The New England Power Pool Markets Committee began a three-day meeting Tuesday at which stakeholders will discuss updated parameters for Forward Capacity Auction 16 for 2025/26.

Before those discussions, members heard an update on ISO-NE’s next FERC Order 841 compliance filing and its proposal to sunset the Forward Reserve Market (FRM).

Order 841 Compliance Update

ISO-NE’s Jennifer Wolfson gave the committee a presentation on the RTO’s plans for responding to FERC’s Aug. 4 order on its second Order 841 compliance filing. (See FERC OKs Most of ISO-NE 2nd Storage Compliance.)

One set of changes responds to FERC’s concern that the RTO’s Tariff language preventing double payment for charging energy at the retail and wholesale levels could allow host utilities to decide whether an electric storage resource (ESR) may participate in its markets. The changes would be effective in the first quarter of 2021.

The other changes address FERC’s directive that ISO-NE add to its Tariff the mechanism by which it will account for state of charge and duration characteristics in the day-ahead energy market. The RTO will propose four day-ahead bidding parameters: initial state of charge; maximum state of charge; minimum state of charge; and round-trip efficiency. They would be effective Jan. 1, 2026.

The RTO also will propose several clean-up revisions to Appendix C of the Tariff.

ISO-NE has asked FERC to allow it to make the filing by Dec. 7. It is targeting a vote by the MC in November and will seek Participants Committee endorsement in December.

The commission’s August order also rejected language applying transmission charges to an ESR when that resource is charging for later resale in wholesale markets and is not providing a service, and to include a basic description of ISO-NE’s metering methodology and accounting practices for ESRs.

The commission also disagreed with the RTO’s contention that storage resources will always be providing a service when charging for later resale in the wholesale markets and should thus be exempt from transmission charges. It said ISO-NE should account for self-scheduled megawatts when calculating an ESR’s contribution to regional network load.

The RTO’s response on the transmission charge exemption will be discussed at the Transmission Committee and Participating Transmission Owners Administrative Committee.

Forward Reserve Market Sunset

The committee also heard a presentation on the RTO’s proposal to sunset the FRM on June 1, 2025, to avoid conflicts with its proposed Energy Security Improvements (ESI) initiative. (See “ISO-NE Seeks to Sunset Forward Reserve Market,” NEPOOL Markets Committee Briefs: Aug. 11-13, 2020.)

The FRM awards obligations for 10-minute non-spinning reserves and 30-minute operating reserves.

Transmission investments and market changes, including the anticipated implementation of ESI, have or will relieve many locational constraints and reward resource flexibility, the RTO says, making the FRM unnecessary.

ISO-NE plans an MC vote on the proposal in October, followed by a PC vote in November and a FERC filing by the end of the year.

The RTO’s Jonathan Lowell presented two versions of the proposed Tariff language because of uncertainty over when FERC will rule on the ESI proposal, which was filed in April. (See ISO-NE Sending 2 Energy Security Plans to FERC.)

One version would be filed if an order on ESI is received by the end of the year that accepts the parts of the initiative that would supplant the FRM — specifically, provisions regarding 10- and 30-minute reserves in the day-ahead market.

Another version includes “contingency language” in case FERC does not act by the end of the year.

If the commission issues an order before the end of the year but rejects the ESI reserves provisions, no sunset filing would be made until the RTO wins approval of a market design that includes day-ahead reserves.

Lowell responded to a stakeholder question about why the RTO wouldn’t sunset the FRM for FCA 15 to avoid an ESI/FRM overlap.

Lowell said bidders have already made decisions for FCA 15 based on the net cost of new entry and other parameters already set for the auction.

“Setting the FRM sunset to align with [capacity commitment period] 15 at this point in time is not a feasible course of action,” the RTO said.

Generation Information System Referral

The committee approved the referral to the NEPOOL Generation Information System (GIS) Operating Rules Working Group of requests to improve uploads by independent verifiers and enable application programming interface (API) access to the account holder public report. The GIS issues and tracks certificates for all generation and load produced in the ISO-NE control area as well as imports.

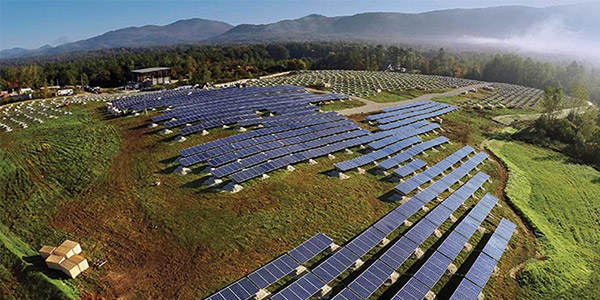

PowerDash, which provides software for the management and monitoring of alternative energy installations, asked the GIS Usability Group to address a problem with the uploads of “independent verifiers” — third-party meter readers.

Currently, if a facility that has not been assigned a “verifier” status is included in a comma-separated value (CSV) upload by a third-party meter reader, the entire upload fails. The proposed change would provide an error message indicating that the facility is not present in the account but would allow all other data to be uploaded. PowerDash said the change would reduce the need for manual crosschecks between the GIS account holders’ internal systems and the GIS.

The Usability Group also received a request from SRECTrade, which provides transaction and management services for solar renewable energy credits, to enable API access to the account holder public report. Currently, the API requires an account ID for each account to which the user is delivering certificates.