Utilities in seven Southeastern states could cut their electric rates by more than a quarter and reduce greenhouse gas emissions by almost half by joining an organized wholesale market, according to a study by a clean energy think tank.

The study by Energy Innovation Policy & Technology compared the use of utility-specific integrated resource plans (IRPs) with an RTO Scenario, which chose the most economical resources, optimized dispatch to minimize cost, and co-optimized transmission and distribution planning and regionwide reserve sharing. The results were based on a combined production-cost and capacity-expansion model of the electric power system in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee and the non-MISO portion of Mississippi.

It projected cumulative economic savings of about $384 billion for the RTO Scenario compared to the IRP Scenario. By 2040, researchers say, retail rates would average 2.5 cents/kWh, or 29% less than current costs (adjusted for inflation).

The researchers also project a 37% reduction in carbon emissions compared with 2018 levels, and a 46% reduction compared to the IRP Scenario. They said the RTO Scenario would create 285,000 more jobs than the IRP Scenario, thanks to the construction of 62 GW of solar, 41 GW of onshore wind and 46 GW of battery storage.

The study is the latest of several recent initiatives looking at the Southeast’s alternatives to the current vertically integrated model. Legislators in the Carolinas have proposed studies on creating an RTO and about 20 utilities and cooperatives in the region — including Duke Energy, Southern Co. and Tennessee Valley Authority — are discussing a voluntary 15-minute energy market, the Southeast Energy Exchange Market (SEEM). (See Southeast Utilities Talking Regional Market.)

Last September, Santee Cooper’s largest customer joined PJM in the wake of the South Carolina-owned utility’s abandoned plans to build a new unit at the V.C. Summer nuclear plant. (See South Carolina Power Cooperative Joins PJM.)

“Despite the fact that new renewable energy and battery storage resources are the least-cost forms of generating electricity, the Southeast region is largely beholden to monopoly utilities that rely on existing coal fleets and new gas-fired power plants to meet consumer electricity needs,” Energy Innovation said. “Policymakers considering a regional market or state-level competitive procurement should be encouraged by this analysis to keep pressing in legislative and regulatory forums. State stakeholders where utilities block competitive reforms now have new quantitative findings to challenge the assumption that the way utilities have traditionally done business is in the public’s best interest.”

Asked to respond to the findings, Duke spokeswoman Erin Culbert said Monday that the utility has “been advancing a clean energy transition for more than a decade” and doesn’t “need to wait for an RTO.”

“Duke Energy customers already enjoy many of the benefits RTOs claim to bring because of our large geographic size and generation diversity,” she added. “The energy market we’re considering would enhance that and better integrate renewables at a much lower cost than an RTO.”

TVA spokesman Scott Fiedler said, “It would be inappropriate to comment on a study that we did not participate in, nor had the opportunity to review the underlying data used to develop the conclusions.”

Officials of Southern Co. did not immediately respond to requests for comment.

Region Resistant to Renewables

Energy Innovation describes itself as a nonprofit energy and environmental policy firm funded by foundations and philanthropic donors that support decarbonization and climate policy. For the study, Energy Innovation used a model from Vibrant Clean Energy, which was supported by funding from the Hewlett Foundation.

The firm says ratepayers in the Southeast are missing out on the economies of a regional market because their monopoly utilities plan their grids and generation needs independently from their neighbors — including subsidiaries of the same holding companies — and discourage competition by imposing wheeling charges on imports. “Largely insulated from meaningful forms of competition, Southeastern utilities have been among the slowest to embrace clean electricity resources, even as resource costs have fallen precipitously in recent years,” it said.

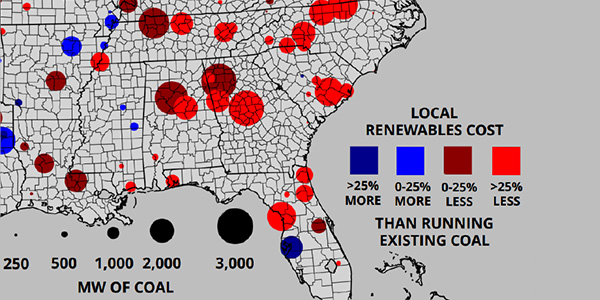

About 92% of the region’s coal capacity was uneconomic compared to local wind or solar as of 2018, the researchers said. “By 2025, that number grows to 100%.”

The study did not include any carbon constraints and also did not imply a market design. “This is not PJM’s RTO. This is not MISO’s RTO. It is a technical optimization of costs based on one single regional grid,” coauthor Michael O’Boyle, Energy Innovation’s electricity policy director, said during a press briefing Friday.

The RTO model used a single planning reserve margin for the region, eliminating the inefficiencies of serving loads on a state-by-state basis in the IRP Scenario. It did not optimize transmission and dispatch with neighboring PJM and MISO, however.

Energy Innovation said its model represented the maximum benefits of competition, noting that some markets allow vertically integrated monopolies to continue recovering costs of generation from captive customers. “RTOs today also face structural and political barriers to transmission development and fair cost allocation, distribution optimization, and clean or distributed energy resource participation,” the researchers noted.

The researchers also acknowledged that the IRP Scenario is likely to differ from utilities’ ultimate 2040 mix because the 10- to 15-year IRPs are updated periodically. “Hopefully, as utilities and their regulators catch up to the reality that clean electricity is less expensive than the status quo, it is reasonable to assume the inefficiencies won’t be quite as stark as the modeling implies,” they said. “Nevertheless, we model the current IRPs to demonstrate how current utility plans … open up customers to financial risk from potential stranded assets.”

Additional Scenarios

The study also looked at two additional possibilities, including the Economic IRP Scenario, which includes a cost-optimal resource mix — reflecting competitive procurement within existing monopoly service territories — but without the co-optimized transmission and reliability planning in the RTO Scenario. It would save $298 billion through 2040 compared to the IRP Scenario — about three-quarters of the savings of the RTO Scenario.

“This recognizes the reality that full regionalization may be politically infeasible in the near to medium term but shows that a majority of the cost savings can still be achieved by subjecting utility procurement plans and existing generators to market competition,” Energy Innovation said.

The RTO with Nuclear Scenario adds to the RTO Scenario the assumption that all existing nuclear plants extend their licenses and remain operational through 2040, regardless of cost-competitiveness — essentially assuming they would be kept in service through subsidies such as those enacted in Illinois, New Jersey and New York.

It would save about $375 billion through 2040, $9 billion less than the RTO Scenario but with a 41% cut in emissions below 2018 levels compared to a 37% drop in the RTO Scenario.

Reduced Reserve Margins

The RTO Scenario rationalizes transmission planning to reduce congestion and allow load pockets access to cheaper generation. It realizes about 10% of cumulative savings ($38 billion) from co-optimized distribution system planning that uses behind-the-meter generation and storage when it reduces total system costs.

“This co-optimization of bulk and small-scale resources helps reduce peak load in the RTO Scenario 11.8% below the IRP Scenario, creating savings from generation all the way down to distribution,” the study says. “Realizing these savings goes beyond reforming the market structure for the bulk power system and likely requires regulatory incentives at the distribution level to coordinate with a central RTO.”

The researchers say the IRP Scenario would result in a reserve margin over 40%, resulting in more jobs in unnecessary coal and gas plants. “Utility IRPs in aggregate are redundant and excessive on their own, but when taking a regional view where significant efficiencies could be obtained by sharing reserves, the waste becomes more apparent,” the researchers said. “Utilities are rushing to build new gas generation that increases their earnings while planning to hold onto uneconomic coal generation for decades longer than economics would dictate.”

The RTO Scenario assumes a 16% reserve margin in 2040. Nevertheless, Energy Innovation says, “By 2040, the RTO Scenario leads to an additional 408,000 jobs in the sector, compared to just 122,000 new jobs in the IRP Scenario, a net of 285,000 jobs.”

Emissions

The study notes that Duke and Southern Co., which represent 45% of retail sales in the Southeast, have pledged net-zero company emissions by 2050. But it says, “a competitive market with no carbon policy does a better job of reducing emissions than Duke and Southern’s efforts.”

“Vertically integrated utilities’ incentives to maintain and earn on existing infrastructure conflicts with both customer wellbeing and environmental goals. … Regional transmission and operational approaches are more effective at integrating high shares of renewable electricity, and Duke and Southern hamper their own efforts to decarbonize at least cost by resisting regionalization efforts,” the researchers said.

The IRP Scenario adds little renewable generation or battery storage, while the RTO Scenario adds large amounts of wind and solar PV, including distributed PV, and utility-scale and distributed storage, with most gas peakers retiring by 2040.

Most generation would remain fossil fuel by 2040 under the IRP Scenario. “In the IRP Scenario, there is almost no wind generation, and solar PV provides just 4% of annual generation. In contrast, wind and solar provide 22% of generation in the RTO Scenario; when aggregated with nuclear (20%), geothermal/bioenergy (5%) and hydropower (4%), 51% of the Southeast fleet is zero-carbon by 2040.”

Other pollutants, including NOX, SO2 and PM2.5, also would be reduced by the elimination of coal-fired generation, the researchers say.

Endorsement

During the press briefing Friday, the Renewable Energy Buyers Alliance, which represents more than 120 major corporate purchasers, endorsed the call for regionalization and suggested the region’s competitiveness is at stake.

“More and more businesses are setting [clean energy] goals. They’re making decisions about siting and expanding facilities based on access to renewable energy,” said Bryn Baker, REBA’s director of policy innovation. “Right now, many parts of the country, including the Southeast, their only option is often a green tariff through the existing utility, which can often be limited.”

Baker said full regionalization offers savings “10-fold higher than anything that’s being contemplated now” in the region, including SEEM.

“There are so many details that need to be filled out that it is a little bit premature to say, ‘the SEEM is x.’ We just don’t know exactly what it’s going to be,” O’Boyle said. “There doesn’t appear to be an agreement to use transmission without those wheeling charges, so … unless there’s an open transmission agreement, there’s still going to be unnecessary costs and a lack of optimization across the region.”

Duke’s Culbert said the SEEM would be much cheaper and faster to create than an RTO, “meaning energy customers in the Southeast would see real benefits much sooner.”

“Participating in that would not prevent any of the companies from participating in an RTO in the future. From our perspective, we don’t see RTOs as the right solution for Duke Energy customers in the Carolinas at this time. We’re currently in the phase of engaging with stakeholders on SEEM and are working through their questions and feedback as we continue to formulate the concept.”