Western Energy Imbalance Market (EIM) stakeholders broadly support a proposal that would significantly expand the EIM Governing Body’s approval authority and grant it a “more collaborative” relationship with CAISO’s Board of Governors.

The plan, part of a broader straw proposal released by the EIM Governance Review Committee (GRC) this summer, would extend the Governing Body’s voting rights to cover any CAISO initiatives that impact the EIM and create a concept of “joint authority” with the ISO board.

EIM stakeholders strongly endorsed the thrust of the GRC’s proposal in comments during a virtual meeting Tuesday while pressing for more details regarding the shared authority.

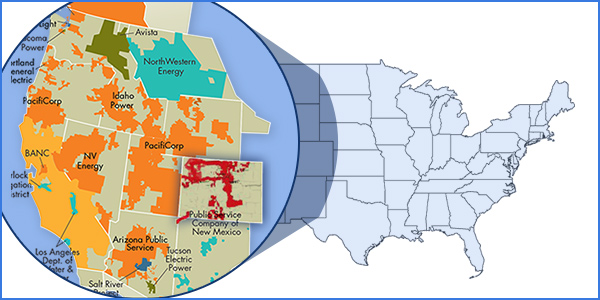

Active and pending participants in the Western EIM | CAISO

The straw proposal states that EIM stakeholders seek “a more ‘bright line’ or at least [a] less complex and more objective set of rules for identifying those matters where the Governing Body has approval authority.”

Still, support for the idea is colored by uncertainty over how joint authority between the two rulemaking bodies will play out in practice, especially when they disagree over Tariff changes to be filed with FERC.

Under the EIM’s existing charter, which falls within CAISO’s Tariff, the Governing Body enjoys “primary” voting authority over rulemakings specific to the EIM and plays an “advisory” role to the Board of Governors regarding ISO rule changes that also impact the EIM.

That arrangement has sufficed under current circumstances in which the EIM and CAISO markets only intersect through real-time operations. But the overlap between the two markets is set to broaden with the proposed implementation of the extended day-ahead market (EDAM) in the EIM, expanding to include rules covering transmission use, congestion revenues, ancillary services, greenhouse gas accounting, convergence bidding and new market power mitigation mechanisms. (See CAISO Proposal Sets Course for EIM Day-ahead.)

“If EDAM is implemented, the Governing Body approval authority would be further expanded to include any proposed changes to the design or market rules governing the CAISO’s day-ahead market,” the straw proposal states. “The GRC also recommends that the EIM Governing Body be provided decision authority over any EDAM market design, thereby formally recognizing CAISO management’s current proposal in the ongoing EDAM initiative to bring the EDAM market design to both the board and the Governing Body for their joint approval.”

‘Jump Ball’ Fear

Matt LeCar, a principal with Pacific Gas and Electric, voiced concerns about a joint authority plan provision that would allow the EIM and CAISO to submit competing Tariff filings with FERC when they reach an impasse over the final project.

“We’re concerned, first of all, that may not be how FERC wants to participate in this process. Typically, FERC is dealing with issues that have already been resolved in a regional transmission organization or independent system operator,” LeCar said. “We’re really punting issues to FERC to decide that are more properly adjudicated among stakeholders within the West.”

LeCar said PG&E also worries that CAISO would not be appropriately staffed to defend both points of view before FERC. “We have a hard time seeing how you would segregate and put in place firewalls between types of staff working on one side versus the other.”

Jennifer Gardner, Western Resource Advocates | EIM Governance Review Committee

GRC member and Western Resource Advocates attorney Jennifer Gardner, donning her hat as a representative of the Western Grid Group and the NW Energy Coalition, expressed similar reservations about the provision.

She pointed to ISO-NE and PJM, where the RTO and stakeholder groups can file competing “jump ball” Tariff revisions. Some of those proceedings have resulted in FERC rejecting both proposals and instead creating its own “Frankenstein” version that includes elements of each, Gardner said. “We were just concerned with the uncertainty that this creates, and we really wanted any type of competing filings to be avoided wherever possible.”

David Rubin, NV Energy | EIM Governance Review Committee

“The preference here is for the stakeholder process here in the West to come up with a sort of a joint proposal,” said NV Energy Federal Energy Policy Director David Rubin, speaking for the 18 current and future EIM entities. Rubin was skeptical of the proposal’s plan for resolving deadlocks through an “iterative” process in which Governing Body and board members convene to discuss objections to a filing, then send it back to CAISO staff for further development before convening another stakeholder process designed to address remaining concerns.

“The challenge that we felt was that going back that second time certainly adds half a year to an already [one-]year, two-year process, and there are times where a market participant feels that the design becomes unjust and unreasonable and they bring it to FERC’s attention anyway,” Rubin said.

Meg McNaul, an attorney representing CAISO’s “Six Cities” municipal utilities (Anaheim, Azusa, Banning, Colton, Pasadena and Riverside), said that while her clients support the joint authority provision, they also think the decisional authority of the CAISO board should be “preserved” because participation in the ISO markets is not voluntary for entities located within its balancing authority area.

McNaul agreed with PG&E’s recommendation for a “reversionary approach” to restoring the board’s decisional authority if a large number of EIM participants opt to withdraw from the voluntary market.

“I think the topic of a reversionary interest is one that’s worth pursuing,” McNaul said.

Lone Skeptic

Chloe Lukins, program manager for the California Public Utilities Commission’s Public Advocates Office, represented the lone voice of dissent on the call, opposing the joint authority model because EIM membership is voluntary and members are not required to pay CAISO’s grid management charge, which largely funds the ISO’s operations.

“If the model does go through, it should be explained how it will be paid for,” Lukins said.

“Is there a presumption that there will be an additional cost to California, and, if so, can you elaborate at all about where you see those cost arising?” Governing Body member Doug Howe asked.

“I think that’s what we would like some clarity on … providing some more information if it will cost more. If it doesn’t, if you could provide that information, that would be good, too,” Lukins said.