ISO-NE announced Friday that it had selected a $49 million project by incumbent utilities National Grid and Eversource Energy as the winner of its Boston 2028 transmission solicitation — the cheapest of the 36 proposals it received in response to its first-ever competitive solicitation under FERC Order 1000.

The RTO also issued a response to stakeholders who challenged its selection process, along with a final review of the proposals and an appendix of redacted executive summaries from them. It also posted a memo promising stakeholders discussions this fall on “lessons learned” since it published the request for proposals in December.

The memo from Director of Transmission Planning Brent Oberlin also promised opportunities for the seven bidders whose proposals did not get selected to have one-on-one discussions with the RTO.

“While the process functioned as intended, the ISO observed some areas for improvement, and I am sure that others have suggested improvements as well,” Oberlin said. “As an example, the ISO has noted that due to the handling of corollary upgrades, inclusion of life-cycle costs as part of the Phase One proposals places a burden on the Qualified Transmission Project Sponsors (QTPS), yet has little value during that stage of the process.”

ISO-NE issued the RFP to address transmission violations expected after the retirement of Exelon Mystic Units 8 and 9, whose closing was extended to May 30, 2024, under a two-year, $400 million cost-of-service contract. The project selected by the RTO on Friday has a projected in-service date of Oct. 1, 2023, eight months before the end of the contract.

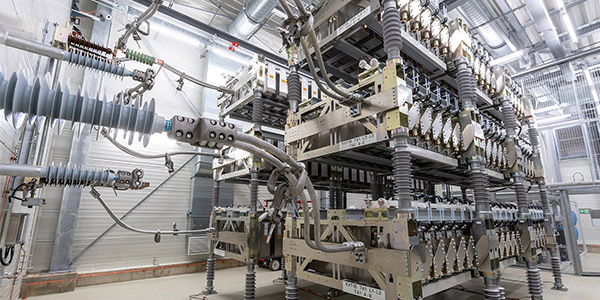

The winning project includes the installation of two 11.9-ohm, 345-kV series reactors at the North Cambridge substation (one each on the two 345-kV Woburn-to-North Cambridge cables); a +/-167-MVAR static synchronous compensator (STATCOM) at the 345-kV Tewksbury substation; and a direct transfer trip scheme on the 394 line to eliminate the contingency that causes the 115-kV K-163 line overload.

The selection announcement said it “also serves as notice of the initiation of the Boston 2028 Solutions Study – Mystic Retirement,” in accordance with the reliability planning process under the Tariff.

ISO-NE surprised many stakeholders and drew a legal challenge when it announced June 8 it had selected the National Grid-Eversource proposal as the single finalist in the solicitation, which produced projects ranging as high as $745 million. (See Boston RFP Review Draws Unexpected Crowd.)

In a complaint filed with FERC last month, Exelon accused ISO-NE of violating its Tariff by shortcutting its transmission security review and prematurely culling the bids (EL20-52). (See Exelon Challenges ISO-NE RFP in Bid to Extend Mystic.)

The RTO did not back down under stakeholder questioning, the Exelon complaint or from political pressure from Massachusetts’ two U.S. senators urging the ISO-NE to “prioritize the effects that projects may have on state climate, energy and health goals.”

Point by Point

Even though it said “cost and speed” were the two most important evaluation factors, the RTO in its response to stakeholders asserted that it had reviewed cost competitiveness only after determining whether the proposals provided a viable solution to the identified needs.

ISO-NE’s response focuses largely on rebutting the comments of Anbaric Development Partners, which had proposed two versions of its Mystic Reliability Wind Link, an AC project at $450 million and an HVDC proposal at $750 million.

The RTO said it agreed with two of the developer’s six complaints and removed two preliminary review factors that led to the exclusion of the Anbaric Phase One proposals. “However, with this additional review, the ISO has identified an additional issue with the Anbaric proposals that would also lead to their exclusion from the listing of qualifying Phase One proposals,” it said.

Anbaric said that the RTO’s concerns over the ability of its AC project to provide at least 300 MVAR of continuous dynamic reactive capability via a STATCOM at the point of interconnection was unnecessarily technical in the first phase of a solicitation. ISO-NE insisted that the inclusion of a step-up transformer in a turnkey STATCOM could not be taken for granted.

In disagreeing with Anbaric’s assertion that the RFP process had not been transparent as required by Order 1000, ISO-NE replied that it had “discussed the results of its review of the Phase One proposals and the draft list of qualifying Phase One proposals with the Planning Advisory Committee on June 17, 2020.”

The RTO posted each proposal’s executive summary on its external website on June 16, the day before the PAC meeting.

“We disagree with what the ISO says, both technically, legally and factually, and we think our comments continue to be right,” Theodore Paradise, Anbaric senior vice president for transmission strategy, told RTO Insider. “We think the ISO looked for ways to exclude projects, not with an eye toward finding the more efficient and cost-effective project for the region, but with an eye toward how they could shut Mystic down as fast as possible. But the project selected may not actually allow Mystic to retire and lead to a few more years of the cost-of-service agreement.”

The RTO said it had intended to mask the names of the developers to try to limit any bias during review, but that even with masking it had concerns that some of the responses thwarted “the intent to let each proposal stand on its own merits.”

“Rather than describing the project, some responses are written as an advertisement for the project,” it said. Other responses criticized other possible proposals or referred to specific technologies that “would essentially identify the QTPS,” it said.

Anbaric on June 16 submitted comments to ISO-NE to correct what it perceived to be errors in the review process and expanded on some of those concerns in comments filed July 15 in the Exelon proceeding.

Anbaric said that the project selected relies on the New England Clean Energy Connect (NECEC), a transmission line to bring approximately 1,200 MW of Canadian hydropower into Maine that has been the subject of lawsuits and voter challenges that could delay the project past its target 2024 in-service date.

A delay on NECEC could mean that the Mystic units will have to remain in service for several years past 2024 at a cost of $200 million to $300 million per year for the generating station and the LNG terminal needed to fuel it, the developer said.

“When you’re speeding this along, there wasn’t really a discussion, and in the intervening months, things have happened,” Paradise said. “There were new lawsuits filed over the NECEC project, the voter referendum was put on the ballot in Maine. Our comments on that being at risk are not against the project; it’s just pointing out a factual situation.”

Paradise said the Boston RFP “is a tale of irony” in some ways.

“By picking a little project that’s supposed to be fast, you might pick the project that takes longer,” Paradise said. “We think that it’s somewhat likely that the cheapest project in terms of capital costs will not solve the needs to allow for a June 2024 retirement of Mystic, and the costs to the region’s ratepayers may end up being far higher than if a more capable project had been selected.”