NEPOOL members are trying to cull and combine nine proposals for the Transition to the Future Grid study that ISO-NE has offered to perform.

ISO-NE CEO Gordon van Welie announced the initiative in March, saying it will give stakeholders information needed to plan transmission and market designs to achieve decarbonization goals. (See ISO-NE Study to Chart Transition to Future Grid.)

Representatives of each stakeholder group gave brief descriptions of their proposals and answered questions during a joint meeting of the NEPOOL Markets and Reliability committees Aug. 4.

In addition, Ben D’Antonio, counsel for the New England States Committee on Electricity, described NESCOE’s suggestion that ISO-NE build on the Pathway Scenario developed by the Northeastern States for Coordinated Air Use Management (NESCAUM) for achieving economy-wide carbon reductions. It assumes that at least 1,000 MW of clean energy resources will be added annually for the next several decades. NESCOE said the Pathway Scenario could be included in energy market modeling to generate hourly dispatch patterns, examine system operating characteristics and requirements and analyze transmission.

Day Pitney attorney Eric Runge presented a summary of the nine other proposals:

- Eversource Energy asked for loss-of-load expectations (LOLE) and other reliability metrics, market prices, total cost to load, a description of how the supply mix could develop under current market rules and a qualitative assessment of how likely it is for such a supply mix to develop. It suggested three scenarios for meeting 80% economy-wide emission reductions by 2050: a mixed portfolio, a high offshore wind portfolio and a high solar portfolio. Eversource also made a second request to identify total installed nameplate capacity of a future system where LOLE meets the NPCC standard of one day in 10 years with no renewables built with out-of-market contracts clearing as new in the primary or substitution auctions.

- National Grid asked how bi-directional controllable transmission with Quebec and other neighbors would impact emissions, LMPs and the use and spillage of intermittent resources. It also wants to identify transmission upgrades needed for a fully decarbonized economy and determine whether markets under high renewable/storage penetration cases would provide sufficient revenues to cover resources’ capital and operations and maintenance (O&M) costs.

- Energy Market Advisors said the RTO should look at the cost, operational and resource adequacy implications of the two options available to new resources addressing state policy objectives: those using capacity network resource interconnection service (CNRIS) and participating in the capacity, energy and ancillary service markets and those using network resource interconnection service (NRIS) and participating in only the energy and ancillary service markets. If policy resources cannot get a capacity service obligation through the forward capacity auction due to the minimum offer price rule or the Competitive Auctions with Sponsored Policy Resources (CASPR) test price, or if the cost of a CNRIS is too high, EMA said that “NRIS may well become the preferred outcome.”

- FirstLight Power said that to avoid understating potential reliability problems, the base scenarios should not assume significant new electric storage entry. It would add new electric storage based on as-modelled market prices, considering round-trip efficiency and variable O&M costs.

- NextEra Energy and Dominion Energy made a joint request to determine how the loss of the NextEra’s Seabrook and Dominion’s Millstone nuclear power plants would impact market prices, system operations and state RPS targets and decarbonization goals.

- American Petroleum Institute asked for a study on how the future grid will balance policy goals with other reliability, affordability and energy access objectives. API cited previous studies and reports by ISO-NE that it said demonstrate “that natural gas infrastructure can further economic and reliability objectives in the region.”

- Multi-sector Group A (Acadia Center, Advanced Energy Economy, Brookfield Renewables, Conservation Law Foundation, Energy New England, Natural Resource Defense Council and PowerOptions) asked for an update and extension of the Planning Advisory Committee’s 2016 economic study on regulation, ramping and reserves to assess the impact of ramping, regulation and load-following resources as the system decarbonizes.

- Multi-sector Group B (Advanced Energy Economy, Borrego Solar, Conservation Law Foundation, Energy New England, ENGIE, Natural Resources Defense Council and PowerOptions) seeks a long-term transmission system assessment to identify new transmission investments that could eliminate obstacles to reaching net zero-carbon and that are more economical than upgrades for near-term transmission needs. They also would like an analysis of whether distribution system generation, mobile and stationary storage, increased energy efficiency or flexible demand could reduce the need for new transmission.

- Anbaric Development Partners called for identifying an onshore and offshore power system that is carbon-free by 2035, as proposed last month by Democratic Presidential candidate Joe Biden. (See Biden Offers $2 Trillion Climate Plan.)

The proposals called for study time frames of at least 10 years (EMA) to as long as 2050 (Multi-sector Groups A and B and Eversource).

Day Pitney will attempt to identify commonalities among the nine proposals before the committees’ next joint meeting on Sept. 1.

“It’s not definite at this point that we’ll be the ones conducting the study,” ISO-NE spokesman Matt Kakley said via email. “We’ve offered to do it if stakeholders want us to [and] we’re able, but it hasn’t yet been decided if that’s the direction stakeholders want to go. It’s still possible that a consultant could be hired for the work.”

E3/EFI Study

The committees also heard a presentation on a study on deep decarbonization by Energy+Environmental Economics (E3) and Energy Futures Initiative (EFI) that was funded by Calpine.

The study projects that electricity demand could nearly double over the next three decades with large additions of renewable generation, particularly solar and offshore wind.

The study included a “High Electrification” case in which 80% of building energy consumption is electricity, with about 230 TWh of annual load in 2050, a 97% increase. It also included a “High Fuels” scenario in which advanced biofuels and hydrogen result in somewhat lower electrification rates and greater reliance on low-carbon fuels, with about 60% of building energy consumption from electricity. It would have a load of 192 TWh by 2050, a 66% increase.

The New England electricity system becomes winter-peaking in the 2030s, and the median gross load peak (net of energy efficiency) is expected to increase from 25 GW in 2019 to 42-51 GW by 2050.

The study identifies land and transmission availability as likely constraining factors for new generation development. Its base case estimates that a land area equal to 4% of the region’s farmland will be needed for solar generation and 2% of farm and forest land needed for wind.

E3 and EFI said that New England will require 30-37 GW of thermal capacity through 2050 under all scenarios studied but that its usage will drop over time, with the capacity factors for gas-fired generation dropping to 10% to 15% by 2050. They expect some form of low-carbon fuel will be available to reduce the carbon intensity.

The study found that cases with the most available solutions have lower costs and lower technology risks. Increasing the availability of land-based wind and solar also reduces costs.

“Firm, low-carbon technologies such as advanced nuclear, [carbon capture and sequestration] or hydrogen could play a significant role,” E3 and EFI said.

Average electric rates will increase at a compound annual growth rate of 1.3% to 1.5% by 2050 to fund infrastructure additions, including new generation, transmission upgrades and spur line costs, and a slight increase in variable costs. Average prices are forecast to rise from $0.17/kWh in 2025 to $0.23/kWh in 2050 under the high electrification case, an increase of 38%.

Removing all combustion turbines (CTs) and combined cycle plants (CCGTs) increases the cost of achieving a zero-emissions grid by about $19 billion annually relative to a zero-emissions portfolio with zero-carbon fuels (hydrogen or biogas).

In most weeks, wind and solar generation minimizes the need for CTs, CCGTs or steam turbine generation. But when renewable production is low, up to 32 GW of thermal generation could be dispatched for reliability. Building a system with no gas or hydrogen would cause a “significant overbuild” of renewables and storage, resulting in many curtailments during typical weeks, the authors said.

Without upgrades to the region’s 345-kV network, the study found enough “headroom” for a combined 800 MW of renewable generation in New Hampshire and Vermont, and 4 GW each for Connecticut, Massachusetts and Rhode Island. There is no headroom for Maine, which has the best onshore wind potential in the region. Offshore wind headroom is estimated at 8 GW.

Utility-scale solar could increase to 50% of the projected 2050 peak load without upgrades. Reaching 100% would require 115-kV line upgrades.

Brattle Offshore Wind Study

It concluded that the current approach — with OSW developers competing primarily on cost to develop offshore generation and project-specific generator lead lines — would be more expensive than developing transmission independently from generation. “A planned approach is likely to result in lower costs in both the near- and longer-term, by lowering risks and costs of onshore upgrades and increasing competition for both offshore transmission and generation,” the study found.

The study also concluded that a planned approach would make better use of limited onshore points of interconnection, reduce seabed disturbances, increase competition for transmission and generation and reduce transmission upgrade costs.

The study found that the region will need to add more than 1,500 MW of OSW annually to reach the “80% by 2050” decarbonization goals.

Phase 1 of the study focused on 3,600 MW of OSW (including authorized procurements of 1,600 MW in Massachusetts and 1,200 in Connecticut). Phase 2 included an additional 4,800 MW, for a total of about 8,400 MW.

It cited as examples of proactive transmission planning Texas’ Competitive Renewable Energy Zones, California’s Tehachapi wind, MISO’s Multi-Value Projects and several European countries.

Brattle said the existing approach for connecting 2,800 MW of OSW already contracted to Cape Cod will require $131 million to $787 million in onshore transmission upgrades. Continuing the current approach in the next 3,600 MW of procurements could cost up to an additional $1.7 billion in onshore upgrades it said.

The planned approach would increase offshore transmission equipment costs by $600 million ($3.3 billion vs $2.7 billion) but reduce costs of onshore upgrades from $1.7 billion to $550 million, a savings of more than $1.1 billion or 10% for Phase 1.

Among other findings, Brattle said the planned approach would result in:

- A 40% reduction in line losses.

- Increased competition: It cited studies of offshore transmission costs in the U.K. showing that competition among independent offshore transmission owners reduced costs 20-30% compared with generator-owned transmission.

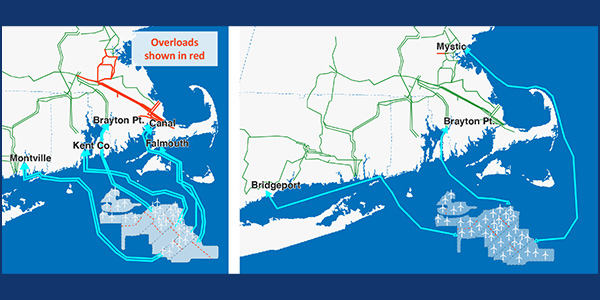

- Fewer system overloads: The study said a scenario using the current planning, with 8.1 GW of generation and five points of interconnection, would have many more system overloads — particularly in Connecticut and the Mystic-North Cambridge-Woburn section of Massachusetts — than a planned system that carried 8.6 GW over nine points of interconnection.

- Lower OSW curtailment: 14% vs. 34% in 2028.

- Increased production cost savings: $619 million in 2028 vs. $564 million for the current process, a difference of $55 million or almost 10%.

- Lower LMPs: Some locations in Rhode Island and Southeastern Massachusetts would face significantly higher LMPs by 2028 under the current approach because of transmission congestion.

- An almost 50% reduction in marine trenching: 831 miles vs. 1,620 miles for Phases 1 and 2.

- Preservation of the option for networked transmission to improve reliability and reduce curtailments from transmission outages: If three 1,200-MW HVDC converter stations were networked offshore, an outage of one line would still allow full power flow in all hours when total generation is less than 2,400 MW, resulting in only 4% of energy curtailed relative to no outages. “Under the current (non-meshed) gen-tie approach, an outage in any one of three lines would [result in a] 33% reduction in delivered energy to the onshore system, causing significantly more curtailments than under a meshed configuration,” Brattle said.