The southern portion of the Northwest Power Pool (NWPP) region could fail to meet resource adequacy requirements for three hours this year under even the most generous buildout scenario, according to a new WECC report.

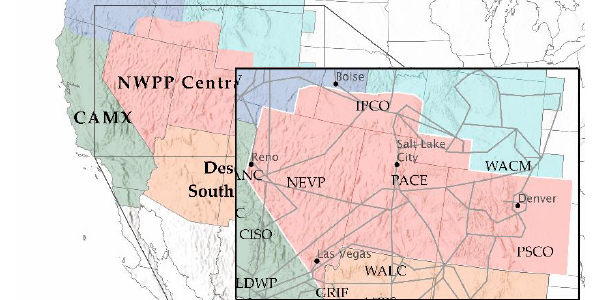

That risk rises to seven hours in 2024 as WECC’s NWPP-Central (NWPP-C) subregion retires more baseload coal-fired generation while taking on growng amounts of intermittent solar, increasing the likelihood that utilities will be stressed to serve load under tight supply conditions, WECC found. The summer-peaking area covers Utah, Colorado, most of Nevada, and parts of Idaho and Wyoming.

“There’s variability in the system — and more and more variability added every day,” WECC Manager of Performance Analysis Matt Elkins said March 2 during a webinar to discuss the report for the summer-peaking NWPP-C region. The meeting also covered separate reports for NWPP’s winter-peaking Northwest (NWPP-NW) and Northeast (NWPP-NE) subregions, which were each studied discretely because of the transmission constraints between them.

All three reports expand on WECC’s more general Western Assessment for Resource Adequacy, which found the Western Interconnection could this year experience one to eight hours in which some of its subregions fail to meet the one-day-in-10-years (ODITY) threshold for RA. (See Western RA Planning Must Change, WECC Says.)

A descent below that threshold could threaten a repeat of last summer’s energy emergencies, which prompted CAISO to initiate rolling blackouts in California during an extended heat wave while neighboring balancing areas prepared similar measures in the face of regionwide resource shortages.

Possible shortfalls have become a growing concern in the West as states direct utilities to replace retiring fossil fuel generation with variable renewable resources to meet climate change goals. Industry stakeholders in the Northwest have expressed worries that a lack of transparency around RA could leave the region’s load-serving entities inadvertently drawing on the same contracted resources in periods of tight supply.

To address that concern, the NWPP is developing an RA sharing program that has so far attracted 20 members spanning the group’s footprint. A first — nonbinding — iteration of the program is slated to roll out in the third quarter of this year. (See NWPP RA Program Taking Shape for Q3 Launch.)

Central Risk

That program might arrive just in time as the NWPP-C heads into summer, based on WECC’s findings, which show the subregion’s supply and demand patterns align more closely with the neighboring Desert Southwest (DSW) and California-Mexico (CAMX) subregions to the south and west than with its NWPP partners to the north. (See Southern Calif. Could Fail RA Test, WECC Says.)

Like the DSW and CAMX, the NWPP-C, with an estimated 3,747 MW of solar resources, tends to experience net-peak loads in the late afternoon and evening as solar rolls off the system. For that reason, it also shares with them a greater potential for a loss-of-load event in the near future.

WECC’s RA analysis applied two scenarios to all five subregions to explore a range of future resource possibilities and factor in known and expected resource retirements. Scenario 1 — the “standalone” scenario — assumes each subregion will be meet its load with internal resources, while Scenario 2 allows for imports.

The regional entity then overlaid each scenario with three variations of RA. Variation 1 includes all resources currently in service and expected to run in future forecasts. Variation 2 includes existing resources and those under construction and expected to operate in the forecast year (Tier 1 resources). Variation 3 — the most optimistic assumption — includes existing and Tier 1 resources as well as those in licensing or siting phases but not yet under construction (Tier 2).

Based on historical analysis of resource performance, WECC estimates that NWPP-C should have about 42,400 MW of resources available this year to meet an expected peak demand of 36,400 MW. But it also found a 5% probability that only 30,500 MW of capacity would be available during the peak hour. Furthermore, there’s a 5% chance that load could actually peak at 42,200 MW, representing a 16% uncertainty in the load forecast.

Under a “standalone” scenario, the NWPP-C region would face 722 hours this year with demand at risk. But Elkins acknowledged the unlikelihood of such an outcome, given that the Western Interconnection “is built with a lot of benefits” to accommodate resource-sharing among summer- and winter-peaking areas.

“If you don’t have risk in the standalone scenario, then you’ve overbuilt the system,” Elkins said.

With imports included in the assumptions, the subregion faces 14 at-risk hours this year, rising to 50 hours in 2024 as more coal plants retire. And even under the most optimistic assumption that includes imports and a full buildout of proposed resources (Scenario 2, Variation 3), NWPP-C faces three hours this year in which load is put at risk, rising to seven hours next year, followed by one hour in 2023 and three hours in 2024.

While WECC said that a 21% planning reserve margin (PRM) is sufficient to maintain the median ODITY threshold for the subregion this year, it cautioned that a 32% PRM might be required in the future to sustain that standard during those periods with the highest variability in supply and demand.

“If a flat reserve margin were applied to all hours of the year, for example 15%, almost 100% of the hours would not meet the ODITY threshold,” the report said.

Lower Risk up North

The other two NWPP subregions fared better under WECC’s analysis.

In the standalone scenario with existing resources, the hydro-rich NWPP-NW, which includes British Columbia, Washington, Oregon and parts of California, Idaho and Montana, faces 208 hours this year in which the ODITY threshold is at risk. Risk under that scenario declines to 195 hours when Tier 1 resources are added and to 194 hours when factoring in Tier 2. The risk falls to zero with the addition of imports, a pattern that holds through 2024.

The report found that a 15% reserve margin will be sufficient for the NWPP-NW subregion this year but recommends future PRMs as high as 42% to accommodate supply/demand variability during the spring months.

The NWPP-NE subregion, which covers Alberta and parts of Montana, Idaho, Wyoming, South Dakota and Nebraska, faces a potential 4,196 hours of unmet demand under all standalone scenarios this year (including with Tier 1 and 2 resources), a figure that steadily rises into 2024. The addition of imports brings the risk to zero for all years.

“The assessment indicates that entities in the NWPP-NE subregion need to build the resources currently included in the construction queue as part of the solution to maintain the ODITY threshold,” the report said.

The report recommends a 15% PRM for the subregion this year but calls for future margins as high as 22% for high-variability periods.

Elkins noted also that while the northern areas of the NWPP scored well on RA on the subregional level, some individual balancing authority areas are at higher risk of not meeting reliability standards under all scenarios.

“The system is built to rely on others, but how much do you want to rely?” Elkins said.