PJM’s transmission owners gave their long-awaited response to the push to open end-of-life (EOL) projects to competition and regional planning Friday, saying they support the RTO’s proposal to increase its oversight of the process.

The TOs made their case during a fractious special meeting of the Markets and Reliability Committee in which both sides of the debate accused RTO staff of treating them unfairly.

For months, stakeholders seeking to make PJM responsible for EOL planning have bemoaned the TOs’ refusal to engage in negotiations. On May 7, however, the TOs gave notice that they are supporting the PJM proposal and considering a Federal Power Act Section 205 filing to revise the Tariff to reflect it.

While conceding to load-side stakeholders in agreeing to increased PJM oversight of the EOL process, the TOs are trying to retain as much control as possible over the billion-dollar business of planning and building EOL projects.

With the TOs lined up behind PJM’s proposal, LS Power announced Friday that it was withdrawing its proposal and joining with the “joint stakeholder” package by a group including American Municipal Power (AMP), Old Dominion Electric Cooperative (ODEC), state consumer advocates, the Public Power Association of New Jersey and the PJM Industrial Customer Coalition.

The maneuvers by the TOs and LS Power mean that only two proposals will be brought to sector-weighted votes at the May 28 MRC meeting.

PJM officials said at the April 30 MRC meeting that the package with the most support that meets the two-thirds threshold will be brought back to special meetings to draft governing document language. The package receiving the greatest support would become the main motion for a vote of the Members Committee on June 18.

On Friday, however, PJM Director of Stakeholder Affairs Dave Anders said it was unclear the May 28 vote on the joint stakeholder proposal would include their proposed Operating Agreement language. He said the procedure would be clarified in the agenda for the meeting.

Under the Consolidated Transmission Owners Agreement (CTOA), the TOs are required to provide stakeholders 30 days to comment before filing proposed Tariff changes. (Comments may be submitted to Comments_for_Transmission_Owners@pjm.com.)

The June 8 comment deadline gives the TOs more than a week to file their proposal with FERC before the MC votes.

“This [Section] 205 notification changes the game fairly significantly relating to the timing of voting on OA changes,” said Sharon Segner of LS Power. “Time is of the essence.”

Both the stakeholder and PJM proposals would require TOs to share how they make EOL determinations and potentially open at least some replacement projects to competition under the Regional Transmission Expansion Plan (RTEP).

The joint stakeholder proposal would require TOs to notify PJM and stakeholders of any facility nearing the end of its life at least six years before its retirement date so that the project could be included in five-year planning models and opened to competitive bidding. It would also modify the supplemental project definition to exclude EOL projects, which would become a new category of regionally planned projects.

LS Power’s proposal was identical except for requiring at least eight years’ notice for facilities of 230 kV and above. Segner said Friday that her company decided to address the issue in future manual changes because the joint stakeholders’ OA changes referred to “at least six years’” notice.

PJM’s package requires TOs to have a formal program for EOL determinations and to identify potential EOL projects five years in advance. Projects that “overlap” with RTEP violations would be included in a competitive window seeking regional solutions.

The RTO said it would implement its plan through changes to Manual 14B: PJM Region Transmission Planning Process. The stakeholders questioned whether it would have authority to enforce the new rules if they were in the manual alone and have proposed changes to the OA, which they outlined during the nearly three-and-a-half-hour meeting Friday.

The TOs’ representative, Chad Heitmeyer, director of RTO policy for American Electric Power, said their proposed changes to Tariff Attachment M-3 go beyond FERC requirements to provide increased transparency on “certain asset management projects, including EOL projects.” The TOs said the revision would continue to “honor [TOs’] responsibility over end-of-useful-life replacement projects.”

He said the only significant difference between the TOs’ proposal and PJM’s is the TOs’ belief that the new rules require changes to Tariff Attachment M-3. “The Tariff is the most appropriate governing document to effectuate the delineation of responsibilities between PJM and the PJM TOs,” Heitmeyer said.

However, the TOs also said that under their proposal, the nonbinding five-year forecast of EOL candidates would be confidential and shared with PJM only. The stakeholders want the list to be made public. Dave Souder, senior director of system planning, said at the April 30 MRC meeting that PJM hadn’t decided whether the list would be made public or not.

On Friday, Souder said PJM would determine which EOL projects “overlap” with RTEP violations and would be included in a competitive window seeking regional solutions. EOL projects for which PJM did not find overlaps would not be disclosed, Souder said.

ODEC’s Mark Ringhausen said PJM’s approach represented a “complete lack of transparency.”

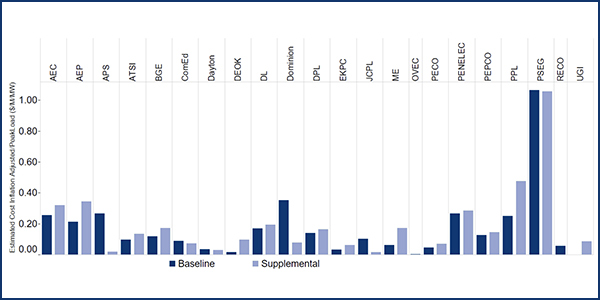

The TOs have been under increasing pressure from both stakeholders and FERC as spending on EOL and other supplemental projects controlled by the TOs has overtaken baseline upgrades planned by PJM. FERC opened Section 206 investigations of PJM, RTOs, TOs Defend Competition Exemptions.)

Last week, the joint stakeholders sent a letter to the PJM Board of Managers highlighting the “the mounting evidence that the majority of transmission planning in the PJM footprint is not occurring on a regional basis.” The letter came as PJM reported that TOs’ supplemental projects totaled almost $3.4 billion in 2019, more than double the less than $1.5 billion in regionally planned baseline projects. It marked the fifth year out of the last six in which supplemental projects exceeded baseline projects. (See related story, Stakeholders Urge PJM: Plan ‘Grid of the Future’.)

Segner said she was concerned by the potential Section 205 filing because it “essentially moved a number of [FERC] Form 715 projects potentially into the supplemental bucket” exempt from competition. Last August, FERC ordered PJM to open Form 715 transmission projects to competitive bidding, with regional cost-sharing for those projects involving high-voltage lines. (See FERC Opens Local Tx Projects to Competition, Cost Sharing.)

“I don’t think PJM can file this because it violates the Operating Agreement,” she said.

Attorney Don Kaplan, representing the TOs, said the Tariff changes were not intended to have any impact on handling of Form 715 projects.

Process Dispute

Friday’s meeting opened with both load-side stakeholders and TO representatives criticizing PJM staff for mismanaging the agenda.

Load-side stakeholders accused staff of ignoring their requests to post the proposed OA language changes with meeting materials and include discussion of them on the agenda.

The OA language had been public since April 23, when it was posted for the April 30 MRC meeting. But it wasn’t until Thursday — after emails from multiple stakeholders — that it was posted with the materials for Friday’s meeting, said ODEC’s Adrien Ford, a former PJM staffer.

PJM facilitator Jim Gluck, who chaired the meeting, said the failure to post the language earlier was an “administrative oversight.”

Ford wasn’t so sure. “There were multiple emails. That’s a lot of flubs,” Ford said. “This really feels like we’re not being treated equitably.”

“The intent is to treat all stakeholders equitably,” Gluck said.

“The outcome is much different from the intent,” AMP’s Ed Tatum responded.

After about 30 minutes of arguments, Gluck agreed to amend the agenda to provide time for the stakeholders’ presentation.

That prompted a protest from PPL’s Amber Thomas, who said stakeholders were not given notice that the OA language would be discussed during the meeting.

“There’s a lot of confusion about how this agenda was developed,” she said. “This all feels very messy and very confusing. … Some of you talked about [how] the stakeholder process is broken. This is another example.”

“I want to acknowledge that this is getting very tense,” responded PJM’s Anders, who promised staff “will certainly do a debrief on this internally.”

OA Page-turn

AMP General Counsel Lisa McAlister, who presented a page-turn of the proposed OA changes, said the stakeholders’ goal is to “put end-of-life planning on a par with reliability planning.”

Responding to questions about proposed revisions to the definition of supplemental projects, attorney Mike Engleman, representing LS Power, said, “To be frank, the intent was to not allow supplemental projects to be used to … prematurely replace facilities to avoid” the EOL notification requirement.

AEP’s Heitmeyer presented the TOs’ proposal. “After reviewing PJM’s package, it was evident we were in alignment,” he said.

The PJM and stakeholder packages were developed in a series of lengthy meetings since December.

Greg Poulos, executive director of the Consumer Advocates of the PJM States (CAPS), said he was “frustrated” by the TOs’ late introduction of their proposal and their threat to file it unilaterally with FERC.

“I would say this kind of ends the CBIR [consensus-based issue resolution] process at the Planning Committee,” he said.

“I don’t think the TOs consider what we’ve done here to be counter to the CBIR process,” said Alex Stern of Public Service Electric and Gas. “All we’re doing is facilitating what PJM has laid out.”

Tatum pressed PJM officials for their reaction to the TOs’ proposal, but Souder refused to take a position, saying only that the RTO is “very supportive of the stakeholder process.”