ERCOT stakeholders last week approved the oldest protocol change on the grid operator’s books, shooting down a late request to table the measure in the process.

Luminant filed comments on the revision request the day before it would be considered by the Technical Advisory Committee and requested a delay so committee members could review the comments.

The Nodal Protocol revision request (NPRR945) is hardly controversial. It simply removes the “associated load” term that proponents say has been interpreted in some instances to restrict private-service arrangements otherwise authorized under state law and regulatory precedent.

“We filed the comments because we’ve heard from different groups that the NPRR didn’t change anything,” Luminant’s Ian Haley said during the TAC’s web meeting Wednesday. “We had concerns that TAC would be voting without understanding what it does. We wanted to ensure TAC is well aware of what we’re voting on today.”

Attorney Katie Coleman, representing Texas Industrial Energy Consumers and the measure’s sponsor, accused Luminant of “a little bit of sandbagging,” noting the revision dates back to May 2019 and that the company has had “ample opportunities to relay this concern.”

She reminded members that the issue has been discussed several times within the TAC’s Protocol Revision Subcommittee and that she conducted a workshop where she went through the NPRR’s effects and its history.

“This section of the protocols was meant to define the electric configurations that were eligible for net metering. It does not pertain to legal and regulatory requirements,” Coleman said. Referring to “associated load” as an “ambiguous term,” she said, “That term has been interpreted as load and generation to be owned by the same entity.

“That’s not what the language says, and I’m not sure it’s clear to market participants. It’s more restrictive than what the law allows in certain scenarios,” Coleman said. “We have [private-network] sites set up today, lawfully set up, and some reviewed by the [Public Utility Commission] in contested cases, where load and generation is not owned by same entity.”

Removing the term, Coleman said, will provide regulatory certainty for both existing and planned sites by deferring to legal and regulatory precedent and avoid potentially inconsistent interpretations of the protocols.

The NPRR adds language that “explicitly state[s]” that private-service arrangements must comply with PUC precedent and Texas’ Public Utility Regulatory Act. It also adds market transparency with a new reporting requirement that identifies all generation resources and settlement-only generators registered as part of behind-the-meter private-use networks (PUNs).

Luminant says NPRR945 provides clarity to those seeking to set up PUNs, but it raises “many additional and equally important policy questions, some of which cannot be addressed by ERCOT stakeholders.”

The generation company said PUNs are neither typical loads nor typical generation resources and are subject to nonmarket incentives that “warrant appropriate controls” to ensure their usage “balances risk and reward fairly across market sectors and customer classes.”

“In an energy-only market, this can actually harm resource adequacy objectives … by allowing a single entity to capture scarcity value that does not accrue to the rest of the market,” the company said in its comments. “Luminant supports correct pricing outcomes that utilize the demand of consumers in ERCOT and all generation bids needed to meet that demand. Unfortunately, [PUNs] bypass this needed aspect of price formation.”

“As Luminant is starting to understand, this has potential implications that are pretty serious,” said Golden Spread Electric Cooperative’s Michael Wise, saying he was concerned about cost shifts and their unintended consequences. “ERCOT’s interpretation of the protocols and the term ‘associated load’ has protected consumers very well. We believe it’s probably one of the most important issues brought forward to stakeholders and it merits this attention.”

Other TAC members weren’t so sure.

“With all due respect to Luminant and Golden Spread, these issues you’re raising are issues we’ve been discussing for months and months,” Demand Control’s Shannon McClendon said. “Katie has given detailed information. PUNs do not cause additional costs to the consumer. That’s a red herring Golden Spread is putting out there.”

Reliant Energy Retail Services’ Bill Barnes said that although he shared some of Luminant and Golden Spread’s concerns, he was “cautiously supportive” of NPRR945.

“I don’t think minds will change in one month. I don’t see the need to table,” he said.

The motion to table failed 8-22. The TAC then passed the measure by a 23-5 margin, with two members abstaining.

Staff, WMS to Address Market Delays

ERCOT staff will work with the TAC’s Wholesale Market Subcommittee to address what has literally become a growing problem.

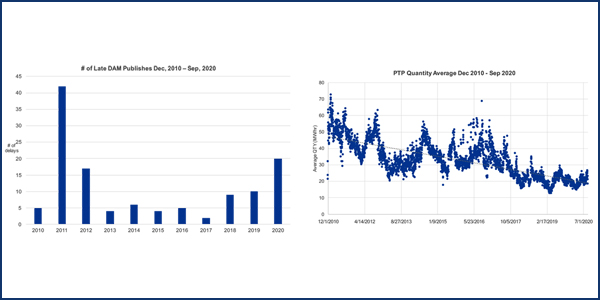

At issue are the increased complexities of the day-ahead market (DAM), which has led to a steady increase in the market’s ability to publish its results on time. There have been 20 delays this year, the most since 42 in 2011, the first year of ERCOT’s nodal market.

The grid operator allots three-and-a-half hours for the DAM’s execution, during which software must optimize its time, validate data inputs, execute the price-validation tool and post results, among other tasks. Input/output verifications and data errors can also lead to delays.

“There’s a lot of iteration in the DAM’s execution. Because of those iterations and other factors, we could have long run times to clear the DAM,” said Kenan Ögelman, ERCOT vice president of commercial operations. “If we get more than 170,000 [point-to-point (PTP) interval] submissions, we’ll pretty much have a DAM delay. An increase in settlement points can also lead to long run times.”

Ögelman said DAM participation has trended upward, with PTP bids largely contributing to the increased variables. Energy bids and energy-only bids have also grown, and binding constraints are on an upward path.

He said staff haven’t been “sitting on our hands,” but going after low-hanging fruit — “easy for us to do on our own,” Ögelman said — has resulted in staff falling further behind in solving the problem.

“We would like to engage stakeholders in an organized basis,” Ögelman said. “When I look at the solutions before us, they all have some drawbacks. I’m not seeing some perfect, low-cost solution without adverse effects.”

TAC Approves 7 Changes, Tables 8

The TAC’s unanimously approved consent agenda resulted in the approval of four NPRRs, a system change request and single revisions to the Planning Guide and Settlement Metering Operating Guide. Eight other change requests were tabled while they wait on their related NPRRs.

NPRR1028: requires qualified scheduling entities to notify ERCOT of physical limitations on their resources’ starting ability that are not modeled in the reliability unit commitment software and excuses compliance with parts of RUC dispatch instructions that violate a notified resource’s physical limitations. The NPRR also establishes a requirement that ERCOT extend a RUC commitment to honor a resource’s minimum run-time limitation when a physical limitation delays its ability to reach its low sustained limit.

- NPRR1031: requires ERCOT to post operations messages informing market participants when load is curtailed because of a transmission problem.

- NPRR1032: limits the DC tie schedules used in RUC optimization and settlements to the ties’ physical rating.

- NPRR1041: adjusts the expiration of the protected information status of wholesale storage load data from 180 days to 60 days, aligning the disclosure of real power consumption and metered generation output to 60 days after each operating day.

- PGRR023: adds a requirement that transmission service providers submit and annually review a list of contingencies for their portion of the system, ensuring that the appropriate contingencies are submitted for ERCOT and NERC planning criteria.

- SCR812: creates an Intermittent Renewable Generation Integration report similar to wind and solar power production integration reports.

- SMOGRR023: provides an option for a professional engineer’s nameplate certification of newly installed or replaced instrument transformers when nameplate photos cannot be physically accessed, and replaces a list of instrument transformer nameplate data requirements by referencing Institute of Electrical and Electronics Engineers standards.