NextEra Energy Transmission (NEET) announced Tuesday that it will pay $660 million to acquire independent transmission company GridLiance, which owns 700 miles of high-voltage lines in Illinois, Kansas, Kentucky, Missouri, Nevada and Oklahoma.

The deal, which includes the assumption of debt, will be financed in part by parent NextEra Energy’s $2 billion sale of equity to BofA Securities and Barclays, announced last week.

Launched in 2014, GridLiance markets its expertise in planning, engineering, construction and operations to small transmission owners, including electric cooperatives and public power. Backed by Blackstone Energy Partners, an affiliate of The Blackstone Group, it also offers its “partners” a source of capital investment for transmission projects.

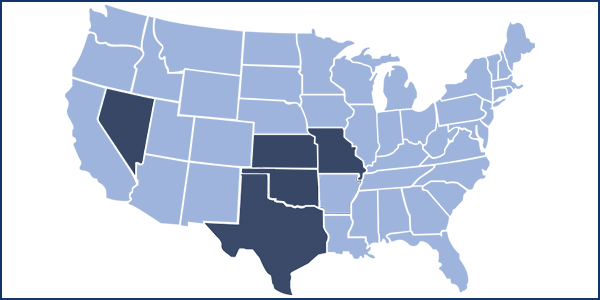

In addition to the transmission it owns, Gridliance also has long-term partnership agreements in Missouri, Oklahoma, Nevada, Texas and Kansas.

For Florida-based NextEra, the acquisition will give it a bigger foothold in the Midwest after failing in its 2016 bid for Texas’ Oncor. (See NextEra Said to be Eyeing Evergy as Acquisition Target.)

NextEra said the deal will require approval from FERC and utility commissions in Kansas, Missouri and Oklahoma. It is expected to close in 2021.

“GridLiance partners with electric cooperatives and public power utilities to enhance transmission system reliability and is well positioned to benefit from the substantial expected renewables growth over the coming years,” NextEra CEO Jim Robo said in a statement. “This acquisition furthers our goal of creating America’s leading competitive transmission company and is consistent with our strategy of adding high-quality regulated assets to our portfolio.”

“We are very excited to be joining NextEra Energy Transmission at a pivotal time in the company’s development,” GridLiance CEO Calvin Crowder said. “Our unique capabilities, proven track record and tremendous growth prospects, coupled with NextEra’s experience as a leading transmission owner, make this a great fit for both companies. We are also grateful for the support of Blackstone in founding GridLiance and for working closely with management over several years to build the company.”

Fighting ROFR

NEET currently has operating assets in California, New Hampshire and Texas, including Lone Star Transmission in Central Texas (330 miles of double-circuit 345-kV line and six substations).

One of NEET’s affiliates was awarded the rights to the Empire State Line in Western New York (20 miles of 345-kV line and two substations), which will increase renewable energy flows from the Niagara hydroelectric facility and imports from Ontario by 3,700 MW. Another affiliate is building the East-West Tie in Ontario (280 miles of double-circuit 230-kV line), which it says is the first competitive transmission project awarded to a nonincumbent in the province.

Appeals Court Sets Dates in Texas ROFR Challenge.)

The Wall Street Journal reported on Tuesday that Duke Energy recently rebuffed a takeover attempt by NextEra. NextEra is still interested in Duke, the Journal said, noting that such a deal would be the largest utility acquisition ever. NextEra is the largest public utility in the U.S. with a market capitalization of $139 billion; Duke has a market value of about $61 billion.

NextEra shares closed Tuesday at $283.12/share, down $1.02 (0.36%). Blackstone shares rose by 5 cents to $52.71/share (0.095%).

GridLiance was the second asset sale by Blackstone Energy this month. On Sept. 24, it announced it would sell its 42% stake in Cheniere Energy Partners to Brookfield Infrastructure Partners and funds managed by Blackstone Infrastructure Partners for $7 billion. In 2012, Blackstone Energy and its affiliates invested $1.5 billion in Cheniere to build the first two liquefaction trains at the Sabine Pass LNG facility in Louisiana, the first LNG export facility in the continental U.S.