MISO said it will file with FERC updates to its emergency pricing design by the end of the year, hoping to spur more action from suppliers when conditions get risky.

The changes involve two new minimum-offer floors, expanding the definition of fast-start resources and integrating costs of its Midwest-to-South transmission limit into prices.

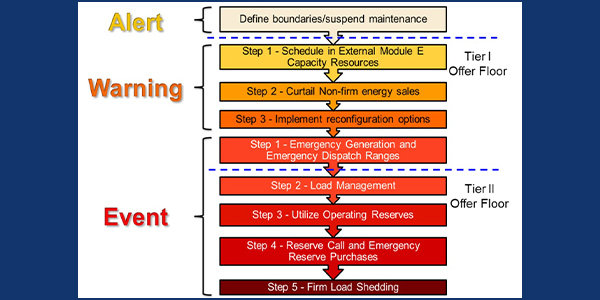

The RTO will introduce two new minimum emergency-offer floors: $500/MWh for maximum generation warnings and $1,000/MWh for maximum generation events.

MISO Market Design Adviser Michaela Flagg told the Market Subcommittee on Thursday that the new floors “reflect the value of emergency supply” and said the $1,000/MWh minimum lines up with the grid operator’s established threshold of how much it’s willing to pay before entering an emergency.

Customized Energy Solutions’ Ted Kuhn urged MISO to move away from static numbers in its proposal. He said tying the emergency-offer floors to the RTO’s current value of lost load (VOLL) and operating reserve demand curve is short-sighted, especially because it is considering an increase to its outdated VOLL figure.

The VOLL has been unchanged since 2009. At the time, $3,500/MWh was the estimated price at which some customers would opt for service interruption.

“That $1,000 number is going to be quite different in perhaps the very near future,” Kuhn said.

Along with the new offer floors, MISO said it will extend resources’ eligibility to set LMPs during emergency conditions. It plans to include online resources with four-hour or less start-up times in the fast-start definition during maximum generation alerts, warnings and events.

MISO’s current fast-start definition requires resources to fire up within 10 minutes of notification and run for at least an hour.

“We really saw the benefits drop off after four hours, so four hours seems to be a sweet spot,” Flagg said. “It allows a lot of these resources to participate in pricing.”

Flagg said allowing a short-lived relaxation of the fast-start lead time requirement in emergencies “better aligns with the real-time commitments made during emergency operations.” Staff say it is common during emergencies for operators to commit resources with notification and start-up minimum run times between one and four hours.

“During emergency conditions, the fast-start resource definition does not align with resources committed in real-time and, therefore, prices are not able to reflect the full costs of units needed to meet system demand and reserve requirements,” MISO said.

The grid operator also wants to better incorporate into energy prices the cost of managing its Midwest-to-South transfer limit.

To do that, MISO will set a marginal value of $200/MWh on its reserve procurement enhancement constraint management.

Under the existing reserve procurement enhancement (RPE), MISO models the effects of transmission constraints on the deliverability of reserves and adds the marginal cost of delivering them to zonal reserve market-clearing prices. The RPE ensures reserves are deliverable within the Midwest and South regions and that MISO doesn’t violate its megawatt limits on the Midwest-South transmission constraint for longer than 30 minutes. The settlement agreement governing the constraint stipulates that the grid operator not exceed the contractually set megawatt limits for longer than 30 minutes.

MISO says the marginal value limit assigned to the constraint — currently administratively set between $20 and $40/MWh — does not reflect the value of meeting the reliability requirement, resulting in “insufficient reserves being cleared in the sub-region and inefficiently low prices.” The grid operator said $200/MWh is more appropriate, according to its studies.

MISO said most of its sub-regional emergencies are called “due to limited transfer capability” over the Midwest-South constraint.

VOLL Questions over Hurricane Laura

Some stakeholders continue to question whether Hurricane Laura’s landfall on Aug. 27 near the Texas-Louisiana border was the right time for MISO to administer VOLL pricing.

Laura’s landfall saw MISO’s first administrative load-shed orders and VOLL usage. (See MISO Keeps Advisories in Effect a Week After Laura.)

Xcel Energy’s Kari Hassler said that because VOLL pricing was applied after-the-fact, generator actions as the event unfolded were motivated by circumstance, not pricing.

“I don’t want to say it was a misuse of VOLL, but it didn’t incent generators,” Hassler said.

WPPI Energy economist Valy Goepfrich said she pictured VOLL discerning cost-causation and not for use “during a disaster.” Other stakeholders agreed that cost-causation is difficult to trace in a natural disaster.