Evergy has decided to stay single after dalliances with several potential acquisition partners, according to a published report.

Quoting “people familiar with the matter,” Bloomberg said Tuesday that the Kansas City-based company has decided to remain independent. Evergy has decided it can create more value for shareholders through a new operating plan, which had been in development while the company explored a possible sale, the report said.

The plan’s details are expected to be shared with financial analysts Wednesday when Evergy holds its quarterly earnings call before the market opens.

Evergy’s share price plunged 13.4% after the Bloomberg story broke, from $62.81 to $55.40. It was trading at $55.79 as the market neared its close.

Evergy has been under pressure from activist investor Elliott Management, which took a $760 million stake in the company and has pushed it to shake up its management team. Evergy said in March that it had reached an agreement with Elliott to establish a new strategic review committee to explore ways to improve shareholder value. (See NextEra Said to be Eyeing Evergy as Acquisition Target.)

Ameren, American Electric Power, CMS Energy and NextEra Energy are among those linked to Evergy as potential buyers.

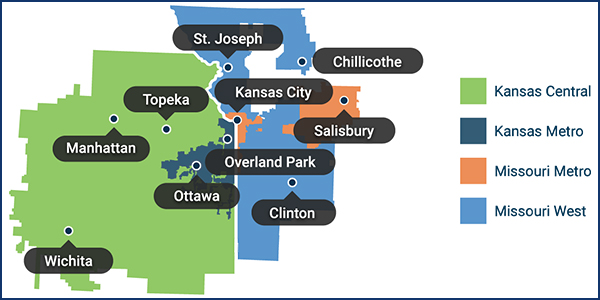

Evergy, an SPP member, was created in 2018 through a merger between Kansas City Power and Light and Westar Energy. It serves 1.6 million customers in Kansas and Missouri.