A webinar panel on Monday discussed how different energy storage technologies are coming to market in Connecticut, the various state targets and incentives, and the challenges for developers in working with both state-sponsored projects and the wholesale electricity markets.

“Connecticut is really trying to get into the game when it comes to energy storage,” said Public Utilities Regulatory Authority (PURA) Chair Marissa Gillett, who moderated the discussion for more than 50 members of the Connecticut Power and Energy Society.

“Last session … we saw the chair of our Energy and Technology Committee, Rep. David Arconti, introduce House Bill No. 5351, which would have established an energy storage target for the state by Dec. 31, 2020, of 1,000 MW,” Gillett said. “While that bill did not receive an up or down vote due to the coronavirus suspending all activities in the legislative session, PURA has been moving forward on its energy storage dockets as part of our Equitable Modern Grid proceeding.” (See Conn. Lawmakers Seek to Balance Energy Goals, Costs.)

State Targets

While it’s important to have federal policies, “the name of the game” is states setting targets, promoting incentives and including storage in their planning, Energy Storage Association CEO Kelly Speakes-Backman said.

“Incentives are sending the signals to companies like ENGIE and Key Capture to know that it’s OK to come and open up business in the state,” she said.

Clockwise from top left: Rachel Goldwasser, Key Capture Energy; Sarah Bresolin Silver, ENGIE North America; Kelly Speakes-Backman, Energy Storage Association; and Connecticut PURA Chair Marissa Gillett. | CPES

Speakes-Backman said FERC Opens RTO Markets to DER Aggregation.)

“What I’d like to see ultimately come out of Order 2222 is a system of aggregated [DERs] that can ride through … short-term outages like we saw in California last month,” Speakes-Backman said. “I want to see this two-way system … [where] buildings can act as a generation source and vehicles can participate in grid systems. Order 2222 starts to get us towards that mix between what’s at the distribution level and what’s at the wholesale level.”

Order 2222 is considered to be a companion order to Order 841, “and we hope it will do for DER aggregations the same thing that 841 did for storage,” said Sarah Bresolin Silver, director of government and regulatory affairs and wholesale markets policy at ENGIE North America.

The order is important because it requires ISOs and RTOs to establish participation models DER aggregations and accommodate all the physical and operational characteristics of those aggregations, she said.

“The goal is to have these assets participate in the wholesale markets without too much burden and perhaps someday without the need for state incentives, [so,] we have to be involved in ISO-NE stakeholder processes to make sure that any changes made welcome these resources into the markets.”

Bridging the Regulatory Gap

Rachel Goldwasser, a lead legal adviser at Key Capture Energy, an Albany-based developer with several projects operating or under construction in New York and Texas, said that ERCOT is much different from ISO-NE.

“There’s no capacity market, and the model the market is built on expects price volatility and expects investment to follow that price volatility,” Goldwasser said. “When you couple that with significant expansion of wind energy, and some level of congestion permitted on the transmission system, you end up building a marketplace that supports the development of storage and certain applications in certain environments and locations.”

In ERCOT, the company doesn’t have to worry about a minimum offer price rule (MOPR) or about clearing the capacity market, she said. It can go wherever the grid needs storage to be deployed.

“ERCOT is fun because it’s just a market, and you can find economic ways of doing storage,” Goldwasser said.

New York is a different story, she continued. From a regulatory perspective, NYISO is a close sibling of ISO-NE.

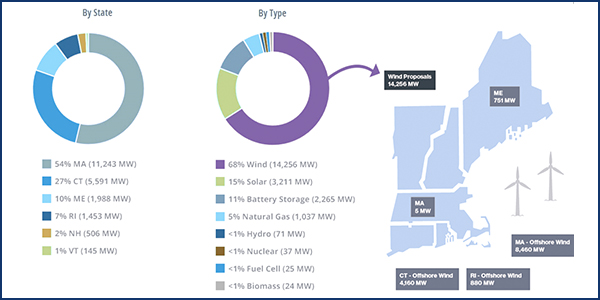

As of January 2020, battery storage comprised about 11% of the 20,100 MW proposed in the ISO-NE generator interconnection queue. | ISO-NE

She said the grid operators’ capacity markets are “an ongoing concern that we hope will be less of one over time. But we also have established programs in New York to support storage; there’s the market bridge incentive program, and utility procurements … and a program causing retirement of fossil fuel generators there, peaking plants in particular.”

It takes time to bring all stakeholders together, including ratepayers, Speakes-Backman said.

“There is a very methodical step from the regulatory perspective in including storage, and that’s why legislation is so important: It creates a bridge of incentives and targets so that businesses know that there is a path forward to make it worth investing in,” Speakes-Backman said.

“One of the biggest challenges we’ve had, and I think this is true of a lot of renewable energy and storage companies with respect to the MOPR and market monitoring … is around managing the state-facilitated projects and the wholesale markets together,” Goldwasser said.

A second issue is the unique nature of storage.

“How do the withholding rules work? What is economic discharge? How do you think about the deployment of a battery over 24 hours in the energy market with respect to what would traditionally be seen as market monitoring concerns?” Goldwasser said.