Exelon announced a major restructuring Wednesday, saying it will separate into two publicly traded companies, one for its regulated transmission and distribution business and the other for its merchant power generation.

Expectations were widespread that Exelon would announce a major restructuring coincident with its fourth quarter 2020 earnings release. It had announced it was considering the separation in November. (See Exelon Discusses Potential Generation Spinoff.)

The company’s stock rose in pre-market action, trading as high as $42.34 after closing at $40.80 Tuesday. It closed Wednesday at $40.19.

Exelon reported higher than expected Q4 earnings but said it may have lost as much as $950 million because of outages at three Texas natural gas plants idled during the arctic blast that left much of the state in the dark for days.

Restructuring

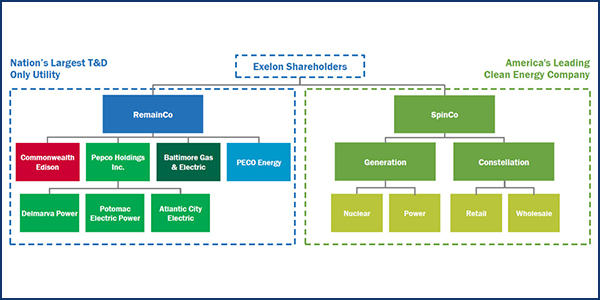

Exelon said the restructuring will create the nation’s “largest fully regulated transmission and distribution utility,” with six utilities in five states and D.C., and the largest producer of carbon-free power — thanks mostly to its 18.7 GW nuclear fleet. It also owns 12 GW of hydropower, solar, wind, gas and oil generation.

The company said the separation “better positions each company within its comparable peer set” and will allow them to pursue business strategies tailored to their sectors. It “aligns our business mix with investor preferences and overall market trends,” it said.

“These are two strong, distinct businesses that will benefit from the strategic flexibility to focus on their unique customer, market and community priorities,” CEO Chris Crane said in a statement.

The company hopes to complete the transition, which will require approvals by FERC, the Nuclear Regulatory Commission and the New York Public Service Commission, by the first quarter of 2022.

One spinoff company, temporarily named RemainCo, will hold the assets in Exelon’s six regulated service areas. Another new company called SpinCo will hold the merchant generation assets.

Questions on Ill. Nuclear Plants

Exelon, by far the largest nuclear generator in the U.S., reported that its fleet’s capacity factor was 95.4% in 2020, the second highest ever for its owned and operated units. But nuclear power has been a troubled part of Exelon. The company said last year it may be forced to shut down its Illinois nuclear plants without state legislation to subsidize the units, which have been pinched as natural gas and renewables have depressed wholesale power prices.

The company is hoping to win relief as part of sweeping Illinois energy legislation expected to be considered this year.

Crane asserted that Illinois Gov. JB Pritzker “has called for passing an energy bill this session that protects our nuclear fleet, grows renewable energy and supports customers and job creation.”

But Illinois industry observers say that the governor remains undecided on his exact stance.

Gov. Pritzker has said only that he supports the principles behind the Clean Energy Jobs Act, which is supported by many legislators in the both the state Assembly and Senate. It does not provide for the nuclear bailout that Exelon seeks.

There is much debate about the profitability of Exelon’s Illinois nuclear plants. The company says they are not profitable and need state support. But Pritzker is skeptical and has hired a consultant to dig into the company’s financials.

In response to an analyst question in the conference call, Crane admitted the company faces “a cloud” in Illinois, its reputation badly tarnished in the wake of a $200 million bribery scandal that resulted in the indictment of former ComEd CEO Anne Pramaggiore. (See Ex-ComEd CEO, Officials Charged in Ill. Bribery Scheme.) Federal officials said ComEd sought favorable legislation by giving jobs and contracts to allies of Assembly Speaker Michael Madigan, who resigned Feb. 18.

Illinois PIRG Director Abe Scarr said the company’s separation plans will reduce, but not eliminate, conflicts of interests that harm consumers.

“Every year, Exelon bills hundreds of millions of dollars of services to ComEd, a subsidiary it controls, a subsidiary which can fully recover those costs from its captured customers,” Scarr said. “The Illinois General Assembly has the opportunity this spring to begin undoing the policy harms of the ComEd bribery scandal. That means winning restitution for ComEd customers, restoring effective utility regulation by ending automatic rate hikes through formula rates, and reforming utility political influence by no longer allowing utilities to charge their customers for charitable contributions. Addressing the conflicts of interest that persist beyond an Exelon breakup should remain on the General Assembly’s agenda.”

Texas Losses

The company estimates pre-tax losses of $750 million to $950 million because its Colorado Bend, Wolf Hollow and Handley plants in ERCOT were unable to operate when prices hit the $9,000/MWh price cap during the cold front.

Crane said the range “includes our best estimate for load obligations, ancillary charges and bad debt,” but cautioned that the estimate was preliminary and would be updated in Exelon’s Q1 conference call in the spring.

“As you know, last week’s events have raised many questions about Texas market design and associated risks,” Crane said. “And this has not been a new conversation. It’s been one that’s been around for a while. And we hope that through this that the proper actions can be taken on the design. As a result, we are evaluating all our options with respect to our ERCOT business.”

Laura Starks, CEO of Texas-based energy consultancy Starks Energy Economics, said it’s difficult to forecast the losses to utilities from the Texas fiasco, especially after five ERCOT board members resigned in the wake of the outages.

Earnings

Continuing a streak of quarterly results that have beaten market expectations, Exelon announced adjusted Q4 earnings and revenues that outperformed market estimates. Other major utilities have also been beating Q4 expectations, including NextEra, Dominion and Xcel.

Exelon reported adjusted (non-GAAP) earnings of $0.76/share, beating analyst expectations by $0.06. But GAAP EPS significantly underperformed expectations at $0.37, $0.60 lower than the market was anticipating. One-time plant retirement costs accounted for much of the difference, totaling $0.38/share.

Revenues for the quarter were $210 million higher than estimates at $8.12 billion.

Full year GAAP 2020 results took a major hit compared to 2019; GAAP EPS was $2.01 versus $3.01 for 2019. Adjusted operating earnings were steady in 2020 at $3.22/share.

Exelon gave adjusted (non-GAAP) operating earnings full-year guidance for 2021 of between $2.60 and $3/share. In the conference call the company said it expects to grow its rate base about 7% per year through 2024.