NYISO continues to advance its Grid in Transition agenda, moving ahead with some energy and ancillary services (EAS) projects while suspending or combining others.

The Business Issues Committee on Wednesday recommended the Management Committee approve the ISO’s Reserves for Resource Flexibility project to increase the portion of the total statewide reserve requirement for Southeast New York (SENY, zones G-K) from 1,300 MW to 1,550 or 1,800 MW depending on the hour. Stakeholders in July had delayed a vote on the proposal pending additional cost analysis. (See NYISO BIC Balks on Increased Reserves.)

If the MC approves the proposal on Aug. 26, the ISO will seek to implement it in 2021.

Preparing for Uncertainty

Michael DeSocio, director of market design, updated stakeholders on NYISO’s coordination of other EAS projects, including ancillary services shortage pricing; constraint-specific transmission shortage pricing; more granular operating reserves; and the reserve enhancements for constrained areas project.

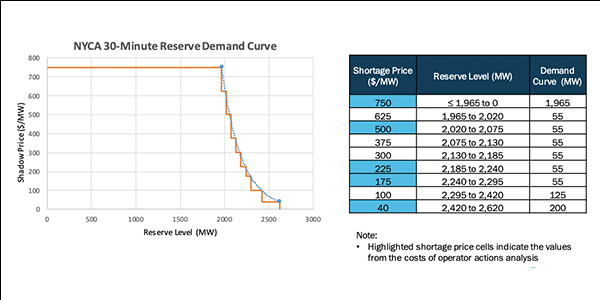

The ISO will continue to discuss the ancillary services shortage pricing proposal over the coming months, complete the consumer impact analysis in September, target seeking stakeholder approval in October and, if approved, implement it after the Reserves for Resource Flexibility initiative takes effect in 2021, he said.

The proposal is intended to improve real-time energy pricing during tight operating conditions to incent resource performance and improve economic signals for import and export scheduling.

“We’re trying to prepare for a world where there’s just going to be more uncertainty,” DeSocio said. “We’ll have more intermittent resources; we will have more resources that we’ll need to manage better over the course of a day, like energy storage or DERs; and therefore, we need to make sure the market is sending the pricing signals needed for resources to be available.”

There are still times when the shortage pricing could be improved to help ensure resource availability. Without flexible resources to help manage real-time conditions, the ISO may need to rely on uneconomically curtailing exports, purchasing emergency energy from neighboring regions or making out-of-merit commitment of uneconomic internal generators, DeSocio said.

It also can make additional commitments of generation after the day-ahead market through supplemental resource evaluations (SREs). All tools like SREs have impacts that can lead to issues where the market fails to incent the need for flexible resources like storage, he said.

“If we’re going to guarantee that any time a committed generator is added to the system, we’re going to make it whole to its minimum generation cost, there’s not a lot of incentive for it to reduce that min-gen cost because it’s not losing anything with the current structure,” DeSocio said. “By getting these reliability actions into the market directly, now the market can come up with a better mix and better pricing outcomes.”

Shifting Priorities

NYISO will continue to discuss its “constraint-specific transmission shortage pricing” proposal next year, but based on stakeholder feedback, it wants to shift resources away from the development of this proposal to supporting the development of the distributed energy resource participation model, DeSocio said. If stakeholders approve the transmission shortage pricing proposal by the end of 2021, the ISO will further consider implementation timing during the 2022 project prioritization planning.

In addition, NYISO recommends suspending work on the “more granular operating reserves” project to allow focusing on the “reserve enhancements for constrained areas” project, which will investigate ways to dynamically allocate reserves requirements between regions based on available transmission head room.

This project will evaluate ways to improve the modeling of reserve and transmission constraints to potentially allow reserve requirements to be shifted to lower-cost reserve regions as long as transmission head room exists to deliver the reserves to where needed without compromising reliability.

NYISO says this functionality would greatly improve the existing proposal for procuring reserves in certain New York City load pockets based on the design developed in the more granular operating reserves project.

The ISO recommends next year studying ways to potentially include a dynamic reserve allocation in the existing market software.