The creation of a single RTO covering the entire U.S. portion of the Western Interconnection could save the region more than $1.2 billion annually in electricity costs, according to the findings of a state-led study funded by the U.S. Department of Energy.

The study, an ongoing two-year effort, was initiated by the Utah Governor’s Office of Energy Development in partnership with state energy offices in Colorado, Idaho and Montana.

“The project is unique in that it provides Western states with a neutral forum and neutral analysis to independently and jointly evaluate the options and impacts associated with various market options in the West,” Brooke Tucker, deputy director of the Utah energy office, said Friday during a virtual meeting of the Committee on Regional Electric Power Cooperation and the Western Interconnection Regional Advisory Board (CREPC-WIRAB).

The study attempts to identify state-by-state savings in capacity and adjusted production costs (the net cost to serve load) under various market scenarios, including a full RTO for the West.

“From a load diversity standpoint, nobody loses” from membership in a West-wide RTO, Keegan Moyer, principal with study author Energy Strategies, said in presenting the findings to CRECPC-WIRAB stakeholders. “There’s some larger winners than others, and that’s simply due to the nature of the system and the coincident or noncoincident nature of the peaks, but we really walked away with the observation that the entire West has a lot to gain from a load diversity standpoint.”

The findings Moyer presented Friday focused on two different market constructs.

The first was the existing Western Energy Imbalance Market (EIM), with its centrally optimized real-time dispatch; separate balancing authority areas and transmission tariffs; limited transmission dedicated to market transfers; and continued operational control by transmission providers.

The second market construct was a full RTO, with consolidated BAAs and the transfer of transmission operations to a central operator; a centralized real-time and day-ahead market; joint transmission tariffs for all members within a given footprint; transmission available up to reliability limits; and joint transmission planning and cost-sharing.

The study also looked at the impacts of a third construct — the EIM with the inclusion of a day-ahead market — but that option didn’t figure heavily into Moyer’s presentation. “The day-ahead market really is an expansion on a real-time-only market, where we’re simply introducing a day-ahead optimization time frame into this market, whereas pretty much everything else remains the same. The big shift comes with the RTO framework,” he said.

The study authors then overlaid the market constructs over two different footprints to evaluate potential “market configurations”:

- a “status quo” scenario consisting of an EIM that includes both existing members and those entities that had committed to joining the market by the end of 2019;

- a “one market” EIM expanded to include the entire U.S. footprint of the Western Interconnection; and

- a West-wide RTO covering the same footprint.

The analysis examines the market configurations from the perspective of both capacity and production cost savings based on 2020 resource portfolios. Moyer noted the analysis did not attempt to capture other potential benefits. “There are some efficiencies from competition that we’re not really getting at,” he said.

Load Diversity is Key

Moyer explained that capacity benefits in the full RTO scenario flow from “load diversity” — the notion that different areas of the Western system peak at different times, “whether that be an hour or two apart or perhaps seasons apart.”

“In the absence of any kind of coordination, we assume each balancing area will require sufficient capacity to meet its peak plus some amount above that, roughly commensurate with a reserve margin,” he said. “However, the coincident peak demand for a combined footprint of those same balancing areas would typically be less than the sum of the individual peaks.”

The overall reduction in peak load counted across the interconnection would allow load-serving entities in an RTO to build or contract for less capacity to meet resource adequacy requirements, the study assumes.

Those reduced needs add up. The study found that under the status quo, the region can expect to realize up to $25.2 million in annual capacity savings, while a “one market” EIM could yield up to $47.8 million in savings. An RTO boosts the potential capacity savings tenfold to up to $478 million.

But the biggest economic gains from an RTO flow from adjusted production cost (APC) savings, according to the study. Moyer called APC the “primary metric for determining state benefits” because it captures the benefits and costs of both net sales and purchases within an area, whereas a simple production cost figure can “mask some of the benefits” for high-export areas that ring up higher production costs that are also offset by sales into the market, reducing net costs to serve native load.

“It’s important to consider this metric instead of others that we have available to us,” Moyer said.

Based on that metric, an expanded EIM would yield about $105 million to $127 million in annual APC savings — on top of the existing EIM benefits of more than $300 million a year — compared with the status quo scenario. Arizona, Washington and California lead in absolute benefits under that scenario, while four states — Oregon, Nevada, Montana and Utah — actually lose out (see graphic below).

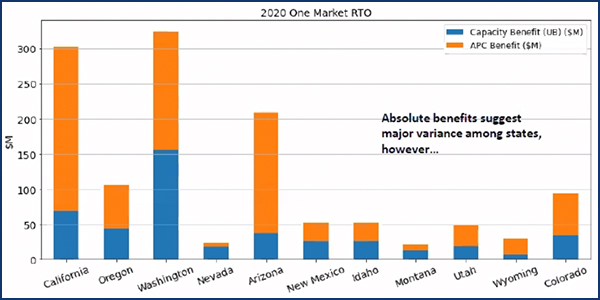

By comparison, a full RTO would produce APC savings of $811 million, bringing the estimated total savings from an RTO to more than $1.2 billion (see graphic below). Washington would be the biggest winner at $324 million, followed by California ($303 million), Arizona ($209 million), Oregon ($106 million), Colorado ($95 million), Idaho ($53 million), New Mexico ($52 million) and Utah ($48 million). Fewer benefits would flow to Wyoming ($29 million), Nevada ($23 million) and Montana ($21 million).

Moyer attributed part of Washington’s large benefit figure to an increased value of the Pacific Northwest hydroelectric system, “just from a simplified energy revenue standpoint.”

He also pointed out that the state would shift from a winter to a summer peak under a consolidated RTO scenario, “so there’s a savings really kind of embedded in that shift” because of the load diversity effect, he said. The study found that Washington would realize more than 4,000 MW in capacity savings from its load diversity relative to the rest of the footprint. Meanwhile, its summer-peaking neighbor to the south, Oregon, would see a capacity benefit of slightly more than 1,000 MW.

Adoption of either market configuration would result in only minor reductions in Western CO2 emissions: 0.1% for the expanded EIM and 0.7% for the RTO. The study’s findings also indicate only slight changes in the types of resources being dispatched under both configurations, at least based on current generation fleets.

“Overall, the big finding here is that, at least in 2020, we don’t believe that market constructs or these incremental constructs that we’re modeling cause major shifts between generation types,” Moyer said. Instead of a major shift from coal to gas, the study finds shifts within each class of generator, with the most efficient being dispatched.

“And [in the RTO scenario], we’re doing a little better job of integrating renewables, and on aggregate, those efficiencies are causing emissions to decrease somewhat, but not a significant amount,” Moyer said. He added that renewable curtailments are low under either scenario but were “already low to begin with.”

The study showed a shift in transmission flows, Moyer said, “but not significant enough to cause congestion.”

By the States, for the States

“I think the state-specific results are really helpful,” said Oregon Public Utility Commissioner Letha Tawney, who is also the chair of the EIM’s Body of State Regulators (BOSR). “We often see results that are for a particular utility, or a particular balancing area, or across all of the WECC … and we’re left with making assumptions about what that means for our consumers in our states.”

The state-by-state breakdown of benefits gives each state a “fact set” for approaching increased regionalization, with the states enjoying more obvious benefits being less concerned about the costs of joining an RTO.

“We all care about costs — don’t get me wrong — but there’s more room for a cost-effectiveness test if the benefits are clearly demonstrated in a single direction, where a state that’s running a little closer to a cost-benefit analysis break-even point might be more conservative,” Tawney said.

As chair of the BOSR, Tawney said, she seeks to identify a consensus view around CAISO processes, “and this sort of study that’s so neutral and sort of lays out the state perspective … is really enormously helpful in understanding how differently states are experiencing the market today and what value their consumers can really find in it.”

Tawney noted the study’s finding that the market is not “inherently” changing the resource mix in the West.

“It’s being driven, as far as the models demonstrate, far more by customer choices, and those customer choices might be demonstrated to the market through either voluntary commitments or through legislative actions or in-state carbon prices,” she said.

Tawney said she looked forward to the findings of the next iteration of the study, which will examine 2030 projections that “layer in the customer choices that have been expressed.”

“What I think this [study] clarifies is that the market makes reaching state clean energy goals more efficient, particularly less costly, rather than explicitly reshuffling the deck automatically,” she said.

Keith Hay, director of utility policy for the Colorado Energy Office, said the study comes at an “interesting time” when his state is undergoing an energy transition and its public health authority is calling for an 80% reduction of carbon emissions below 1990 levels by 2030, compared with the current 70% goal.

“I think for us as a state, it’s helpful that one of the outcomes of this work will be a set of factors that states might want to consider as they look at their market orientation,” Hay said. He noted that previous discussions at the Colorado Public Utilities Commission about whether to join an organized market prompted questions about how to make the decision, given the different factors stakeholders asked the state to consider.

“I think it’s important as this study comes forward, we’ll learn a lot from the perspective of the state and the state commissions, so it’s not being driven by a utility or a particular set of stakeholders who may have an interest in the outcome,” Hay said.