Utilities and cooperatives in the Southeast have been meeting for months on a plan to create a regional 15-minute energy market, officials confirmed Wednesday.

The talks, led by Southern Co. and Duke Energy, were largely secret until Monday, when the initiative was mentioned at a meeting of stakeholders working on North Carolina Gov. Roy Cooper’s Clean Energy Plan. The Charlotte Business Journal was the first to report on the plan Tuesday, saying as many as 20 companies may be involved.

Officials of Southern, Duke and the Tennessee Valley Authority confirmed the talks Wednesday, saying the Southeast Energy Exchange Market (SEEM) would be a 15-minute energy market designed to lower customer costs, optimize new renewable energy resources and improve reliability.

Dominion Energy South Carolina; Oglethorpe Power; PPL subsidiary LG&E and KU Energy; Santee Cooper (the South Carolina Public Service Authority); the North Carolina Electric Membership Corp.; the North Carolina municipal members of ElectriCities; and several electric cooperatives also are reportedly involved in the talks.

‘Exploratory Stage’

Southern Co. spokesman Schuyler Baehman said talks are in the “exploratory stage.”

“If we determine that partnering with our neighbors makes sense, we’ll certainly take the appropriate steps to describe that more fully for regulators and stakeholders,” he said.

“While we’re still early in the learning phase, we’re eager to see the kind of benefits a regional energy market might have for our customers, particularly if it helps improve how we can jointly operate growing solar resources on our systems,” Duke spokeswoman Erin Culbert said. “This evaluation is a response to stakeholder interest we’ve been hearing for a few years on a potential energy market so we can advance these concepts and see if they make sense.”

“If we determine that partnering with our neighbors makes sense, we’ll certainly take the appropriate steps to describe that more fully for the 10 million people we serve,” TVA spokesman Jim Hopson said.

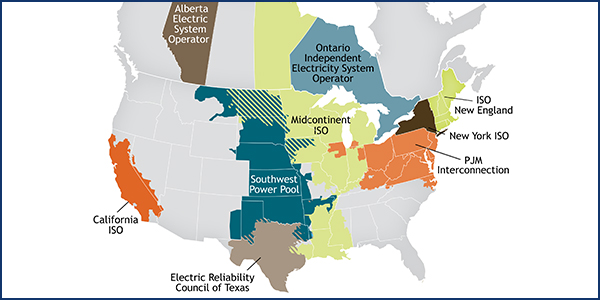

The Southeast is the only region of the continental U.S. that has not moved to some form of regional market, continuing to be served by vertically integrated monopoly utilities. Lawmakers in North and South Carolina, however, have been discussing prospects for joining or creating a new regional market for more than a year.

Culbert said the SEEM would be limited to energy — not capacity — and build on the existing bilateral market. It would use the “same principles” as the Western Energy Imbalance Market but be less “granular [and] costly to set up,” she said.

“It would allow participants to buy and sell power close to the time electricity is consumed and would give system operators real-time visibility across neighboring electric grids,” she said, adding that better integration of renewables could mean fewer solar curtailments.

“This isn’t a regional transmission organization, nor does it prohibit the ability for any of the companies to form or join an RTO in the future,” she added. “No decisions have been made yet. As we learn more details, we’ll be sharing those with regulators and stakeholders and, if we proceed, would make the appropriate filings with FERC, etc.”

Lack of Transparency?

News of the utility discussions alarmed some stakeholders.

“More competition in the electricity sector is inherently good for ratepayers and the economy, but it’s not truly competition if vertically integrated utilities can continue exercising their monopoly power,” Katherine Gensler, vice president of regulatory affairs for the Solar Energy Industries Association, said in a statement. “As details emerge, policymakers must ensure that this imbalance market has the proper governance to ensure that ratepayers, generators and participating utilities can all share the benefits.

“While an energy imbalance market may be the best solution for the Southeast, we should take a collaborative approach to discussing utility business model reforms, including robust stakeholder input,” Gensler continued. “We cannot be in the situation where utilities ignore stakeholders and state legislators and simply announce their preferred solution. We care deeply about expanding competition, but today’s news shows an alarming lack of transparency.”

“The South’s power sector — dominated by large monopolies with not enough accountability or competition — is in need of significant change,” said Frank Rambo, senior attorney for the Southern Environmental Law Center. “A fully open wholesale electricity market could produce the efficiencies and competition that would result in cleaner energy and lower power bills, but a plan hatched in secret by the monopoly utilities that have most benefited from the status quo is not a promising vehicle to deliver that kind of change.”

A spokesman for the South Carolina Public Service Commission said he was unaware of the discussions. The North Carolina Utilities Commission did not immediately respond to a request for comment.

RTO Legislation

North Carolina House Bill 958, introduced in April 2019, would authorize the NCUC to require the state’s investor-owned utilities establish or join a regional transmission entity after determining such a move would be in the public interest. It was referred to the House Committee on Rules, Calendar and Operations of the House.

South Carolina lawmakers introduced legislation (S. 998 and H. 4940) in January 2020 that would establish an Electricity Market Reform Measures Study Committee to study the benefits of electricity market reforms and whether the legislature should adopt them. In February, H. 4940 crossed over to the Senate.

Prior Studies

In May, law firm Nelson Mullins Riley & Scarborough sponsored a webinar on “How Markets and Reform Can Reduce Electricity Costs in the Carolinas.”

Among those who spoke were Jennifer Chen of Duke University’s Nicholas Institute for Environmental Policy Solutions and the author of a March 2020 policy brief titled “Evaluating Options for Enhancing Wholesale Competition and Implications for the Southeastern United States.”

Rachel Wilson of Synapse Energy Economics shared evidence indicating that membership in an RTO would result in savings for Duke customers.

She said the 2012 merger of Duke and Progress Energy, which combined their generation fleets in the Carolinas, “resulted in hundreds of millions of dollars in savings,” prompting questions about whether joining an RTO would produce bigger savings.

One study estimated that joining PJM could reduce production costs for Duke’s North Carolina customers by up to $600 million annually, a savings of 9 to 11%, Wilson said.

In Duke’s 2018 integrated resource plan proceedings, Synapse compared the company’s proposed IRP with an alternative scenario for the North Carolina Sustainable Energy Association.

While the Duke IRP called for using new gas resources to meet future demand, the “market scenario” used solar paired with storage, as well as standalone solar and battery resources, to meet projected peak.

Under Duke’s IRP, fossil fuels would be 42% of its fuel mix with renewables representing 9%. The market scenario reduced coal to 1% and gas to 8%, with renewables taking a 27% share, imports representing 18% and nuclear making up most of the rest.

By 2033, Synapse said, wholesale costs under the market scenario would be 30% lower than under the IRP.