Pennsylvania Republican senators said last week that Gov. Tom Wolf’s plan to join the Regional Greenhouse Gas Initiative will accelerate the closure of the state’s coal-fired generating plants, dealing another economic blow on top of the coronavirus pandemic.

The Senate Environmental Resources and Energy Committee heard from 11 speakers, including a Critics: Pa. RGGI Hearing Stacked with Detractors.)

Committee Chairman Gene Yaw (R) said joining RGGI will exacerbate the disruption Pennsylvania’s energy sector has suffered during the pandemic. “There are many questions that remain with regard to the governor’s executive order instructing the Pennsylvania Department of Environmental Protection [DEP] to participate in RGGI,” Yaw said.

Yaw and Committee Vice Chairman Joe Pittman (R) led a group of legislators that signed a letter in April asking Wolf to rescind his executive order out of “respect for the oversight process,” noting the committee had to cancel four public hearings on the issue because of the pandemic.

During the hearing, Pittman grilled DEP Secretary Patrick McDonnell, saying that three coal-fired plants in his district — Conemaugh Generating Station, Homer City Generating Station and Keystone Generating Station — will likely be shut down if the state joins RGGI, causing thousands of job losses.

“I’m not naive to the market conditions,” Pittman said. “I recognize the challenges that exist already. But my goodness, allow the market to work. And if you really want us to adjust as communities, then show us the examples of what you’re going to do to rectify the damage being done to our communities.”

McDonnell said people are “going to be standing outside shuttered plants” within the next 10 years regardless of whether Pennsylvania joins RGGI because of the direction of the energy market. He said utility-scale solar generation is becoming the cheapest resource available within the PJM market and that coal generation is quickly disappearing.

“The reality is the market is driving these decisions,” McDonnell said. “The market is driving decisions around moving to renewable energy, clean energy and energy efficiency.”

Minority Chairman Steven Santarsiero (D) said he “wholeheartedly” supported Wolf’s plan, saying RGGI will allow the state to meet its carbon emission goals and provide economic benefits to residents.

“This is an important change in Pennsylvania policy, and as a consequence, it does require thorough public input and thorough input to this committee as we move forward,” Santarsiero said.

First Climate Goals for Pennsylvania

Reducing CO2 emissions is a top priority for the Wolf administration. In 2019, according to the DEP, only 5% of Pennsylvania’s 231,245 GWh of electricity production were from renewables. Nuclear contributed 36%, natural gas 42% and coal 17%.

In January 2019, Wolf signed an executive order setting Pennsylvania’s first statewide climate goals: reducing greenhouse gas emissions by 26% by 2025 and by 80% by 2050 compared to 2005 levels.

Wolf followed with a second executive order instructing the DEP to begin the regulatory process to join RGGI. On June 22, citing the pandemic, Wolf provided the department with a six-week extension to deliver a proposed rulemaking to the Pennsylvania Environmental Quality Board, extending the previous July 31 deadline to Sept. 15.

Wolf said RGGI states have reduced power-sector CO2 pollution by 45% since 2005 while returning $2.31 billion in lifetime energy bill savings to more than 161,000 households and 6,000 businesses that participated in programs funded by RGGI proceeds through its first six years of existence.

Hayley Book, senior adviser on energy and climate for the DEP, said Pennsylvania’s RGGI implementation date of Jan. 1, 2022, remains in place. Book said the department plans to hold stakeholder and public meetings on RGGI throughout the summer.

RGGI, which includes New York and the six New England states, currently has three PJM states: Delaware, Maryland and New Jersey. Virginia also is planning to join RGGI under the Clean Economy Act that passed its legislature in February and goes into effect Jan. 1. (See PJM Panel Weighs Impact of Pa., Va. Joining RGGI.)

In her testimony June 23, Gladys Brown Dutrieuille, chairwoman of the Public Utility Commission, said about 24% of the electricity produced in Pennsylvania is exported out of the state. Dutrieuille said the cost of RGGI compliance for exported electricity will be paid by electric customers in the states where that electricity is ultimately used.

PJM Testimony

PJM stakeholder opinions regarding RGGI and carbon pricing have been mixed, with many members encouraging the RTO to take a more active role in facilitating carbon pricing as states decide to join the environmental collective. (See Stakeholders Urge PJM Action on Carbon Pricing.)

In a letter sent to the PJM Board of Managers on Friday, 29 companies and renewable industry groups called for the RTO to continue its efforts to consider the integration of carbon pricing in its markets.

“With continued and heightened focus by states in the PJM market on reducing carbon emissions from power generation, PJM should continue to work with stakeholders to explore the relative roles that its competitive wholesale markets and state policies should play in shaping the quantity and composition of resources needed to meet such carbon emission reduction goals while cost-effectively meeting future reliability and operational needs,” they said.

Stephen Bennett, PJM manager of regulatory and legislative affairs, took a neutral stance on carbon pricing in his presentation during last week’s committee hearing, but he said, “A price on carbon emissions generally integrates well with PJM’s current markets.”

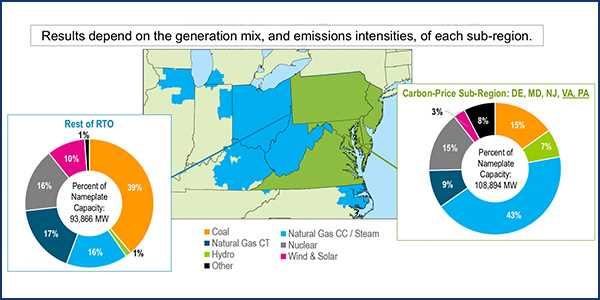

PJM’s Carbon Pricing Senior Task Force has received briefings from RTO staff on its modeling of carbon pricing scenarios and ways to address emissions “leakage” occurring when certain states choose to apply a carbon price and others do not. One of the strongest conclusions drawn from PJM’s modeling to date, Bennett said, is that the mix of states included in the carbon pricing region are a “driving factor in determining the overall impact that carbon pricing has on net PJM carbon emissions and electricity prices.”

Bennett also reiterated PJM’s stance that it does not propose to establish a carbon price and does not take advocacy positions on state legislation.

“PJM recognizes and respects Pennsylvania’s prerogative to determine its policies regarding environmental protection and emissions management,” Bennett said. “PJM also recognizes that state policy plays a significant role in determining the assets and fuel mix used to meet the state’s resource adequacy needs. Rather than advocate, PJM seeks to be a neutral party and provider of factual information on the planning and operation of the bulk electric power system, the operation and evolution of the wholesale power markets that help ensure reliability at the lowest reasonable cost, and the value PJM provides as an RTO.”

Chairman Yaw asked Bennett whether PJM will purchase generation from outside of the state if Pennsylvania’s generation capability is reduced because of RGGI.

Bennett said one of the biggest benefits of PJM is its geographic diversity, with a market spanning 13 states and D.C.

“If there is a generator or a generation source that has very high cost of prices, they’re likely to be displaced either in state or out of state by resources that have a lower cost,” Bennett said. “And that’s how across the footprint we’re able to provide that power at the lowest reasonable cost.”

Leakage Concern

Sen. Scott Martin (R) cited PJM’s opportunity statement on carbon pricing, which said that “without addressing leakage, rising emissions can eliminate the environmental benefits that carbon pricing policies are intended to produce.” He asked if environmental benefits touted by the DEP would be offset by other fossil fuel generation units in non-RGGI PJM states, as the department’s draft CO2 trading program regulation contains no provisions to address leakage.

Bennett said he couldn’t “categorically” say that any emissions or environmental benefits would be offset, citing the complexity of the modeling PJM has conducted.

“Depending on the cost of carbon and things of that nature, you do have differing outcomes as far as the impact of leakage on the overall net price and emission intensity outcomes,” Bennett said. “Leakage is certainly something that can have that impact.”

Republican Legislation

The Senate hearing was not meant to be a consideration of Vice Chairman Pittman’s Senate Bill 950 or its companion House Bill 2025 sponsored by state Rep. Jim Struzzi (R), which require RGGI to be “vetted through the legislature,” though both were mentioned during testimony.

Tom Schuster, clean energy program director for the Sierra Club in Pennsylvania, said SB 950 would prevent Pennsylvania from regulating electric sector carbon pollution and revoke the DEP’s existing authority under the Air Pollution Control Act to regulate greenhouse gas emissions in any sector.

Shawn Steffee, executive board trustee and business agent for Boilermakers Local Lodge 154, said he has joined with community, business and labor leaders in the Power PA Jobs Alliance to support both the Senate and House bills. Steffee said Pennsylvania coal-fired power plants and older gas plants will lose their ability to compete with similar units in West Virginia and Ohio, two states that are not examining joining RGGI.

“Our plants will abruptly close, and new power generation growth will happen in West Virginia and Ohio, costing us thousands of good paying, blue collar jobs,” Steffee said.