FERC on Friday sent SPP back to the drawing board, saying its proposed Tariff for its Western Energy Imbalance Service (WEIS) market fails to respect transmission rights of non-participants and could improperly burden reliability coordinators. The commission also cited shortcomings on supply adequacy, market power protections and line-loss calculations (ER20-1059, ER20-1060).

“We recognize the potential benefits that the WEIS market could bring to utilities and customers in the Western Interconnection … and we appreciate the efforts by SPP and the market participants to develop regional solutions,” FERC said. “… Although we reject SPP’s proposed WEIS Tariff, we do so without prejudice and provide guidance on other aspects of SPP’s proposal that may require revisions to ensure SPP’s proposal is just and reasonable.”

SPP said it is reviewing the order and plans to “address [FERC’s] concerns” in a subsequent filing.

On Monday, SPP’s Market Monitoring Unit (MMU) posted a market power study on the WEIS market that concluded it presents “significant structural market power concerns” for energy and imbalance energy that should be addressed before the market’s implementation.

The MMU said market share, supplier concentration, residual supply index (RSI), and pivotal supplier analysis all indicate “high potential structural market power in the WEIS Market.”

Given its “substantial concerns,” the MMU recommends SPP and WEIS market participants consider developing a system-wide mitigation measure and using cost-based offers if the mitigation measures cannot be implemented before the market goes live.

SPP had hoped to launch WEIS in February. At launch, WEIS will include eight members and cover the Western Area Power Administration’s (WAPA) Colorado Missouri (WACM) and Upper Great Plains West (WAUW) balancing authority areas.

During the July 27 quarterly stakeholder update, Bruce Rew, SPP’s senior vice president of operations, said the RTO has received interest in WEIS from “a couple of other entities” who would sign on after the launch. Staff was preparing to begin market trials in August. (See “WEIS Market ‘At Risk,’ Waiting on FERC Approval,” SPP Briefs: Week of July 20, 2020.)

Use of Non-participants’ Transmission

Colorado utilities Xcel Energy-Colorado, Colorado Springs Utilities, Platte River Power Authority and Black Hills Energy, all of which plan to join CAISO’s Western Energy Imbalance Market, protested the WEIS filings. They contend that an existing and neighboring joint dispatch agreement could be impaired by the WEIS market dispatch and that its market flows may harm the Western Interconnection Unscheduled Flow Mitigation Plan. They also contend SPP’s proposal disregards the Northwest Power Pool’s activities and could island Xcel’s balancing authority area from the NWPP reserve sharing group.

The commission agreed with some of those concerns, saying SPP proposed using non-participating entities’ transmission in a manner that would violate Orders 890 and 890-A.

“Under the pro forma OATT, a transmission customer must reserve and pay for transmission service on a transmission provider’s system. Although SPP indicates its intent to use transmission that is reserved and contributed by participating entities, SPP also argues that it appears just and reasonable to allow all unused transmission capability within participating [balancing authority areas], whether reserved or otherwise unused on an intra-hour, as-available basis, to be made available to the WEIS Market’s least cost dispatch.”

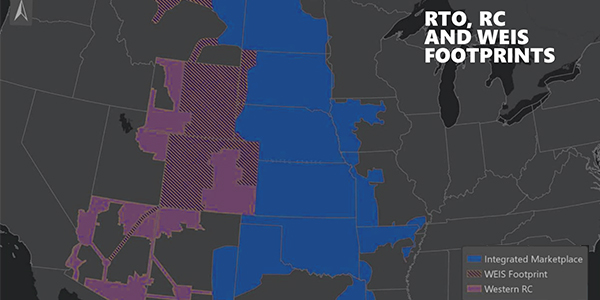

SPP RTO, RC and WEIS footprints | SPP

FERC disagreed with arguments by SPP and WAPA that because the balancing authority is currently permitted to use any transmission in the WACM and the WAUW BAAs to serve imbalance, the WEIS market could also use all available, unused transmission in these BAAs.

“Although non-participating entities who take imbalance service from WAPA under existing contracts may currently have an expectation of WAPA’s use of their transmission to serve imbalances on their systems, SPP has not justified its proposal to alter WAPA’s current use of transmission to serve customers’ imbalance needs to a potentially more expansive use of transmission for the WEIS market,” FERC said. “As Xcel points out, this proposal would allow the WEIS market to use a far greater amount of a customer’s transmission capacity than the customer’s amount of imbalance in order to serve other customers.

“In fact, as Black Hills Service Co. asserts, it appears that under the proposal the WEIS market could use non-participating entities’ transmission capacity without compensation, even when those non-participating entities have no need for imbalance service in a particular hour, because the reorganized dispatch will likely involve wheeling of power across multiple transmission systems. SPP’s proposal therefore may limit the use of non-participating entities’ transmission capacity that is currently available for other purposes, such as the [Public Service Co. of Colorado joint dispatch agreement].”

The commission said any future proposal should ensure that the WEIS market respects the transmission capacity of non-participating entities with appropriate constraints in its security-constrained economic dispatch (SCED). “If SPP is not able to reach an arrangement with non-participating entities to use their transmission capacity, SPP must include constraints in its market model to appropriately respect the transmission rights of non-participating entities when calculating the market solution,” it said.

The commissioners noted that CAISO’s Western EIM offered a memorandum of understanding among the ISO, Bonneville Power Administration and PacifiCorp to ensure that EIM transfers would not adversely impact non-participants. “We encourage SPP to coordinate proactively with its neighbors to address these operational concerns prior to resubmitting any proposal,” FERC said.

Role of Reliability Coordinator

FERC also found SPP presumptuous in expecting that reliability coordinators and transmission operators will provide WEIS with data on the availability of transmission, saying the RTO had not proven its proposal will ensure accurate, real-time information about available transmission and congestion.

“While this obligation is not currently a concern because SPP is both the reliability coordinator and market operator for the entire WEIS footprint, SPP states that the WEIS market is flexible to operate across multiple reliability coordinator footprints. If the market expands to include participants that are not within the SPP West RC footprint, it could potentially impose an obligation on neighboring reliability coordinators to act as a conduit for market-related information in a way that is outside of the role for reliability coordinators envisioned by NERC,” the commission said.

It said SPP could propose a different arrangement to obtain information on transmission availability and other system conditions that do not rely on roles defined by NERC.

Other Issues

FERC also said it was unclear how SPP’s proposal would incentivize market participants to maintain supply adequacy.

“While the NERC reliability standards establish requirements for the reliable operation of the bulk electric system, it is not clear that reliance on these standards and after-the-fact reporting to the commission is sufficient to avoid market participants excessively leaning on the other market participants for energy supply,” it said. In the Western EIM, it noted, CAISO limits the imbalance imports of EIM entities that fail a resource sufficiency test.

SPP’s proposal to use the “average cost” method of accounting for line losses also was criticized by the commission, which cited prior rulings finding that under LMP, the use of marginal losses “better represents the optimal and efficient solution for settlements.”

It said SPP should consider including marginal losses in dispatch and LMP to “minimize imbalance costs, provide prices that accurately reflect marginal costs and preserve resources’ incentives to follow dispatch. The omission of marginal losses from dispatch prevents production costs from being minimized and could result in a less efficient market solution, especially in a geographically large market such as the WEIS market.”

Finally, FERC called for more assurances on market power mitigation.

“Other than an unsupported reference to the SPP [Market Monitoring Unit’s] analysis of six hubs, SPP has not provided any justification for its proposal to automatically increase the threshold below which energy offer curves are not subject to mitigation and the LMP impact threshold,” it said. “… SPP should either remove the automatic increase provisions or otherwise justify their inclusion.”

In its market power study Monday, the MMU said its RSI analysis revealed that if the WEIS market’s largest supplier was removed, generation can still meet demand about 50% of the time.

“This result can provide a basis for implementing mitigation measures for system-wide market power, similar to those implemented in other markets,” the MMU said, using as an example an ISO-NE mechanism that identifies system market power. “This approach … can act as a blueprint for the WEIS Market.”

“The mitigation measures in the proposed tariff and in the response to [FERC’s] deficiency letter will provide sufficient protections for participant conduct to exercise of market power with implementation of system wide mitigation measure(s) as recommended in this study,” the Monitor said.

The MMU said it relied primarily upon FERC precedent in assessing structural market power for approval of market-based rate authority applications in conducting its study. The MMU analysis defined relevant product market(s) and a relevant geographic market as two components of the market. It then assessed structural market power with the help of market concentration, market share, RSI and pivotal supplier analysis metrics within those defined product and geographic markets.