PJM’s first-quarter energy prices fell to their lowest level since the RTO was created in 1999, according to the Independent Market Monitor’s first-quarter State of the Market report released Friday.

The Monitor cited lower fuel costs, mild winter conditions and a significant drop in energy use resulting from COVID-19 pandemic-related stay-at-home orders as contributing factors.

The report showed that real-time LMPs averaged $19.85/MWh during the quarter, down 34.2% from the same period in 2019. The Monitor found that 46.4% of the $10.31/MWh decrease was a direct result of lower fuel costs, specifically natural gas.

“Our analysis concludes that the results of the PJM energy market were competitive in the first three months of 2020,” Monitor Joe Bowring said in a press release.

PJM load was down 6.8% cumulatively in the first quarter compared to the same time last year, the report said, and heating degree days fell 21.8%. Total energy uplift charges decreased by $12.1 million — or 62.6% — from $19.3 million in 2019 to $7.2 million in 2020.

Energy prices were set mostly by generating units operating at or near their short-run marginal costs, the report said, providing evidence of competitive behavior and market outcomes. Net revenues decreased for all generator unit types compared to 2019, the report said, including theoretical net revenue drops of 98% for a new coal unit, 34% for new nuclear plant, 32% for a new combustion turbine and 29% for a new combined cycle unit.

Meanwhile, the trend toward more natural gas-fired generation and less coal grew in the first quarter, with the share of gas increasing from 33.2% to 40% compared to a year earlier, while coal declined from 26.9% to 18% today.

Congestion costs decreased significantly compared to the same time last year, falling from $163.9 million in 2019 to $85.1 million in 2020.

Structural Change Recommendations

The Monitor added four new recommendations to its list, some dating back as far as 2009.

In the “Energy Market” section of the report, the Monitor recommended that that PJM clarify, modify and document its process for dispatching reserves and energy when security-constrained economic dispatch (SCED) indicates that supply is less than total demand, including forecasted load and reserve requirements. The suggested modifications from the report include a definition of a SCED process to economically convert reserves to energy, a process for the recall of energy from capacity resources and a determination of the minimum level of synchronized reserves that would trigger load shedding.

“When the real-time security constrained economic dispatch (RT SCED) solution indicates a shortage of reserves, it should be used in calculating real-time prices, and those prices should be applied to the market interval for which RT SCED calculated the shortage,” the report said. “There are significant issues with operator discretion and reluctance to approve RT SCED cases indicating shortage of reserves, and in using these cases to calculate prices.”

Debate over fast-start pricing has been ongoing among PJM and stakeholders for several years. (See PJM IMM at Odd on 5-Minute Dispatch, Pricing Rules.)

In the “Demand Response” section of the report, the Monitor recommended that all demand resources register as pre-emergency load response and that the Emergency Load Response Program be eliminated. The recommendation was listed as a high priority.

“Emergency and pre-emergency resources receive capacity revenue from the capacity market and also receive energy revenue at a predefined strike price from the energy market for reductions during a PJM initiated emergency or pre-emergency event,” the report said. “The rules applied to demand resources in the current market design do not treat demand resources in a manner comparable to generation capacity resources, even though demand resources are sold in the same capacity market, are treated as a substitute for other capacity resources and displace other capacity resources in Reliability Pricing Model (RPM) auctions.”

Finally, in the “Interchange Transactions” section, the IMM made two recommendations:

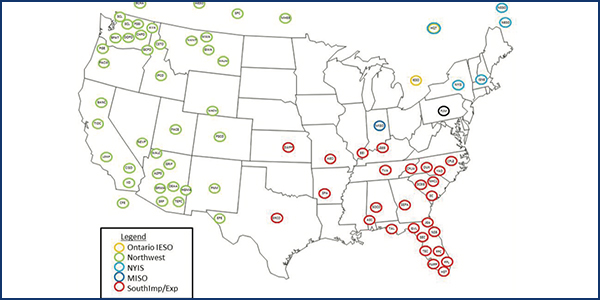

- Transactions sourcing in the Western Interconnection should be priced at either the MISO interface pricing point or the SouthIMP/EXP interface pricing point based on the locational price impact of flows between the DC tie line point of connection with the Eastern Interconnection and PJM. The recommendation is a high priority.

- The assignment of the Saskatchewan Power and Manitoba Hydro balancing authorities from the Northwest interface pricing point should be changed to the MISO interface pricing point, and the Northwest interface pricing point should be eliminated from the day-ahead and real-time energy markets. The recommendation is a high priority.