How many committees, working groups, task forces and strike teams are too many?

SPP is about to find out as it balances staff and stakeholder time spent on analysis and studies with the need to adapt to a business environment that won’t stand still.

“The industry we’re a part of is changing so dramatically and quickly that solutions that looked good when you take a snapshot in time … don’t fit as well if it takes two years to implement,” SPP Board Chair Larry Altenbaumer told the Strategic Planning Committee last week.

“We have to deal with ongoing change,” Altenbaumer, also the SPC chair, said during a conference call Jan. 13. “That’s a key consideration when it relates to these kinds of activities.”

Still, the situation has resulted in stakeholders being involved in as many as seven different teams, in addition to their day jobs.

“Richard, I don’t know how you do it,” SPP COO Lanny Nickell said, addressing American Electric Power’s Richard Ross.

“If you don’t look to the future, at some point, you’re never going to get out of the mess you’re in,” Ross responded.

Having wrapped up the Holistic Integrated Tariff Team’s (HITT) year-long study of the footprint’s many challenges, which begat initiatives on energy storage, transmission-cost allocation and congestion hedging, among others, SPP has now embarked on an in-depth evaluation of its transmission planning and applicable cost-allocation processes.

The Strategic and Creative Re-engineering of Integrated Planning Team (SCRIPT) is comprised of 16 stakeholder representatives from the board, Members Committee, SPC, Markets and Operations Policy Committee and the Regional State Committee. The team reports to the board and plans to provide updates during the April and July governance meetings. A high-level review of its work is expected to be shared in October. (See “SPC Takes Look at Tx Planning,” SPP Briefs: Week of Aug. 31, 2020).

Director Mark Crisson, who chairs the SCRIPT, has divided its members, many of whom are involved in other stakeholder groups, into sub-teams focused on six key areas: consolidation, services, decision quality, transfers (exports/imports), optimization and cost-sharing. Each representative was assigned to two sub-teams, which are scheduled to meet twice a month through at least March. The SCRIPT itself will meet monthly.

“It’s a pretty busy schedule and our teams are busy with many other things,” Crisson said, noting the SCRIPT will meet Feb. 2 to decide whether all the meetings are necessary. “We have to consider the burnout factor here. We’re asking people to do an awful lot by October and evaluate where we are.”

“It’s a lot of meetings and a lot of different ideas,” SCRIPT member Bill Grant of Southwestern Public Service said. “We are tackling a broad spectrum of issues here in a very tight timeframe. I’m concerned whether we get into the details. I hope we can meet [the very aggressive schedule], especially with all the other initiatives going on.”

“The quality of this is so much more important than hitting the deadline,” SPP CEO Barbara Sugg said. “We’ve really got to focus on the quality. This is solving many of the challenges we have.”

Altenbaumer said he hopes the SCRIPT’s members will be able to get their arms around “everything that’s been addressed come October.”

Otherwise, he said, “it opens up a whole stream of things that need to be done. My hopes are the team working on this will come up with a game plan to help us address that moving forward.”

Nexant to Take Crack at Congestion Hedging

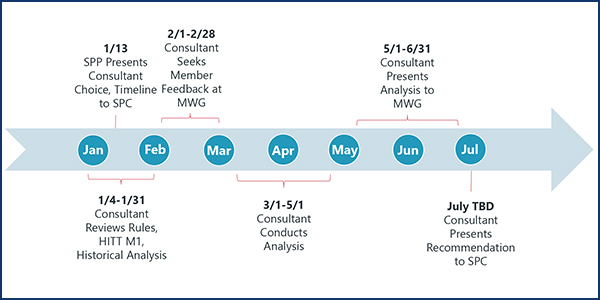

SPP has hired the Nexant consulting and software firm to perform a root-cause analysis of discrepancies in the grid operator’s congestion-hedging rules and policy, an issue stakeholders have been unable to reach consensus on.

The analysis will determine the reasons behind the difference between the total value of an entity’s congestion hedge and its day-ahead market position. Nexant is expected to recommend a solution to the SPC that incorporates new or existing measures — or any combination thereof.

“We’re looking at creating a clean slate,” said director Graham Edwards, who headed a strike team looking for a path forward on hedging issues.

“Why Nexant? They perform the analysis that is out there to solve this issue,” he said. “They’re the ones that are experts in this particular area of congestion hedging. They’re working with other RTOs and ISOs. They’re familiar with our rules.”

The SPC took up the cause when the Market Working Group was unable to coalesce around 11 different proposals after the HITT recommended adding counterflow optimization (CFO), limited to excess auction revenues, to the RTO’s hedging market mechanism. (See SPP SPC Takes on Congestion Hedging Issues.)

Nexant will work with the MWG and is expected to present its final recommendation to the SPC in July.

“Hopefully, we’ll be successful in drawing conclusions we can all gather around,” Altenbaumer said.

Separately, staff has begun a 2025 future study “to show the strategic importance of having [CFO] in SPP’s congestion-hedging markets.” The study will consider incremental long-term transmission congestion rights’ use in the markets, the NRIS/ERIS Deliverability Task Force’s white paper policy, and the effects of auction revenue rights awards.

SPC Welcomes New Members

The SPC began its first meeting of the year with several personnel changes, including Crisson stepping into the vice-chair’s role. Crisson replaces Golden Spread Electric Cooperative’s Mike Wise, who remains on the committee.

The new members are EDP Renewables’ David Mindham, Evergy’s Kevin Noblet and Oklahoma Municipal Power Authority’s Melie Vincent.