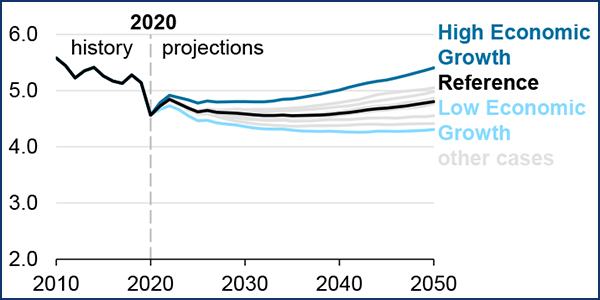

Electricity demand will return to pre-COVID levels by 2025 while total energy consumption will likely lag until at least 2029, the Energy Information Administration said Wednesday.

Energy demand from the residential, commercial, transportation and industrial end-use sectors dropped by 10% from 2019 levels to 2020 — faster than the drop in gross domestic product — because of the coronavirus pandemic. The drop in demand was about 70% larger than that following the 2008 financial crisis and the speed at which it rebounds “remains uncertain,” EIA said.

“In a case that assumes low economic growth, energy consumption does not return to 2019 levels until 2050,” the agency said in releasing its Annual Energy Outlook 2021 (AEO), which projects energy trends to 2050.

EIA’s reference case, or baseline projection, does not include the effects of proposed legislation or regulations. The report also includes sensitivities assuming high and low levels of economic growth and high and low oil and renewable prices. The high renewables cost case, for example, assumes no cost reduction from learning for any renewable technologies.

The AEO also projects that U.S. energy-related CO2 emissions will drop through 2035 before increasing.

Industrial energy consumption is projected to rebound faster than other sectors, although EIA noted “specific industries will return to 2019 levels at different rates.”

Electric Demand and Generation

The AEO’s reference case projects an annual average electricity growth rate of less than 1%, as economic growth is partially offset by efficiency improvements.

Generating capacity is projected to increase 52 to 84% through 2050 across the scenarios considered. The reference case foresees renewables accounting for almost 60% of the 1,000 GW of capacity additions.

“Although capital costs for both wind and solar continue to decline throughout the projection period, without additional policy intervention, wind is not as cost-competitive as solar,” EIA said. “More than two-thirds of cumulative wind capacity additions from 2020 to 2050 occur before the [production tax credit] expires at the end of 2024. The steadier pace of solar additions in part reflects the continued availability of a 10% investment tax credit, which continues in perpetuity after 2023 when the current 30% phases out.”

Natural gas-fired generators account for most of the remaining capacity increase — almost evenly split between combined-cycle plants and combustion turbines — but its share of the generation mix will remain at about one-third. Gas capacity factors for existing combined-cycle units are projected to drop by nearly half from a peak of 60% in 2020.

Most of the coal-fired generating capacity retirements assumed in the reference case occur by 2025, but the report notes that the baseline includes the Trump administration’s Affordable Clean Energy (ACE) rule, which was vacated by an appellate court on Jan. 19. (See DC Circuit Rejects Trump ACE Rule.)

Rooftop PV systems and combined heat-and-power systems are projected to total more than 7% of total generation by 2050, almost double the current share.

Transportation

Energy consumption for transportation is projected to remain below 2019 levels through 2050 as improvements in fuel economy will offset a resumption in travel growth. The reference case sees air travel demand returning to pre-COVID levels in 2025, with bus travel demand rebounding in 2031 and light-duty vehicles returning by 2024.

While aviation’s energy consumption (excluding military use) will hit 2019 levels by 2030, energy consumption by light-duty and heavy-duty vehicles is forecast to be lower than 2019 levels through 2050.

While transportation has the greatest potential for increased use of electricity, demand from the sector is expected to remain below 3% of economy-wide electricity demand. “Current laws and regulations are not projected to induce much market growth, despite continuing improvements in electric vehicles through evolutionary market developments,” EIA said. “Both vehicle sales and utilization (miles driven) would need to increase substantially for EVs to raise electric power demand growth rates by more than a fraction of a percentage point per year.”

However, motor gasoline consumption will peak before the middle of this decade, EIA said, because fuel economy improvements will partially offset travel growth.