NYISO will face myriad challenges in the coming decades as New York decarbonizes its economy and the power sector transitions to zero-emissions generation, industry stakeholders heard Monday.

“Aggressive renewable goals raise questions about how a fully decarbonized energy system can work, especially given the intermittency of wind and solar,” Sam Newell, a principal with The Brattle Group, told the Installed Capacity/Market Issues Working Group.

“Importantly, why we’re here discussing this in New York is because New York has the mandates, and it’s actually the first entire RTO to go to 100% clean,” Newell said. “There are plenty parts of the country where individual entities have already gone to 100%, but they’re embedded in a much larger system that helps balance, so New York will be on the front end of seeing the challenges of going to a completely clean system.”

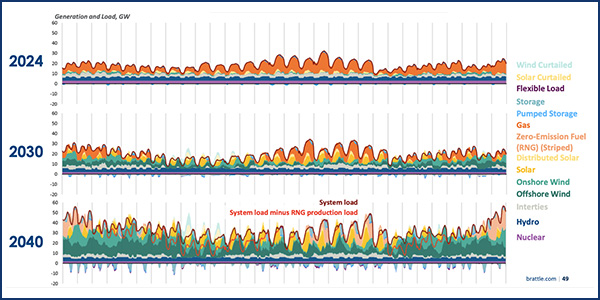

Brattle representatives presented an interim report on New York’s evolution to a zero-emission power system, modeling operations and investment in scenarios of increasing electrification for the years 2024, 2030 and 2040. They will consider feedback before presenting the final study results to stakeholders in June.

As part of its “Grid in Transition” initiative, the ISO retained Brattle to simulate the resources that can meet state policy objectives and energy needs in order to inform planning for reliability and market design over the next two decades. (See N.Y. Looks at Grid Transition Modeling, Reliability.)

Electricity generation is already a relatively minor source of greenhouse gas emissions in New York, representing less than 16% of total emissions, so reaching economy-wide decarbonization goals likely implies significant electrification of buildings and transport, Newell said.

The high electrification case in the study sees 43 GW more capacity in New York by 2040.

Statewide Effort

NYISO is not alone in thinking about the future of the New York grid.

The state’s Public Service Commission this month authorized a study to identify distribution upgrades, local transmission upgrades and bulk transmission investments needed to meet the state’s clean energy goals (20-E-0197). (See NYPSC Launches Grid Study, Extends Solar Funding.)

The study was mandated by a budget amendment passed in April that created a new siting agency for renewable energy projects. The New York State Energy Research and Development Authority will collaborate with the Department of Environmental Conservation and the Department of Public Service to develop build-ready sites for renewable energy projects. (See NY Renewable Supporters Push for New Siting Agency.)

“We’re accounting, of course, for the Climate Leadership and Community Protection Act [CLCPA], but also other related programs and policies, such as continued participation in the Regional Greenhouse Gas Initiative, and the zero-emissions credit [ZEC] program for nuclear,” Newell said. The ZEC program expires in March 2029.

New York’s CLCPA (A8429), signed into law last July, mandates that 70% of the state’s electricity come from renewable resources by 2030 and that generation be 100% carbon-free by 2040. (See Cuomo Sets New York’s Green Goals for 2020.)

The law’s clean energy mandates also include doubling distributed solar generation to 6 GW by 2025, deploying 3 GW of energy storage by 2030 and raising energy efficiency savings to 185 trillion BTU by 2025.

Newell said the NYISO study also accounts for the retirement of the Indian Point nuclear plant, as well as for “the new NOx rules that are likely to cause about 3,000 MW of older peaker plants downstate to retire.”

The state’s new emissions regulations go into effect May 1, 2023, and generator compliance plans were due March 2. (See NY DEC Kicks off Peaker Emissions Limits Hearings.)

Balancing Challenge

The paradigm shift coming to the electricity sector will see new technologies and resources supplant the old ways and means, the report said.

Today, gas-fired generators, dispatchable hydro and pumped hydro storage are key sources of flexibility, but the wind and solar output expected to dominate in the future is primarily driven by weather, thus reducing the amount of flexibility provided by generation.

“Between 2030 and 2040, we also see significant growth in renewable generation, so by 2040, we’re finding about two-thirds of load is served by wind and solar, and about one-third of load is served by offshore wind alone,” said Brattle senior associate Roger Lueken.

The future system will require more flexibility across all timescales, with hourly and seasonal balancing of intermittent renewables and more volatile load, he said.

Flexible loads, such as controllable electric vehicles and HVAC, can provide limited balancing within the hourly time frame, but new technologies will be needed to provide seasonal storage or zero-emission, dispatchable supply. The balancing challenge is across multiple timescales, the report said.

“We find that throughout 2030 and even 2040 there’s really minimal curtailment of wind and solar, despite the system predominantly being served by renewable generation, and that’s due to the amount of short-term balancing from storage and from the long-duration balancing provided by renewable natural gas production and consumption,” Lueken said.

Transmission Flows and Pricing

Today, New York transmission flows are primarily southbound, transferring power from upstate to downstate zones. In the future, those flow patterns become more variable, with flows occasionally reversing direction, the report said, noting that the frequency of constrained hours southbound generally increases.

Several stakeholders wanted more information on the transmission constraint and energy pricing assumptions in the study, but Newell deflected those questions.

“A model like this does produce shadow prices of all the constraints, which you could interpret. For example, if we have in 2030 a 70% clean requirement, you could interpret that as a market price for RECs [renewable energy credits],” Newell said.

“I think the New York ISO doesn’t want to be in a position of putting out a study that implies a cost of the state policy objectives, particularly when we haven’t focused in great detail with stakeholders on some of the cost constituents, like how much will the cost of various renewable resources come down, what might be the cost of an option with Hydro-Québec, or what might be some of the full resource integration costs,” he said.

The value in studying the future grid is not the ability to predict very particular resource mix scenarios, but in providing illustrative outcomes of how the grid may evolve in order for planners to understand future attributes of the power system.

“What NYISO said to me, and I think said to you all in the beginning, is that this is to try to inform across a range of scenarios, what type of fleet does it look like?” Newell said. “Is it 100 GW of equal amounts of solar, wind and offshore wind? Just broad-brush, paint a picture so that we can even start to look at what reliability concerns there will be. Later we can discuss how you even begin to think about price formation.”