FERC last week established a paper hearing to explore the justness and reasonableness of ISO-NE’s new-entrant rules for its Forward Capacity Market (EL14-7-002, EL15-23-002, EL20-54).

The June 30 decision came on remand from the D.C. Circuit Court of Appeals, which ruled in February 2018 that the commission failed to adequately explain why it approved capacity market rules for ISO-NE in 2014 like those it had rejected in PJM for suppressing prices. (See DC Circuit Orders FERC to Review ISO-NE Auction Orders.)

The court ruling granted petitions for review by Exelon and the New England Power Generators Association on rules allowing new suppliers to lock in their first-year clearing prices for six additional years while requiring them to offer at $0 in years 2 through 7 (15-1071).

“In light of the time that has passed since the NEPGA and Exelon complaints were filed and the changes to the ISO-NE Forward Capacity Market during that time, we believe it is appropriate to provide parties an opportunity to refresh the record on which we will address the issues raised in the court’s remand,” the commission said.

It noted that capacity prices have been trending downward in ISO-NE auctions and that it has approved several changes to the FCM, including Tariff revisions to implement the Competitive Auctions with Sponsored Policy Resources construct, it said. (See ISO-NE Capacity Prices Hit Record Low.)

The commission issued a set of questions to guide the paper hearing and said it was instituting a new Section 206 proceeding “because certain of these questions may not have been directly presented in the original NEPGA and Exelon complaints.”

Relevant Questions

At the inception of the FCM in 2006, the commission accepted Tariff provisions that allowed a new resource to lock in for five years the capacity price that it receives in the first Forward Capacity Auction in which it participates. Under that rule, a new resource receives that initial clearing price for the four subsequent annual auctions (the lock-in period), even if the actual clearing price for those subsequent auctions is higher or lower.

Exelon and NEPGA had complained that the commission’s approval of the rules was at odds with its 2009 ruling rejecting a similar construct in PJM. The D.C. Circuit agreed, saying that FERC had “failed to square its decision with its past precedent.”

In last week’s order, FERC said it was concerned that any potential effects that the current new-entrant rules could have on the FCM clearing price may outweigh the certainty and other benefits that the commission considered when approving those provisions.

To evaluate the need for the price lock in its entirety, the paper hearing will first pose the following questions:

- How many resources have taken advantage of the price lock to date?

- Is a price lock still needed to incent new entry in ISO-NE?

- Does the price lock lead to unreasonable price suppression in the entry year?

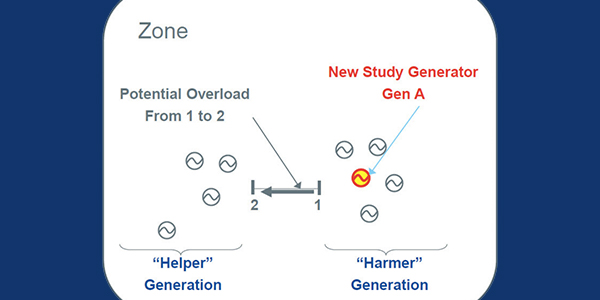

- Does the price lock with the zero-price offer rule result in unreasonable price suppression in years 2-7?

- Is the price lock unduly discriminatory?

- If the price lock is retained, should the term be shortened and, if so, what would be a just and reasonable term?

Second, to evaluate retaining the price lock and adding an offer floor, the commission will ask how an offer floor would be implemented, whether it would require significant market redesign, and what the timeline would be for implementation.

Third, to evaluate whether to impose an alternative replacement rate, the commission seeks to address whether there are alternative approaches to the current price lock that would be sufficient to incent new entry, and how these alternative approaches would address any concerns related to unreasonable price suppression, undue discriminatory or preferential treatment.