Vistra reported third-quarter adjusted EBITDA from ongoing operations of $1.19 billion, a 10.3% increase from last year’s third quarter. Year to date, the company’s adjusted EBITDA is at $2.96 billion, up from 2019’s third quarter of $2.62 billion.

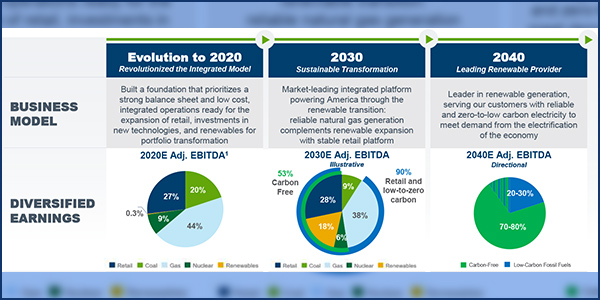

Since 2016, “we have meaningfully reduced our cost structure, strengthened the balance sheet to position the business to achieve investment grade credit ratings and enhanced the integrated model,” CEO Curt Morgan said in a statement. “We are now set-up to reinvest in our business as we transform our generation fleet for a sustainable future.”

In September, Vistra told investors it was developing nearly 1,000 MW of renewable generation projects in Texas, including six solar facilities and one battery, and intends to retire an incremental 6.8 GW of coal-fired generation in Illinois and Ohio.

Morgan reminded analysts that “every reputable and objective study” of electric generation sees natural gas playing a “significant role for several years to come, especially as we electrify the economy.”

“We believe we are a natural owner of renewable and energy storage assets given our capabilities and competitive position,” he said. “We have a high degree of competence that we can generate healthy return from these assets through the same skills and methodology by which we extract significant value from our existing fleet.”

The Irving-based company said it expects to allocate about $1.15 billion of capital to transformational growth investments over the next two years, including its Moss Landing and Oakland battery storage projects in California. In May, Vistra entered into a 10-year resource adequacy agreement with Pacific Gas and Electric for a new 100-MW/400-MWh battery to complement the 300-MW/1,200-MWh battery already under construction at Moss Landing.

Vistra also said it had acquired the 60,000 Texas customers of Infinite Energy and Veteran Energy. That expands the footprint of TXU Energy, already the largest competitive retailer in in the Texas market.

The company uses adjusted EBITDA as a measure of performance because it says that analysis of its business is improved by visibility to both that metric and net income prepared in accordance with generally accepted accounting principles.

Vistra share prices peaked at $18.82 shortly after the market’s opening but finished at $18.34, down 5 cents.