MISO’s seemingly simple plan to extend payment arrangements for market participants that use the Midwest-to-South transmission path is destined for settlement proceedings.

While FERC in late January accepted the plan to extend the existing rate structure through Jan. 31, 2022, it also established hearing and settlement procedures, saying that the arrangement could be unjust or unreasonable (ER21-530).

FERC cited Alliant Energy’s and MidAmerican Energy’s complaints that market participants in an Iowa local resource zone bore a disproportionate one-third of rate schedule costs in 2020. The companies raised the issue in stakeholder meetings leading up to MISO’s filing. (See MISO Prolongs Terms on Midwest-South Tx Limit.)

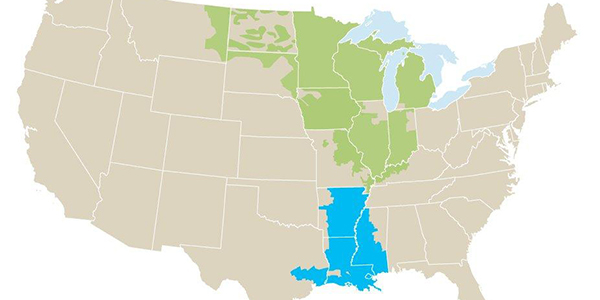

Without the extension, the rate schedule was set to expire this month. The schedule lays out the cost allocation for market participants that use the subregional transfer limit beyond the 1,000-MW contract path linking MISO Midwest and MISO South.

Currently, MISO’s payments to SPP and other parties for flows across the transfer limit are recovered from market participants through a combination of load-ratio calculations and flow-based beneficiary allocations.

The load-based share has declined every year since 2016, while the flow-based portion has increased. From Feb. 1, 2016, to Jan. 31, 2017, the allocation was 45% load-based and 55% flow-based. From Feb. 1, 2020, to Jan. 31, 2021, the mix was 10% load-based and 90% flow-based.

Alliant said MISO “ignored stakeholders’ requests to share production cost modeling information necessary to determine why the share of costs allocated to Local Resource Zone 3 [in Iowa] continues to increase while the identified benefits (and thus costs allocated) to other zones remain zero.” The utility said either MISO’s production cost modeling or the allocation itself is “distorting the identification of the real economic beneficiaries.”

Alliant and MidAmerican said an extension of the rate schedule could affect MISO’s annual transmission planning because the grid operator performs a benefit analysis of potential projects that stand to reduce dependence on the Midwest-to-South transfer and thus reduce settlement payments to SPP and other parties. If MISO’s current cost allocation process identifies market participants in Zone 3 as being particularly helped by a transmission project that could offer an alternative to the transfer, Zone 3 could unfairly foot the bill on the project, Alliant and MidAmerican argued.

MISO doesn’t have any transmission projects lined up to secure more transfer capability between its subregions. (See “No Midwest-South Tx Solution this Year,” Price Tag Rising for MTEP 20.)

During a Market Subcommittee teleconference Thursday, MISO senior adviser Jack Dannis said the settlement process will begin soon.

In the meantime, Dannis said the RTO will use the extension to discuss a new settlement agreement and cost allocation with stakeholders.

“We want to initiate a more permanent cost-allocation mechanism for settlement payments after Feb. 1, 2022,” he said.

Dannis said MISO hopes to file a fresh allocation with FERC by Nov. 1. He said the grid operator will use “a lot of stakeholder feedback and interaction” to inform the rate schedule.