Stakeholders in SPP’s Western Imbalance Service (WEIS) market on Monday unanimously approved its Feb. 1 launch, the last major milestone in a project that began in 2019.

Bruce Rew, SPP’s senior vice president of operations, broke the news during the RTO’s joint quarterly stakeholder briefing, saying the grid operator is “excited” to be operating a power market in the Western Interconnection.

The WEIS Project leadership team, comprising the eight-member Western Markets Executive Committee (WMEC) and representatives from the Western Area Power Administration’s (WAPA) Colorado Missouri and Upper Great Plains West balancing authority areas, met with staff Monday to determine whether to transition from final system testing to a live marketplace.

Following the vote, WAPA tweeted its thanks to customers, stakeholders, SPP, fellow participants and employees “for supporting this monumental effort.”

SPP now joins CAISO in offering a power market in the Western Interconnection.

The vote on the launch had been delayed from Friday after some participants wanted more time to test the WEIS systems’ functions and interfaces.

David Kelley, SPP’s director of seams and tariff services, said last week that staff and stakeholders were trying to “button up some final loose ends.”

“Giving the weekend for some of that to occur would allow for greater confidence in the decision and the vote to take place,” Kelley said on Friday.

Market participants had asked for additional time to see bid-to-bill data with modeling changes they requested, an SPP spokesperson said. That led staff to extend parallel operations, with the WEIS market system running alongside the participants’ current systems, to Jan. 26. Parallel operations had originally been scheduled to end Jan. 14.

Staff has also identified seven “enhancements” that are in yellow status but deemed ready to be addressed after the WEIS market launches.

“We do have plans for those. They’re not problematic,” Customer Relations Manager Don Martin told WEIS stakeholders Friday.

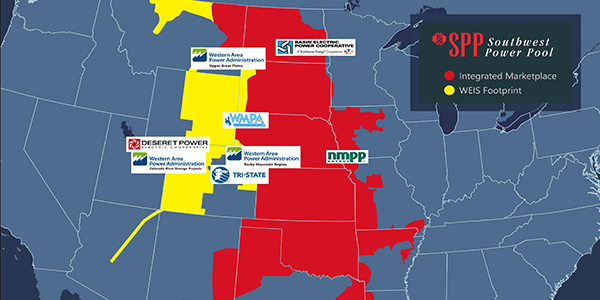

SPP is managing the WEIS market on a contract basis for eight utilities. However, seven of those — Basin Electric Power Cooperative, Deseret Power Electric Cooperative, the Municipal Energy Agency of Nebraska, Tri-State Generation and Transmission Association, and WAPA’s Upper Great Plains West, Rocky Mountain Region and Colorado River Storage Project utilities — have said they are interested in becoming SPP RTO members. (See Western Utilities Eye RTO Membership in SPP.)

SPP also serves as an RC for about 12% of the Western Interconnection. It will add about 3.45 GW of generating capacity to its RC footprint — eight generating resources that are part of Gridforce Energy Management’s BA in Washington, Oregon, Arizona and New Mexico — effective April 1. (See SPP Expands its Western RC Footprint.)

MMU: No Frequent Constraints

SPP’s Market Monitoring Unit told a joint meeting of the WMEC and the Western Markets Working Group (WMWG) Friday that the WEIS market will begin operations without frequently constrained areas (FCAs).

The Monitor analyzed real-time data from Nov. 1, 2019, through Oct. 31, 2020, looking at Western Interconnection constraints monitored by the SPP RC. It found four areas, all in Colorado, with scenarios resulting in at least 100 binding hours.

It defines FCAs as the market footprint areas that both experience high levels of congestion and are associated with one or more pivotal suppliers. It says a supplier is pivotal when some or all of its output is necessary for reliable operations within a defined area.

The Monitor said it will re-evaluate the FCA “designations at least annually.”

Last 3 Open WRRs Approved

The WMWG and WMEC both unanimously approved the final three open revision requests to the WEIS protocols:

-

-

- WRR17: adds documentation to outline how dynamic schedules used to transfer imbalance energy between the market’s balancing authorities will be handled in settlements.

- WRR18: corrects the real-time loss adjustment factor’s description to accurately reflect its true calculation (“total BA state estimated load without losses/total BA state estimated load with losses”).

- WRR19: corrects the settlement sign conventions to state that supply imbalance energy is positive and obligation imbalance energy is negative.

-