MISO last week reiterated the extraordinary nature of mid-February’s winter storm, promising more data later this month and resource adequacy solutions by year-end.

During a teleconference of the Market Subcommittee on Thursday, MISO Director of Operations Planning J.T. Smith thanked control room staff and members a month after extreme winter weather forced load shedding in MISO South and Central Illinois.

“There was a lot going on … the week of Feb. 15, not just in MISO, but in the Eastern Interconnect,” he told stakeholders.

Smith said all players did “commendable work” in the “heat of the moment.” But he said the RTO’s extensive preplanning and communication was no match for the sustained cold and ice.

“From my seven years in Minnesota, 20 degrees is one thing; but also living in the South, having extended cold days, having 20 inches of snow, having ice cover a good portion of the South … it’s not surprising that we got to load levels that are all-time peaks,” he said.

MISO said demand Feb. 16 peaked at 31.6 GW in its South region, nearly matching the all-time winter peak of 32 GW set in early 2018. The demand was also close to MISO South’s all-time summer peak of 32.7 GW, set in 2015.

Smith said the shortages were largely driven by fuel supply issues: frozen coal piles, natural gas pipelines and power plant equipment.

“I’m sorry if I keep saying this word, and I’ve heard this work so much, but: ‘unprecedented.’ The weather was so broad; it was so complicated,” he said.

The RTO was forced to order load shedding on the evening of Feb. 16 as the cold settled in and generation began tripping offline. Staff said that by 3 p.m., 2.5 GW of generation had gone dark in MISO South.

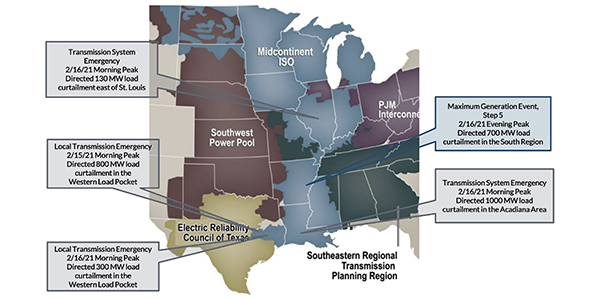

The grid operator said that when it ordered load balancing authorities in the South region to collectively shed 700 MW of load around 8 p.m., grid stability was in “danger.” MISO had run out of imports and it was trying to “avoid widespread cascading outages.”

The “procedures worked as drilled and designed, limiting load curtailment in the MISO footprint to a regional event lasting approximately two hours and a handful of local events,” the RTO said.

It also ordered localized rolling blackouts because of transmission emergencies. It sent 1,000 MW of load offline for about four hours in Louisiana and another 130 MW offline in Central Illinois for seven hours. It also shed load twice in southeast Texas across two days because of local transmission emergencies, taking 800 MW offline for 16 hours on Feb. 15 and dropping 300 MW for almost six hours on Feb. 16. Smith said that in a few instances, MISO was also forced to dispatch down generation to manage transmission constraints.

By Feb. 17, approximately 40% of the grid operator’s installed resources were unavailable.

Smith credited in part the “beauty of the Eastern Interconnect” for making imports from PJM possible during wintry conditions and preventing a more dire situation. Early on, he said MISO and PJM were also able to flow power to support SPP’s operations.

Smith also said MISO was “bumping up against” its 3,000-MW limit on Midwest-to-South transmission flows over SPP’s system for much of the event.

Gabel Associates’ Travis Stewart asked staff to prepare a breakdown of unavailable resources by resource type to see which were most affected by the storm. Others asked MISO to prepare a chart of unplanned generation outages by region and to share its load forecasts for the week so they can be compared to actual load.

Smith said the load forecast request was “doable” but that during the storm, third-party weather models were not capturing the worsening conditions fast enough. However, he said MISO had more cold-weather cutoff data for generation than in previous polar vortexes.

Texas Public Utility Commission market economist Werner Roth said that even though he appreciated MISO’s proactive approach, the event marked the second time in six months that Southeast Texas was forced into load shed. He passed on the commission’s thanks but warned that in the future, the PUC would be very involved in evaluating resource adequacy in transmission-constrained areas.

Shawn McFarlane, MISO’s executive director of market operations, said staff will host more discussion on pricing fallouts and how the weather highlights the need for new resource adequacy mechanisms to ensure reliability.

“‘This is not it’ is probably the headline around this discussion,” he told stakeholders, adding that the emergency would likely command attention during MISO’s quarterly Board Week March 22-25.

It’s unclear how the load shed brought on by the cold snap will be priced. MISO has proposed to stop assigning its $3,500/MWh value of lost load pricing during force majeure events that cause transmission or generation losses. However, Director of Market Design Kevin Vannoy said capacity shortages in MISO South during the cold might not qualify as a force majeure event.

Mississippi PSC Unhappy

At its March meeting, the Mississippi Public Service Commission discussed using a routine audit of Entergy Mississippi’s MISO membership to examine the fairness of load shed orders in the state. Commissioners said they would consider the item at April’s meeting.

Commissioner Brandon Presley said Mississippi’s utilities on Feb. 16 produced 800 MW above the state’s demands, yet MISO placed Mississippi balancing authorities in the regional load shed orders. He also said the RTO’s notification to utilities before the rolling blackouts was inadequate.

“That notice came, and our utilities had exactly six minutes — six minutes — to make preparations and begin … cutting off circuits throughout their territory,” Presley said. “That, in my opinion, is inexcusable.”

Presley said the commission’s review is not an attempt to exit the RTO but to try and “correct the problems that exist.”

“Our state was forced to take the same share of forced outages spread across the region as other states, although Mississippi utilities performed well,” he said, adding that MISO offers “no incentive” for utility preparedness.

“To many of the MISO folks who I hear moaning about this move: You know you’re in the business to answer questions,” Presley said. “That’s what you get paid the big bucks to do, and [this] is legitimate. It is a legitimate question for a commission to ask.”

“MISO looks forward to working with the Mississippi Public Service Commission as well as providing information regarding the arctic storm,” RTO spokesman Brandon Morris said in response to Presley’s criticism.

Meanwhile, Entergy Texas announced it is conducting a post-event review of the storm and examining what grid resilience investments it might need to make. The company warned that customer bills might be higher but that, as a MISO member, its ratepayers wouldn’t fall victim to the price spikes affecting ERCOT.

“We are committed to working with any customer facing financial difficulties as a result of the winter storm,” Entergy Texas CEO Sallie Rainer said.

MISO: RA Changes Should Help

MISO last week also resumed a conversation on a seasonal capacity auction design that puts more emphasis on wintertime risk.

Staff said the RTO hopes to make a MISO Sets Sights on 4-season Capacity Market.)

“There’s a need for change,” Executive Director of Market Strategy and Design Scott Wright said during a Resource Adequacy Subcommittee call Wednesday. “There’s substantial risk outside of summer. … This is not a future what-if, but it’s on our doorstep in many ways.”

Wright said there’s much in the proposal that “speaks to issues” MISO experienced Feb. 14-19. (See MISO Begins Cold Snap Examination.)

As part of the process, MISO will most likely rely on past emergency events and retrospective tight supply times to select “resource adequacy hours,” or times when reliability is under threat. It will use resource adequacy hours to define reliability risks and reserve requirements, supplanting a single summertime peak. Staff said they’re examining how new MISO reliability requirements will interact with state reliability targets.

The grid operator said it is still working through protocols for capacity resources that take protracted outages that span more than one season.

MISO is also considering enacting a minimum capacity rule that would require load-serving entities to demonstrate that they’ve secured 50% of their planning reserve margin requirements before the planning year begins.