The COVID-19 pandemic is having little impact on Bonneville Power Administration operations or financial health, with fiscal year 2020 net income projected to easily exceed a “bad case” scenario outlined last quarter, agency officials said Tuesday.

“Even though we’ve had some unusual times, with disciplined cost management and favorable market conditions, we are forecasting hitting all of our financial targets for this year,” CFO Michelle Manary said during BPA’s third-quarter business review (the federal power marketing administration follows an October-September fiscal calendar).

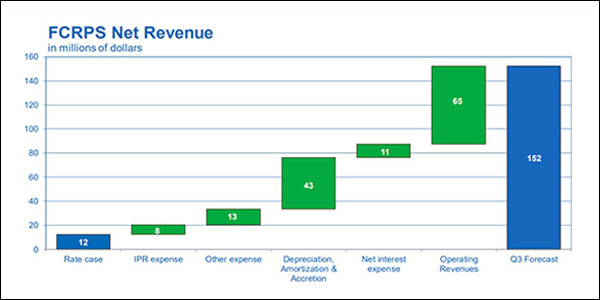

Having weathered a highly uncertain third quarter, BPA now forecasts fiscal year net income could hit $152 million, up sharply from a second-quarter “baseline” case prediction of $110 million and well above the pandemic worst-case figure of $44 million. The latest estimate also puts BPA far ahead of its rate case target of $12 million for the year, Manary noted.

While reduced expenses account for some of the increase, the largest share stems from a big boost in net operating income, which is predicted to ring in at $65 million, compared with the $8 million estimate in the second-quarter outlook.

“This increase comes from power [generation], with higher secondary sales” of surplus power, Manary said. “Secondary sales have benefited from higher market prices and a good runoff pattern. Shape is everything,” indicating that hydroelectric surpluses happened to coincide with intervals of higher demand.

“While we’re seeing local reductions with certain customers due to COVID-19, we’re seeing increases in other areas, with a net result of no drop in aggregate load,” she added.

BPA’s power generation business is expected to yield more than $2.76 billion in total revenues, compared with the rate case estimate of $2.71 billion. That business line is also projected to incur expenses of nearly $2.6 billion, about $65 million below the rate case, in part because of delays in fish and wildlife project work stemming from social distancing measures. An amortization accounting adjustment related to the Columbia Generating Station nuclear plant in Washington state will additionally reduce expenses from the rate case level.

“These reductions were partially offset by power purchases, which were higher than rate case due to higher spill conditions that took place this summer. We saw average inventory in water … but we’re spilling at higher levels,” Manary said.

BPA’s transmission business should take in revenues of about $1.085 billion, just a million shy of the rate case. At nearly $1.01 billion, transmission expenses are projected to be about $25 million below the rate case, “primarily driven by lower interest rates and capital spending,” Manary said.

The latest FY 2020 capital expenditure forecast of $613 million is below the second-quarter baseline forecast of $656 million (and well below the rate case estimate of $847 million), but “substantially higher” than the COVID-19 “bad case” of $412 million “due to a restart of our capital program in June. We basically saw only a $20 million hit from COVID throughout the capital program,” she said.

Last Waltz for Mainzer

BPA also took steps early this summer to relieve the economic burden on its customer base of publicly owned utilities, including suspending collection of a surcharge implemented last year to buttress its financial reserves. That move is expected to save those utilities a combined $3 million per month for the rest of this fiscal year and a total of $30 million next year.

“At Bonneville, we remain very sensitive to the economic challenges facing our customers — and the communities they serve — as a result of the pandemic,” BPA Administrator Elliot Mainzer said. “We truly understand the hardship and uncertainty that many of you are facing.”

Mainzer said BPA would also “streamline” the process by which its customer utilities can request payment extensions if they’re facing financial hardship from the pandemic.

“This is not a waiver of the bill, but it extends the payment out, with interest, for up to three years,” he said.

Mainzer noted that the “vast majority” of staff continue to work from home in light of the pandemic and will continue “to do so for the foreseeable future,” while field staff are ramping up their work “consistent with social distancing requirements.”

“While we have not had any interruptions to service delivery, the coronavirus numbers in our service territory have remained challenging, and we’ve asked our workforce to be ever diligent in protecting the health and safety of their co-workers and their families,” he said.

Tuesday’s quarterly review was the last for Mainzer, who will depart BPA at the end of August to take over the helm at CAISO in October. (See CAISO Names Bonneville Administrator as New CEO.)

“I hope you’ve found these meetings to be informative and useful as we’ve defined clear metrics for BPA’s business performance and hold ourselves accountable to you for delivering results,” Mainzer said. “I know that Michelle and our leadership team are committed to this process going forward and will stay connected as we evolve and progress together. I’d like to thank you for all of your support along the way.”