PJM’s Independent Market Monitor urged the RTO not to rush into making changes to its capacity market before the recently approved design is given a chance to succeed.

The IMM made the plea in its latest quarterly report, issued Thursday, which noted that PJM energy prices were the lowest in the first nine months of this year compared to any year since the creation of the RTO’s markets in 1999.

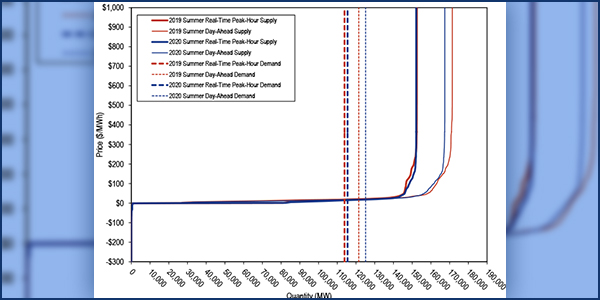

According to Monitoring Analytics’ third-quarter State of the Market Report for PJM, the load-weighted average real-time LMP was 23.1% lower in the first nine months of 2020 than the same period last year, coming in at $21.22/MWh versus $27.60/MWh. Of the $6.38/MWh decrease, 57.7% was a result of lower fuel costs, while mild winter weather and the COVID-19 pandemic caused a significant drop in demand.

The Monitor used these data to extol competitive electricity markets, noting that “changes in input prices and changes in the balance of supply and demand are reflected immediately in energy prices.”

“The value of markets is under attack, from those who assert that energy prices are too low and from those who assert that markets are incompatible with decarbonization of the power sector,” the Monitor said. “Organized, competitive wholesale power markets are the best way to facilitate the least-cost path to decarbonization. Markets provide incentives for innovation and efficiency. Renewables can compete. Innovation will occur in renewable technologies in unpredictable and beneficial ways.”

The Monitor said fears by over the impacts of the expanded minimum offer price rule (MOPR) have led stakeholders to discuss overhauling the PJM capacity market and states to consider opting out of the market using a fixed resource requirement. It acknowledged there are “clear issues” with the market’s design, including an overstated offer cap, the shape of the demand curve and the application of penalties for nonperformance.

But the Monitor also said there is no evidence that the new MOPR will make the market less competitive or that nuclear and renewable resources won’t clear it. The IMM noted that PJM has not run its annual Base Residual Auction since 2018 and that capacity prices have not been set for beyond June 1, 2021. “PJM should not rush to overhaul its capacity market again.”

New Recommendations

The Monitor included 10 new recommendations for changes and enhancements to existing market rules and implementation of new rules.

It made seven new recommendations in the Energy Market section of the report, including that:

- the temporary cost method and penalty exemption provision be removed;

- all units that submit non-zero cost-based offers be required to have an approved fuel-cost policy;

- market participants be required to document the amount and cost of consumables used when operating to verify that the total operating cost is consistent with the total quantity used and the unit characteristics;

- market participants be permitted to include only variable maintenance costs, linked to verifiable operational events and that can be supported by clear and unambiguous documentation of the operational data, including run hours and megawatt-hours, that support the maintenance cycle of the equipment being serviced or replaced;

- offer capping be applied to units that fail the three-pivotal-supplier (TPS) test in the real-time market that were not offer capped at the time of commitment in the day-ahead market or at a prior time in the real-time market to ensure effective market power mitigation when the TPS test is failed;

- eliminating up-to-congestion (UTC) bidding at pricing nodes that aggregate only small sections of transmission zones with few physical assets; and

- eliminating increment offers, decrement bids and UTC bidding at pricing nodes that allow market participants to profit from modeling issues.

In the Energy Uplift section of the report, the Monitor recommended that PJM designate units whose offers are flagged for fixed generation in Markets Gateway as not eligible for uplift. It said units that are flagged for fixed generation are not dispatchable, and following dispatch is an eligibility requirement for uplift compensation.

The Generation and Transmission Planning section of the report included a recommendation that storage resources not be included as transmission assets for any reason. Monitor Joe Bowring brought the issue up in the Planning Committee on Nov. 4. (See PJM Moves Closer to Endorsing SATA.)

Finally, in the Financial Transmission Rights and Auction Revenue Rights section, the Monitor recommended that PJM enforce the FTR auction bid limits at the parent company level beginning immediately.