Public Service Enterprise Group CEO Ralph Izzo used the company’s earnings call Friday to lobby for increased subsidies for its New Jersey nuclear plants and predicted the sale of its non-nuclear generation by the end of the year.

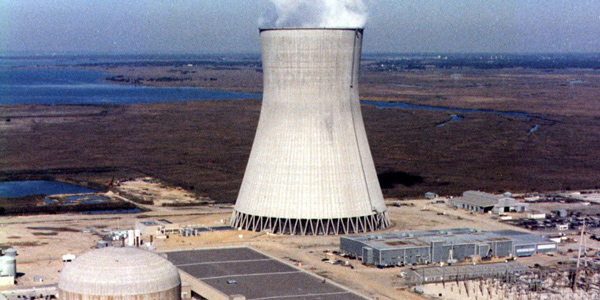

PSEG has requested a three-year extension to New Jersey’s controversial zero-emissions certificate (ZEC) program, which paid the company $300 million last year to continue operating the Salem and Hope Creek nuclear plants. The subsidy works out to $10/MWh, which Izzo said is not enough to make the plants competitive with natural gas and zero-marginal-cost renewables.

Izzo said the company is pleased that the staff of the state Board of Public Utilities recently concluded that Salem and Hope Creek will remain eligible for ZEC payments when the current subsidy order expires in 2022. But he said the payments are too low considering falling PJM forward power prices. He added that the three-year ZEC cycle is too short to give the company confidence to make major capital improvements or consider relicensing the plants when their current licenses expire between 2036 and 2046.

The company would retire the plants if the ZEC payments were reduced below $10/MWh, he said.

“The nuclear plants need more than $10, and what we’ve said is we’ll look at longer-term solutions for that and hopefully coming out of the federal government with a carbon price,” Izzo said during the earnings call with analysts. “And the only reason why we would accept $10 now is that that’s all [the state] can do. So that’s not a negotiation.”

The BPU’s ZEC decision is expected April 27, Izzo said.

Generation Sale, ESG Report

Izzo said PSEG has received “initial indications of interest” from potential buyers for its 467 MW of solar generation and its 6,750-MW fossil generation fleet in New Jersey, Connecticut, New York and Maryland, which it put up for sale last July. Izzo declined to name potential buyers but said “we are on track to announce an outcome in the second half of 2021.”

The company is selling the generation assets as part of its planned transformation to a “primarily regulated electric and gas utility,” Izzo said.

Responding to an analyst’s question, Izzo said the widespread generation outages that accompanied subfreezing temperatures in ERCOT will have no impact on the company’s operations. “Our near-death experience in January of 2014 with our own polar vortex really has winterized these assets in a way that I’m sure Texas will now follow suit with,” he said.

In January, PSEG released its first environmental, social and governance (ESG) performance report, which included an expanded disclosure of employee demographics along with new goals for fleet electrification and waste reduction. The company’s carbon-reduction plan calls for an 80% decrease in emissions below 2005 levels by 2046, with the goal of achieving net-zero by 2050.

By 2030, the utility said, it will convert all passenger vehicles, 62% of medium-duty vehicles and 90% of heavy-duty vehicles to battery electric vehicles, plug-in hybrids or “anti-idle job site work systems.”

It also pledged to reduce the total weight of waste that is landfilled and incinerated to 4.78% of the total waste generated by Public Service Electric and Gas by 2023.

The report also mentions the BPU’s approval in January of $205 million in spending by PSE&G on EV infrastructure. (See NJ BPU OKs $205M EV Spending by PSE&G.) And it noted that the company will retire its last coal-fired unit, the 383-MW Bridgeport Harbor 3 generating station, in June.

Looking ahead, Izzo said PSE&G is forecasting capital spending of $14 billion to $16 billion through 2025, with 50% going toward carbon-reduction investments, including energy storage, energy efficiency, methane emission reduction and advanced metering infrastructure.

Offshore Wind

However, Izzo noted the capital spending forecast does not include any potential investments in offshore wind. PSEG agreed in December to take a 25% stake in Ørsted North America’s 1,100-MW Ocean Wind project, which won the BPU’s first offshore wind solicitation. Construction on the project, 15 miles off the Atlantic City coast, is expected to begin next year, with commercial operation expected in 2024.

PSEG has an option to increase its stake in Ocean Wind by an additional 25%. Izzo said the company is taking a cautious approach and would not seek to increase its stake beyond 50%. “The commercial risk is completely mitigated by the [power purchase agreement with New Jersey]. And the operational risk is mitigated by making sure you partner with a world-class partner. And we think we have that in Ørsted,” he said.

He was bullish on the company’s chances to build the onshore transmission needed to connect New Jersey’s OSW to PJM’s grid.

“There is likely to be a transmission solicitation that will be managed by PJM on behalf of New Jersey that we feel very confident that we could do something of that sort without necessarily needing partners, although we will be welcomed to partnerships in that regard too,” he said. (See NJ Asks PJM to Seek Bids for OSW Tx.)

Q4 Results

PSEG reported declining profit and revenue in its most recent quarter, blaming mild weather for depressing electricity demand.

Net income was $431 million ($0.85/share) in the fourth quarter of 2020, compared with $437 million ($0.86/share) a year earlier. Revenue fell to $2.4 billion, below the $2.73 billion predicted by analysts.

On an adjusted basis, profit was 65 cents/share, in line with Wall Street’s expectations. Most of the difference was attributed to a 31-cent/share gain from PSEG Power’s nuclear decommissioning trust fund.

Earnings call transcript courtesy of Seeking Alpha.