MISO is once again evaluating the effectiveness of the rules behind its scarcity pricing just three years after shelving a similar effort.

Market Design Adviser Michaela Flagg said the RTO will analyze whether to up its value of lost load (VOLL) and change the shape of the operating reserve demand curve. It would likely file revisions in the second quarter of 2021.

“Shortage conditions are not appropriately priced,” she told stakeholders at during a Market Subcommittee teleconference Thursday.

MISO has said it needs to re-evaluate its scarcity and emergency pricing and is exploring a different cost structure under its yearslong resource availability and need (RAN) project. Shortage and emergency pricing has generally been inefficiently low, the grid operator says. (See MISO Exploring Emergency Pricing, Forward Market.)

The current $3,500/MWh VOLL could be understating the value of involuntary load shedding, and the administratively set price doesn’t account for congestion, generation losses or other reserve shortages, MISO contends.

Principal Adviser of Market Design Michael Robinson said MISO first set the VOLL in 2009 based on the class of customers who value uninterrupted electrical service the least and consider shedding load at that price.

“It’s a little bit dated here,” he said. “We established the price that people weren’t willing to pay, and that’s $3.50/kWh. Now, they’re not going to shed hospitals; they’re not going to shed entities that value uninterrupted electric energy service. They’re going to shed customers that value it less … and prefer interruption to those rates. That was the thinking back then.”

MISO’s Independent Market Monitor recommended it ratchet up the VOLL three years ago when it was implementing MISO, IMM Differ over Scarcity Pricing Changes.) Ultimately, MISO didn’t pursue a higher VOLL.

The RTO must consider the consequences to different market segments when adjusting the VOLL, Robinson said, whether that be inconvenience or ruining leisure, to property damage or spoilage of food and other perishables. He said residential and light industrial customers typically suffer the least from load shedding.

Robinson said MISO has never shed firm load because of a capacity emergency since the rollout of the wholesale markets, although it has experienced local load shedding because of transmission outages.

MISO could use a price index or economic research to update the VOLL, Robinson said. “There are a lot of potential approaches.”

However, while MISO could perform its own analysis of end-use customers to establish a price, it would likely be prohibitively expensive and too labor-intensive, he said.

WPPI Energy economist Valy Goepfrich suggested MISO research the retail rates of customers getting paid to interrupt their load. “It might be interesting what you find,” she said.

Monitor David Patton said the understated VOLL means MISO generation still exports to neighboring PJM during shortage conditions. “It creates a mess when you have two [RTOs] valuing electricity at very different levels. … We view this as the No. 1 item for achieving MISO’s RAN initiative,” he said.

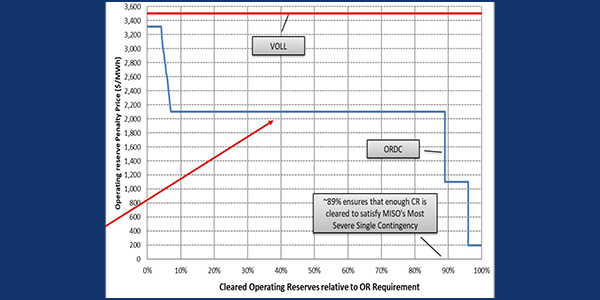

Additionally, MISO’s operating reserve demand curve (ORDC) isn’t nuanced enough to “differentiate shortage severities, especially above minimum requirements,” Flagg said. “A very large portion of the curve is flat.”

The ORDC curve, based on the VOLL, begins at $3,300/MWh, dropping to $2,100/MWh when the RTO clears 8% of its requirement level. At 89%, the level falls to the original $1,100, remaining there until 96% or more of the requirement is cleared, when the curve flattens at $200.

MISO is also reassessing a five-year-old Monitor recommendation that the RTO stop allowing offline resources to set prices. Currently, offline fast-start resources can set extended LMPs during a shortage. The Monitor contends that allowing offline units to set prices artificially suppresses scarcity prices.

Emergency Pricing Fixes on the Way

MISO Research and Development Adviser Yonghong Chen said the RTO will most likely file with FERC before the end of the year to improve its emergency pricing. Chen said that for now, MISO is pursuing a few “simple” fixes that have high impact:

- expanding extended LMP eligibility to allow online units with start-up times of four hours or less to set prices during emergencies and emergency alerts;

- taking the Monitor’s advice to set an administrative emergency offer floor for emergency resources that respond without an offer; and

- updating the emergency pricing structure to reflect the costs of managing congestion on the regional directional transfer limit linking MISO Midwest and South.

Chen said MISO will work on a conceptual design and a benefits evaluation in the fall.

Restoration Energy Pricing Approved

Meanwhile, FERC last month authorized MISO’s new plan to compensate generators that re-energize the grid following a blackout (ER20-1673).

MISO’s compensation for restoration energy relies on last-submitted offers before a blackout as a starting point for pricing, resulting in unique costs based on resource. The RTO will allow for the recovery of start-up costs, emergency purchases and resource-specific energy costs. It would also include recovery for any unusual costs incurred during operation, provided they can be verified by the Monitor. It would also accept after-the-fact updates of offers. (See “Restoration Energy Design Nears Completion,” MISO Market Subcommittee Briefs: Dec. 3, 2019.)