 million in 2019, a 43% reduction.

“Thus, while losses dropped from $131 million to $32 million in 2019,” the Monitor said, “a significant portion of this decrease can be attributed to the drop in overall congestion.”