Stakeholders in SPP’s Western Energy Imbalance Service (WEIS) market last week approved three revision requests (WRRs) in response to FERC’s recent rejection of the RTO’s proposed Tariff.

The Western Markets Working Group and Western Markets Executive Committee held two joint web meetings to expedite protocol changes necessary to help SPP meet an early September schedule for refiling its WEIS Tariff.

FERC in July rejected SPP’s first attempt, saying the grid operator failed to respect nonparticipants’ transmission rights and could improperly burden reliability coordinators. The commission also cited shortcomings on supply adequacy, market power protections and line-loss calculations (ER20-1059, ER20-1060). (See FERC Rejects SPP’s WEIS Tariff.)

While the groups easily passed three WRRs, it was unable to hold a vote on nonparticipant transmission. After nearly four hours of discussion and one minor editing change Friday afternoon, stakeholders agreed to postpone action until a yet-to-be-scheduled third joint meeting can be held this week.

In its order, FERC said any future WEIS market proposal “should include the mechanisms or agreements that will ensure that the SPP WEIS market respects the transmission capacity of nonparticipating entities with appropriate constraints in the [security-constrained economic dispatch].”

The commission said if SPP is unable to reach an arrangement with nonparticipating entities for their transmission capacity, it “must include constraints in its market model to appropriately respect the transmission rights of nonparticipating entities when calculating the market solution.”

Colorado utilities Xcel Energy-Colorado, Colorado Springs Utilities, Platte River Power Authority and Black Hills Energy, all of which plan to join CAISO’s Western Energy Imbalance Market, protested the first WEIS filing. They contended that an existing and neighboring joint dispatch agreement could be impaired by the WEIS market dispatch and that its market flows may harm the Western Interconnection Unscheduled Flow Mitigation Plan, which mitigates real-time flows on certain transmission paths to reliable levels.

WRR6 provides that SPP will include constraints in SCED to use the combined transmission capability made available by market participants (MPs) and participating balancing authorities on transmission facilities within a participating BA area or on transmission facilities used to transfer energy between participating BAs.

SPP staff also added a new section to the WEIS protocols that lists the responsibilities to communicate transmission capacity by SPP, MPs, BAs and the joint dispatch transmission service provider. The addition came following comments by Xcel and Black Hills.

“After some internal deliberation, we thought we could make the roles and responsibilities of communicating information clearer,” said David Kelley, SPP’s director of seams and market design.

The WEIS stakeholder groups approved three other revision requests addressing the commission’s order:

- WRR7: Incorporates a pricing mechanism for MPs in BAs that experience supply-adequacy shortfalls. The mechanism responds to FERC guidance that its next Tariff proposal should ensure MPs are incentivized to maintain supply adequacy. Black Hills argued that the change doesn’t address the FERC order, saying it was concerned there still remains opportunities for deficient MPs to cause a BA to be deficient.

- WRR8: Adds a marginal loss component to the LMP calculation, meeting FERC’s request that SPP include marginal losses in dispatch and LMPs to minimize imbalance costs, provide prices that accurately reflect marginal costs and preserve resources’ incentives to follow dispatch.

- WRR9: Clarifies that demand response resources will be compensated at the LMP, as are other MPs offering resources in the market.

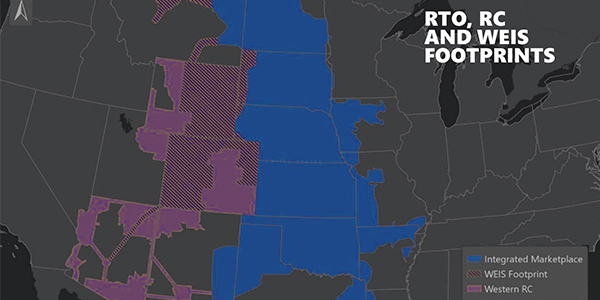

SPP hopes to launch the WEIS in February. The market will include eight members and cover the Western Area Power Administration’s Colorado Missouri and Upper Great Plains West areas.