The COVID-19 pandemic might not have impacted Eversource Energy’s first-quarter earnings, but it is affecting the company’s business both as a frontline utility and developer of offshore wind energy projects, analysts heard last week.

Most of the company’s customer service staff are working from home, and state regulators have delayed two rate case decisions until fall. And while federal officials are keeping up with offshore project reviews, a New York judge has delayed by 10 weeks a state-mandated hearing into the company’s 130-MW South Fork project off Long Island.

During an analysts call Wednesday, Eversource reported first-quarter earnings of $334.8 million ($1.01/share), up more than 8% from the same period a year ago.

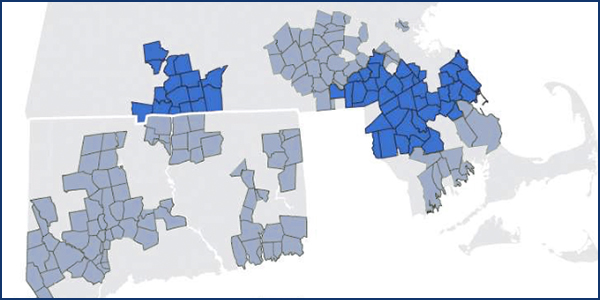

Eversource is New England’s largest utility company, with regulated subsidiaries offering retail electricity, natural gas, and water service to approximately 3.6 million customers in Connecticut, Massachusetts and New Hampshire.

The company is about to get bigger, confident that it will receive regulatory approval for its $1.1 billion acquisition of Columbia Gas’ 320,000 natural gas customers in Massachusetts.

“We are acquiring the assets of Columbia Gas of Massachusetts, not any of the liabilities associated with the tragic September 2018 incident in the Merrimack Valley,” CFO Philip Lembo said in an earnings call.

Current Rate Cases

New Hampshire Gov. Chris Sununu issued an executive order last month that will allow state regulators to delay ruling on a Eversource subsidiary Public Service Company of New Hampshire’s request to raise annual base distribution rates by approximately $70 million. The decision, originally slated for July 1, will be pushed to November, Lembo said.

PSNH implemented a temporary $28 million rate increase effective July 1, 2019, which will remain in effect until permanent rates are set. Any difference between the temporary rates and the permanent rates will be reconciled back to that July time frame.

In Massachusetts, the company’s NSTAR gas subsidiary is seeking a $38 million base rate adjustment, having agreed to a one-month delay with a decision now expected at the end of October and rates effective on Nov. 1, Lembo said.

In addition, a new three-year grid modernization work plan for 2021-2023 will be filed in Massachusetts this summer, and Connecticut regulators on Wednesday issued an order requesting proposals on program designs for a number of initiatives related to grid modernization, with proposals due by the end of July, he said.

Sailing Close to the Wind

Eversource’s offshore wind energy partnership with Ørsted on March 13 filed a construction and operations plan (COP) with the Bureau of Ocean Energy Management for the 704-MW Revolution Wind project.

“BOEM’s review of that project has begun, and we expect to have a full schedule for that review later this year,” Lembo said. (See Offshore Wind Slogs Forward in Massachusetts.)

“We have not yet received a new schedule from BOEM on its review of the 130-MW South Fork project. The COP on that was filed back in 2018, but the process was paused last year so that we could update the project for our new 1-nautical-mile-by-1-nautical-mile configuration. We expect the new schedule to be posted by midyear.”

The companies last October signed a contract with New York for the 880-MW Sunrise Wind offshore wind project, but even with the 10-week delay in the review ordered by the state’s Public Service Commission, the developer still expects the project to come into service by the end of 2024.

“We continue to have a target filing date on our COP for Sunrise Wind with BOEM in the second half of this year,” Lembo said. “That timetable may be affected by New York’s current restrictions on both onshore and offshore survey work. We expect to have more insight into the timing of that cost filing and the schedule for Sunrise by late this summer.”

Eversource expects South Fork to come into service by the end of 2022, and Revolution Wind by end-2023, he said.

“Despite these near-term scheduling headwinds, we remain strongly convinced that the opportunities in offshore wind off the Northeast coast are excellent, with 15,000 MW likely to be built over the coming years to supply the significant clean energy needs of New England and New York,” Lembo said.

Call transcript courtesy of Seeking Alpha.