PJM’s load-side stakeholders were disappointed last month when they failed in their bid to give the RTO control over end-of-life (EOL) transmission planning.

But the joint stakeholders rebounded at the June 18 Members Committee meeting, recording a 69% win that culminated more than four years of battles with PJM’s Transmission Owner sector. The victory sets up a showdown at PJM Stakeholders Endorse End-of-Life Proposal.)

Ed Tatum, American Municipal Power | © RTO Insider

How did the joint stakeholders pull off their comeback, after falling short in votes in May? A review of voting records and interviews with more than a dozen stakeholders indicate it was the joint stakeholders’ gains among the Generation Owners and Other Suppliers sectors that turned the vote after days of intense lobbying by both sides.

“In all the time I’ve been involved in the stakeholder process, I’ve never seen so much outreach on an issue,” said Ed Tatum, vice president of transmission for American Municipal Power, which led the joint proposal with Old Dominion Electric Cooperative (ODEC), the PJM Industrial Customer Coalition (ICC) and LS Power. “That includes PJM and the [TOs] as well as our group.”

End of Life Task Force

AMP, ODEC and the PJM ICC have been fighting to increase the transparency of the EOL process since at least February 2016, when they won approval of a senior task force to consider development of RTO-wide criteria for EOL transmission facilities. (See PJM TOs Oppose Proposal to Develop End-of-Life Criteria.)

Some TOs have established criteria for such projects under FERC Form 715, while others consider them supplemental projects — improvements not required for compliance with PJM system reliability, operational performance or economic criteria. The RTO does not approve supplemental projects but does study them to ensure they won’t harm reliability.

PJM says TOs’ supplemental projects totaled almost $3.4 billion in 2019, more than double the less than $1.5 billion in regionally planned baseline projects. It was the fifth year out of the last six in which the costs of supplemental projects exceeded those of baseline projects.

Load interests, who noted that much of the grid is 30 to 50 years old and in need of replacement, say EOL projects should be planned regionally by PJM to optimize and control spending. LS Power would like to see the projects eligible for competitive bidding under Order 1000.

The Transmission Replacement Processes Senior Task Force held more than two dozen meetings over two years before reaching an impasse. The group was sunset in July 2018. (See PJM Stakeholders End Transmission Replacement Task Force.)

The group ended its work five months after FERC approved the TOs’ request to move language governing supplemental projects from PJM’s Operating Agreement to Tariff Attachment M-3, while requiring changes to improve transparency. (See FERC Orders New Rules for Supplemental Tx Projects in PJM.)

In January 2019, AMP and ODEC won 69% support of the Markets and Reliability Committee for changes to Manual 14B that would give PJM more control of supplemental projects. PJM officials refused to implement the changes, however, saying they would conflict with FERC rulings. After months of negotiations, AMP and LS Power reached agreement with the TOs on manual language to prevent TOs from proposing supplemental projects designed to meet regional needs. (See PJM TOs Sign off on Supplemental Project Deal.)

Last fall, Tatum won approval of a new issue charge that resulted in five special MRC meetings to consider “Transparency and End of Life Planning” — discussions that resulted in the joint stakeholders’ EOL proposal and PJM’s alternative.

The joint stakeholders’ proposal would amend the OA to require TOs to notify PJM and stakeholders of any facility nearing the end of its life at least six years before its retirement date. The projects would be included in five-year planning models and potentially opened to competitive bidding.

The Transmission Owners Agreement-Administrative Committee (TOA-AC) laid out its own EOL proposal, which aligned with the position of PJM staff, in proposed amendments to Attachment M-3 (ER20-2046). It would require TOs to have a formal program for EOL determinations and to identify potential EOL projects five years in advance. Projects that “overlap” with Regional Transmission Expansion Plan reliability violations would be included in a competitive window seeking “the more efficient and cost-effective solution.”

The TOs say the proposal would increase transparency and improve planning coordination with PJM while honoring their rights and responsibilities over asset management. The joint stakeholders contend it would do little to improve transparency or change the status quo.

Element of Surprise

The TOs gave notice on May 7 that they were considering the M-3 amendments, starting a 30-day clock to accept comments before they could make the filing under Section 205 of the Federal Power Act. Their action forced the joint stakeholders to seek a vote at the May 28 MRC meeting — earlier than stakeholders had planned, Tatum said. “We felt like it might have been a little too soon, but we had to give it a run,” he said.

The stakeholders garnered 64% support for the proposal in a sector-weighted vote in the MRC, then 62% on a procedural vote to bring the matter before the Members Committee — both short of the two-thirds threshold required.

The stakeholders felt more confident heading into the June 18 vote, after addressing what they said was misinformation about their proposal.

One stakeholder said some members were concerned the proposal would “mess up” the interconnection queue. Others were told TOs “couldn’t replace a pole without going to the stakeholders.”

“There were a lot of things that were being said about our proposal that weren’t entirely accurate,” Tatum said. “We talked to a lot of folks to make sure they had an unbiased view of the facts and the focus.”

Getting out the Vote

“It really did require a lot of listening on our part … to address the concerns” that caused the failed May vote, said Susan Bruce, who represents the PJM ICC. “You had to do old school get-out-the-vote discussions.”

“In the last four or five years, I can’t think of more grassroot-level voting calls than I received on this issue,” one stakeholder said. “I had folks on both sides reaching out to me. … There was almost none of that before the prior [May] vote.”

The joint stakeholders gained 21 supporters on June 18 among those absent in May and also won over one member that had abstained. All told, 30 more members voted in June than in May (from 128 to 158), an increase of almost one-quarter.

The joint stakeholders lost six “yes” votes from May: four to abstentions and two to absences. But none of the original “yes” votes joined the TOs in opposition. Meanwhile, four “no” votes switched to “yes,” and four other “no” votes abstained.

The stakeholders made big gains among the Generation Owners, picking up six votes to rise from 56.5% of the sector (13 of 23) to 82.6% (19 of 23). Among members of the PJM Power Providers, voting affiliates for seven supported the proposal while three members abstained, including two, Advanced Power (voting as Carroll County Energy) and Talen Energy, which had voted “no” in May.

Vistra Energy (voting as Dynegy Marketing and Trade), Eastern Generation and Wheelabrator Falls, which had voted “no” in May, flipped to the “yes” column. The stakeholders also won backing from five generators that hadn’t voted in May: Cape May County Municipal Utilities Authority, CPV Power Holdings, Pixelle Specialty Solutions, Tenaska Power Services and NRG Power Marketing.

NRG Energy “supports using competition to control transmission costs in PJM and voted accordingly today with consumer interests and others at the RTO’s Members Committee,” Travis Kavulla, vice president of regulation for NRG, tweeted after the vote.

By one count, the RTO’s renewable generators split with six “yes” votes, three “no” votes and six abstentions. “What happened was the competitive generators all lined up behind the proposal, while the renewable crowd kind of sat on the sideline,” one stakeholder involved said.

Financial Traders Side with TOs

The stakeholders also peeled off enough Other Suppliers to squeak out a majority in the sector, rising from 40% in May (14 of 35) to 51% (26 of 51).

They added 12 “yes” votes — including Conoco Phillips, BP Energy and NextEra Energy Marketing, which had abstained or not voted in May, and Direct Energy, which switched from “no” to “yes.” The TOs were able to add only four “no” votes.

Sixteen of 21 financial traders in the OS sector opposed the joint stakeholders, with two voting “yes” and three abstentions. Eleven of the companies that voted against the stakeholders are represented by attorney Ruta Skučas of Pierce Atwood. | Pierce Atwood

The joint stakeholders would have cleared the two-thirds threshold at the May MRC meeting had they been able to flip four OS votes. RTO Insider reported previously that it was a bloc of financial traders that turned the sector against the stakeholders’ proposal in May. (See “Financial Traders Joined TOs in Opposition,” PJM TOs Outline End-of-life Tariff Amendments.)

Sixteen of 21 financial traders in the OS sector opposed the joint stakeholders, with two voting “yes” and three abstentions. Ten of the companies that voted against the stakeholders are represented by attorney Ruta Skučas of Pierce Atwood.

Several stakeholders noted that financial traders have been at odds with load interests, who have questioned whether the traders bring value to PJM markets.

In 2017, the Financial Marketers Coalition, led by Skučas, vigorously opposed a rule change supported by the PJM ICC and Electric Distributor sector that reduced bidding locations for increment offers, decrement bids and up-to-congestion transactions by almost 90%. (See PJM MRC OKs Uplift Solution over Financial Marketers’ Opposition.)

In May 2019, the Organization of PJM States Inc. (OPSI) pressed PJM to act on a recommendation from the independent consultants’ report on the GreenHat Energy default that the RTO conduct a general review of the financial transmission rights market and consider potential reforms. The RTO announced last month it will hire a consultant to help it consider whether the FTR and auction revenue rights markets should be changed to ensure more of the benefits go to load-serving entities rather than financial traders. (See PJM ARR/FTR Review Could Pit LSEs vs. Financial Traders.)

With that review looming, one stakeholder speculated that the financial traders were engaged in vote trading with TOs. “That’s the only conclusion I can come to,” the stakeholder said. After the May vote, the stakeholder added, “there was a huge get-out-the-vote effort in the Other Suppliers sector to counter the financial traders.”

Skučas declined to discuss her clients’ reason for their votes, saying, “I am also concerned and disheartened that a stakeholder could not reach the conclusion that a fellow stakeholder group was substantively weighing disputed issues and reaching a position that differed from their own.”

States Supportive

As they had been in May, the Electric Distributor and End-Use Customer sectors were almost unanimous in supporting the joint stakeholders in June. The End-Use Customers sector added two “yes” votes in the June vote (from 17 to 19), remaining unanimous.

Consumer advocates from D.C. and nine of PJM’s 13 states — Delaware, Indiana, Maryland, New Jersey, Kentucky, Pennsylvania, North Carolina, West Virginia and Ohio — supported the proposal. Representatives for Virginia, Illinois, Michigan and Tennessee did not vote.

Greg Poulos, executive director of the Consumer Advocates of the PJM States (CAPS), said it is difficult to get participation from all CAPS members for a variety of reasons; some states need more time to obtain voting authority.

Although OPSI took no position on the vote, staff for the New Jersey Board of Public Utilities and the Kentucky Public Service Commission spoke in favor of the proposal at the June MC meeting.

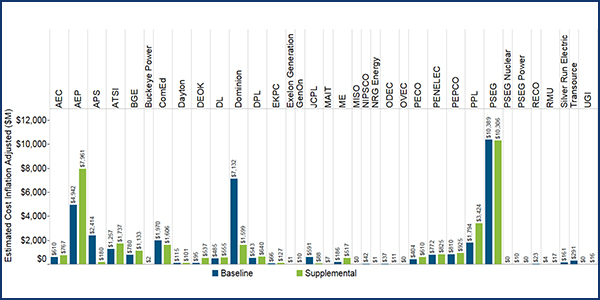

The EOL issue is particularly important for New Jersey, as Public Service Electric and Gas has led all PJM TOs since 2005 in spending on supplemental transmission projects. PSE&G spent $10.3 billion on supplemental projects between 2005 and 2019. Only one other TO, American Electric Power ($7.96 billion), spent more than $4 billion. PSE&G spent more than $5 million on supplemental projects per transmission line circuit mile over the period. Second-ranked Baltimore Gas and Electric spent less than $1.5 million per mile.

Asked to explain the discrepancy, a PSE&G spokesman declined to comment, saying only “we’ll pass.”

PSEG has led all PJM transmission owners since 2005 in spending on supplemental transmission projects, which include end-of-life facilities and are excluded from competition. | PJM

Public Power

The Electric Distributor sector was unchanged at 96.6% in the June vote, with support from all but one of the 29 voting.

All but two of the 21 members of the PJM Public Power Coalition, represented by Carl Johnson, voted for the stakeholders’ proposal. | © RTO Insider

All but two of the 21 members of the PJM Public Power Coalition represented by Carl Johnson voted for the stakeholders’ proposal. (Most of the coalition is in the Electric Distributor sector; members that don’t have load in PJM are registered as Other Suppliers.) Similarly, all nine members of the Public Power Association of New Jersey (PPANJ) voted “yes.”

“For the most part, there was support among the public power entities to having PJM do a broader look at replacing facilities that reach their end of life,” said Johnson, a consultant for Customized Energy Solutions. “And there was interest in having FERC finally give us a clear determination” on whether its CAISO rulings apply to PJM, he added, saying stakeholders have made convincing arguments on both sides.

PJM has said its role is limited by the two FERC rulings, which concluded that equipment replacements that result in only incidental increases in system capacity are asset management decisions under TOs’ exclusive control, not planning matters subject to FERC Order 890. (See ‘Asset Management’ not Subject to Order 890, FERC Rules.)

“For us, [transmission] is a very big component of our cost, particularly in the PSEG territory,” said Brian Vayda, executive director of the PPANJ. “Transmission is on the verge of overtaking the cost of the commodity on a per-megawatt basis.”

Vayda said his members, who serve 75,000 customers, are keenly aware of the importance of reliability and resilience. “But we’re very concerned about the escalating costs and the lack of transparency that has always been an issue with supplemental projects.”

Margin of Victory

Backers of the joint stakeholders’ proposal said they were gratified by the widespread support they received.

“The joint stakeholders put tremendous time and effort into educating stakeholders on the need to push PJM into a grid of the future approach that includes competition and a regional perspective,” Poulos said. “It was amazing to see stakeholders rally behind the proposal with only the transmission owners, financial traders and a handful of renewable interests voting against it. On a major issue like this, it is quite impressive to see a unified position from the vast majority of stakeholder interests.”

“The key takeaway for me is that a majority of every sector other than the TOs supported the joint stakeholder proposal,” ODEC’s Adrien Ford said. “That is powerful to me.”

“There were 94 companies that voted in support of this. That’s a lot of companies,” LS Power’s Sharon Segner said.

Tatum said the joint stakeholders are eager to have FERC opine on issues that have provoked disagreement among PJM members, including the applicability of the two CAISO orders and the PJM TOs’ rights under the OA, Tariff and Consolidated Transmission Owner Agreement (CTOA).

After the June 18 MC vote, AMP Transmission and ODEC filed a motion to have the TOs’ Attachment M-3 filing dismissed. They contend the TO’s 30-day notice was issued without a formal vote of the TOA-AC, as they say is required by the CTOA. As PJM TOs, AMPT and ODEC have seats on the committee.

Outgoing TOA-AC Chair Takis Laios, of AEP, had said a vote wasn’t necessary because a “supermajority” of the TOs had approached him and said they had the votes necessary for a Section 205 filing they wanted to take before stakeholders.

Tatum acknowledged that AMP and ODEC could not have blocked the TOA-AC from approving the Attachment M-3 changes. But had the TOs followed the CTOA rules, Tatum said, “we would have known this was coming.”

PJM, TOs: Joint Proposal Violates Rules, Precedent

As in the May votes, the TOs were near unanimous in opposition to the joint stakeholders on June 18 (11 of 13 “no” votes in May to 12 of 14 “no” votes in June). The only defectors were two merchant transmission operators, Linden VFT and Neptune Regional Transmission System, who supported the joint stakeholders.

TO representatives did not respond to requests for comment for this story.

During debates before the MRC and MC, the TOs and PJM said the stakeholders’ OA changes violate the CTOA by attempting to give the RTO authority over asset management decisions, making it in the words of Exelon’s Robert Taylor “substantively and legally flawed.”

In a May 22 letter, 10 of the TOs said the joint stakeholders proposal is “not in the best interest of our customers and will impair system reliability and safety.”

PJM said the joint stakeholders’ proposal to amend the definition of supplemental projects and create a new category of EOL projects under the RTO’s planning authority “is beyond the scope of authority transferred to PJM under the CTOA.”

Alex Stern, PSEG | © RTO Insider

Alex Stern, director of RTO strategy for PSEG Services, told the MC on June 18 that the TOs spent six months trying to work with other stakeholders only to find “divide and a disconnect” in the stakeholder process. He said the OA changes will hinder, not facilitate, “the grid of the future.”

Tatum disagreed. “I honestly believe this is how [the PJM stakeholder process] is supposed to work. There’s nothing broken about this in any stretch of the imagination.”

He said he has been encouraged by PJM’s new CEO, Manu Asthana, who he said has shown a willingness to listen to other stakeholders. “The stakeholder process can work when PJM’s fingers are not on the scale,” he said.

Erik Heinle, of the D.C. Office of the People’s Counsel, said the transmission assets being replaced now were built under different business models — before retail choice, renewable generation, demand response and other innovations.

“We want to see more oversight by PJM. We want to see it fulfill its role as the regional transmission planner.

“PJM has been great about being a leader on the market side. They’ve been less good about bringing that leadership on transmission,” he said. “I am concerned that PJM is not always a neutral player.”

Asked to respond, PJM referred to General Counsel Chris O’Hara’s comments at the June 18 meeting — at which he said the RTO would file the OA changes with FERC although it disagrees with them — and the Board of Managers’ May 27 letter to the joint stakeholders defending PJM’s EOL proposal.

“These issues will be ultimately settled at the FERC,” said spokeswoman Susan Buehler.